- XMR stays excessive above all EMAs, suggesting consolidation throughout the bullish development

- Above $438, XMR maintains bullish construction with $500 being a serious breakout set off

- Growing open curiosity and stabilizing spot inflows point out elevated confidence within the XMR development

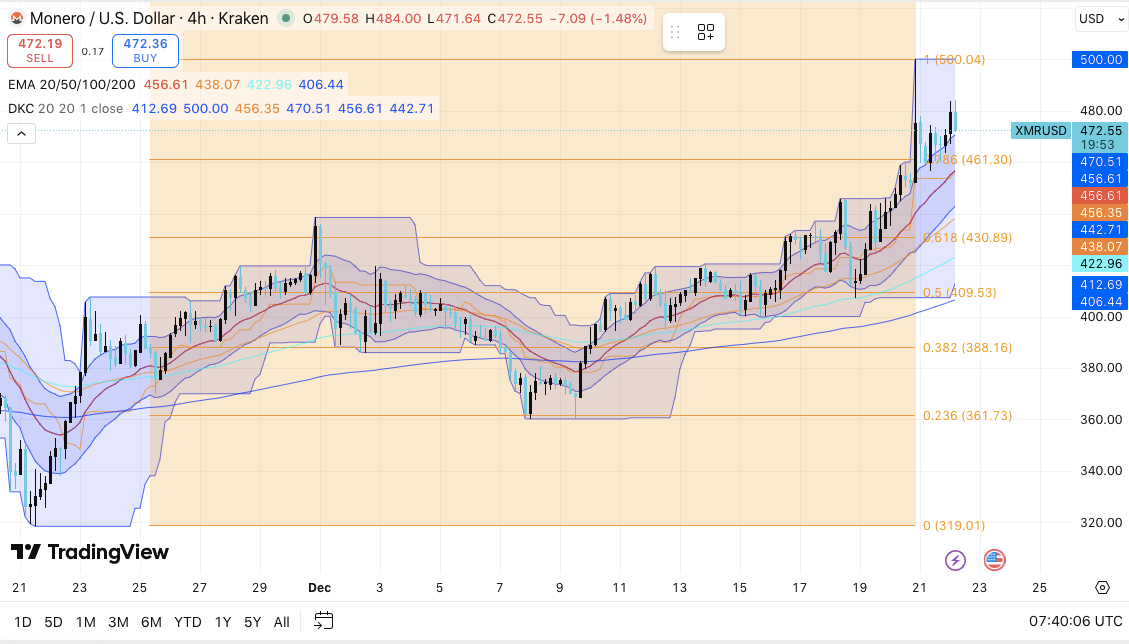

Monero (XMR) continues to draw market consideration as its 4-hour value construction stays bullish regardless of the current pullback. The asset is buying and selling nicely above the key exponential transferring averages, indicating sustained upward momentum.

Consequently, merchants proceed to deal with short-term declines as consolidation fairly than development failures. Along with value developments, derivatives and spot stream knowledge present elevated participation throughout each leveraged and spot markets.

Bullish construction stays regardless of volatility

On the 4-hour chart, XMR maintains a transparent sample of highs and lows. Subsequently, the broader construction nonetheless favors the continuation of the development. The current rejection close to $500 triggered a managed retracement fairly than a structural collapse. Importantly, value stays above the 20, 50, 100, and 200 EMAs, reinforcing the bullish bias.

Moreover, the Bollinger Bands stay widened, reflecting the elevated volatility after the earlier impulse motion. This situation typically helps continuation fairly than reversal. Quick-term resistance is at the moment situated close to the $472-$476 vary the place value is at the moment reacting. If this zone could be firmly regained, the upward momentum could also be restored.

Moreover, the $486-$500 space stays a serious barrier. A decisive break above $500 is more likely to set off additional enlargement.

Nevertheless, draw back ranges stay vital for validating developments. The $456-$458 zone is roughly in keeping with the 20 EMA and serves as preliminary help. Holding this space maintains short-term momentum. Beneath that, there’s stronger Confluence help within the $438-$442 vary, combining the 50 EMA with the earlier construction.

Associated: Late Evening Worth Forecast: Spot Outflows Collide with Bullish Buildings

Consequently, a sustained maintain above $438 maintains a bullish framework. Deeper ranges round $413-$406 mark the 100EMA cluster and the 200EMA cluster. Beneath this zone, the present construction will likely be weakened. Moreover, Fibonacci ranges add context, with $409 performing as key midrange help and $388 performing because the final bullish line of protection.

