- Because the bear market continues, exercise on the Bitcoin community has slowed as a consequence of fewer transactions and decrease charges.

- The decline in extremely energetic addresses signifies a decline in speculative buying and selling and quiet accumulation.

- Analysts be aware that there’s resilience in comparison with 2018, with a possible market backside anticipated to be round October 2026.

The Bitcoin (BTC) community is exhibiting indicators of slowing down, with key indicators exhibiting decrease exercise and fewer speculative curiosity. Analysts at CryptoQuant be aware that whereas the market stays in a bearish cycle, structural resilience may restrict long-term injury.

Bitcoin market stays in bear territory

GugaOnChain, licensed writer of CryptoQuant, emphasised that the BTC market continues to be in a bearish section. The BTC Bull Bear Cycle Indicator, together with the 30-day transferring common being beneath the 365-day transferring common at -0.52%, confirms the bearish development.

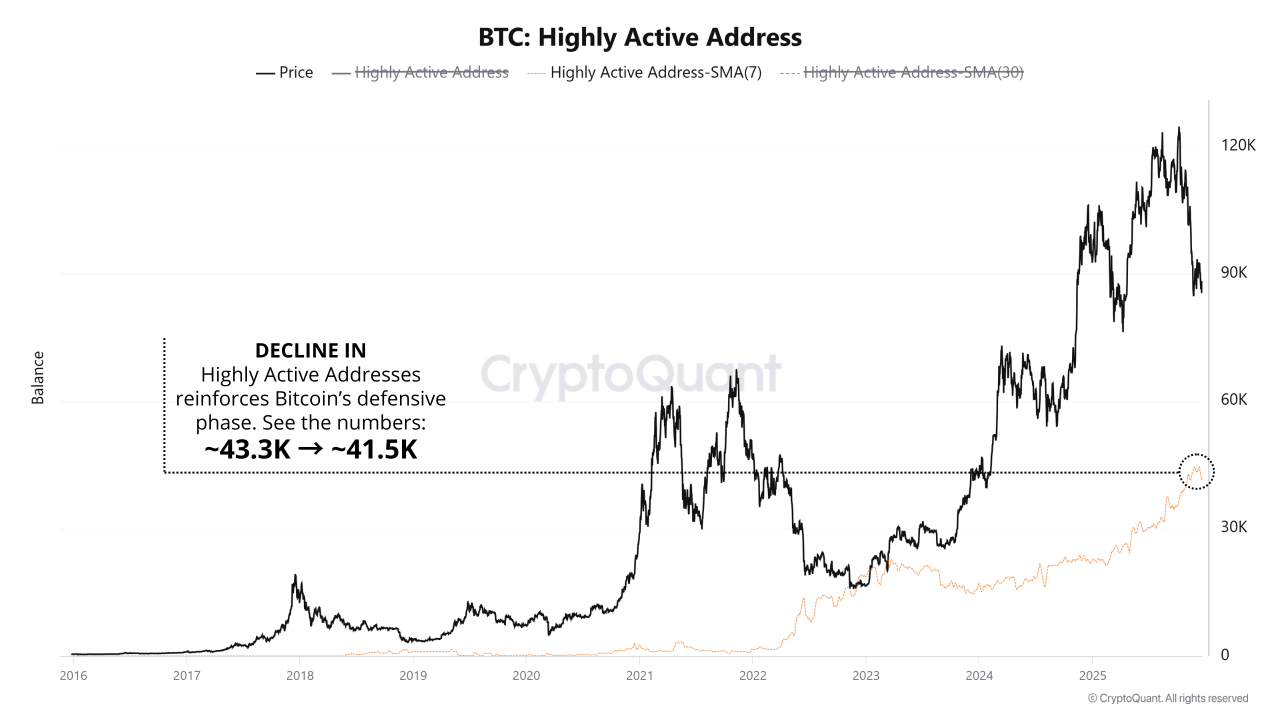

Moreover, the Extremely Energetic Tackle metric exhibits a constant decline, confirming a decline in speculative exercise. This sample has all the time urged a interval of quiet accumulation earlier than potential volatility spikes.

Key community metrics present slowdowns

The variety of Bitcoin transactions decreased from roughly 460,000 to roughly 438,000, indicating fewer transactions and fewer speculative exercise. Historic cycles have proven that intervals of declining market momentum are preceded by a decline within the variety of offers.

You can even see that the community costs (USD) have dropped from about 233,000 to about 230,000, indicating much less congestion. Decrease charges coincide with decrease demand and fewer competitors for block area.

Moreover, the variety of extremely energetic addresses has decreased from 43.3,000 to 41.5,000, suggesting fewer giant merchants and institutional buyers are actively buying and selling. This defensive conduct is according to a quiet accumulation section earlier than future value actions.

Comparability with 2018 bear market

GugaOnChain factors out that the present indicators intently mirror the bear market of 2018, which additionally noticed a lower in energetic addresses, decrease buying and selling volumes, and decrease charges. Nonetheless, at the moment’s consumer base has considerably elevated to roughly 800,000 in comparison with 600,000 in 2018, demonstrating the rising structural resilience of the ecosystem.

However, historic patterns recommend that there are sometimes intervals of low exercise earlier than elevated volatility. In different phrases, when a catalyst emerges, the market could transfer extra sharply.

Analysts predict market backside in 2026

Individually, analyst Ali Martinez predicted that Bitcoin may attain the market backside in October 2026, about 288 days from now. His evaluation suggests a possible drawdown of about 70% and a goal ground of round $37,500.

General, Bitcoin community indicators assist a defensive and inactive atmosphere typical of bear markets. Though exercise has been subdued, a bigger and extra resilient consumer base in comparison with earlier cycles gives a buffer towards excessive market downturns.

Associated: Bitcoin Worth Prediction: BTC Stays Necessary as Liquidity Story Positive factors Momentum

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.