Derivatives and spot flows help the development

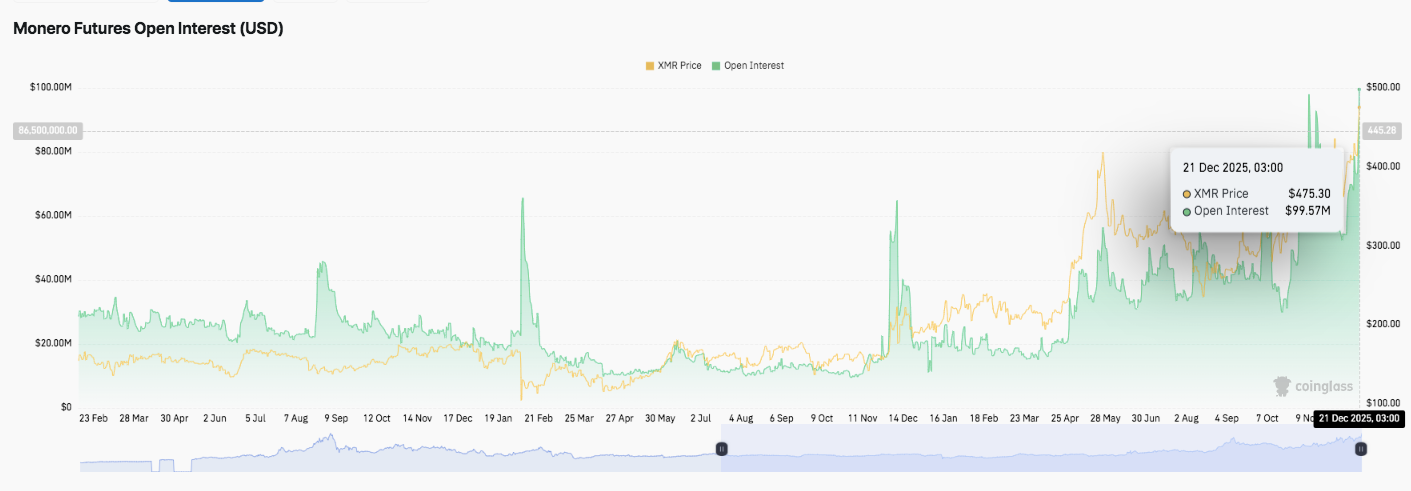

Importantly, Monero futures open curiosity has steadily expanded as the worth has elevated. Open curiosity remained low within the early phases, however has been persistently rising since late March. There have been a number of spikes adopted by a brief reset.

Nevertheless, the rise in lows since mid-year suggests continued participation fairly than a speculative outburst. The current transfer in the direction of the $100 million degree coincides with XMR buying and selling above $450, reflecting elevated confidence amongst merchants.

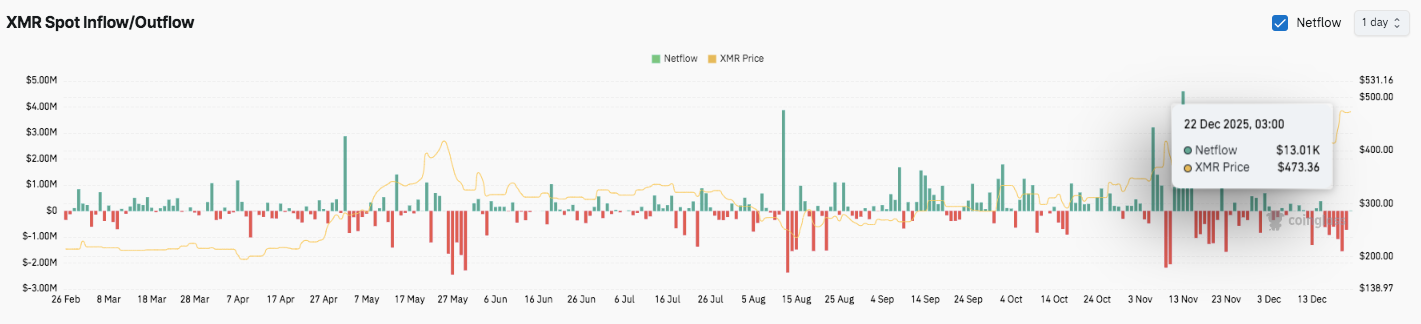

Moreover, spot influx and outflow knowledge reveal adjustments in conduct. The early interval noticed low-conviction flows and buying and selling in a spread. The mid-year capital outflow coincides with a rebound, indicating profit-taking actions.

Beginning within the second half of the third quarter, the frequency and magnitude of capital inflows elevated, supporting the worth restoration. Nevertheless, intermittent outflows proceed, suggesting aggressive positioning fairly than long-term holding.

Technical outlook for Monero value

Monero value continues to commerce inside a transparent 4-hour bullish construction regardless of current consolidation beneath the $500 zone. The broad development stays constructive with XMR above all main transferring averages. This positioning retains draw back threat inside a transparent help zone whereas protecting upside eventualities lively.

High degree: Fast resistance lies between $472 and $476, the place the worth is at the moment reacting. A sustained restoration might strengthen short-term momentum. Past that, the $486 to $500 zone stays the key breakout space. A decisive transfer above $500 might open the door to new upside, which is more likely to proceed with momentum if quantity is confirmed.

Cheaper price degree: Preliminary help is at $456-$458 aligned with the 20-EMA. Holding this space maintains the short-term bullish construction. Beneath that, $442-$438 acts as a stronger confluence zone, supported by the 50-EMA and former market construction. A deeper decline might check $413 to $406, with the 100 EMA and 200 EMA clusters offering main development help.

The $409 degree, which is near the 0.5 Fibonacci retracement, serves as an vital axis. If losses proceed, bullish management will weaken. The $388 degree, which coincides with the 0.382 Fibonacci retracement, represents the final main bullish line of protection if promoting stress accelerates.

Will Monero rise additional?

Monero’s near-term outlook is determined by whether or not consumers proceed to defend the $438 to $442 help zone. So long as costs stay above this space, the decline seems to be a correction fairly than a development reversal. Consequently, consolidation beneath resistance might function the premise for an additional breakout try.

The rise in open curiosity helps this view, suggesting that participation in derivatives is growing, fairly than curiosity in them waning. Moreover, enhancing spot influx developments recommend new accumulations, whereas periodic outflows spotlight lively buying and selling exercise.

Associated: Ethereum Worth Prediction: Trendline Resistance Continues as ETH Trades in a Tight Vary

If XMR sustains above $486-$500, the bullish development might resume with extra momentum. Nevertheless, failure to defend $406 will shift focus to deeper retracement ranges. For now, Monero stays at a key inflection level and volatility is more likely to improve as the worth approaches resistance.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.