- PIPPIN rose greater than 30% in 24 hours as merchants raised issues of manipulation.

- Critics allege focus of insider provide and synthetic buying and selling volumes.

- The trade and information platform haven’t confirmed any wrongdoing.

Yesterday, PIPPIN tokens soared regardless of accusations from some merchants alleging market manipulation. These claims embrace issues about concentrated provide, uncommon buying and selling, and trade practices.

PIPPIN expands earnings regardless of controversy

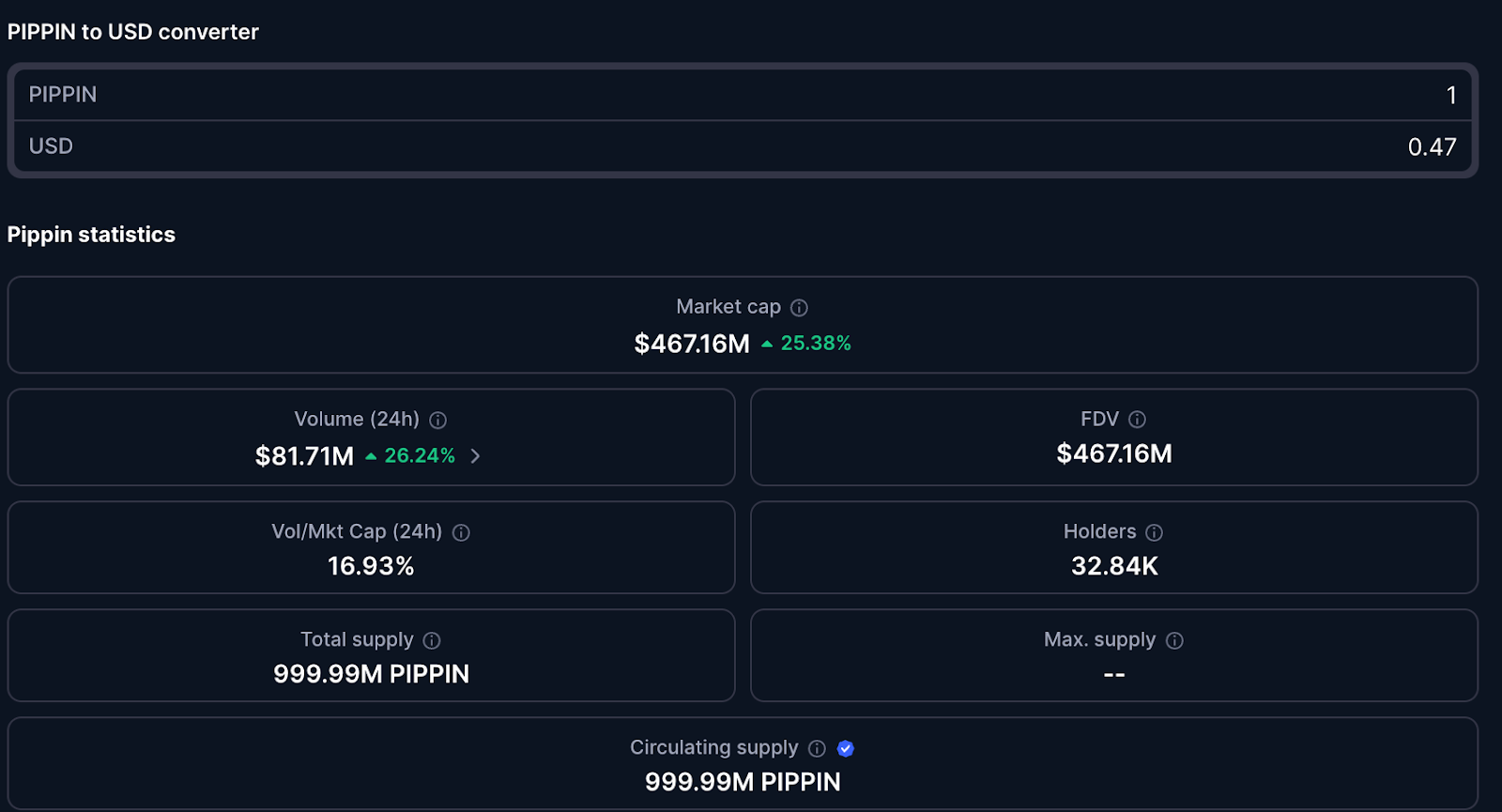

In keeping with market information, PIPPIN was buying and selling at round $0.497 on the time of writing, marking a every day enhance of over 31%. The token’s rise extends current positive aspects, together with positive aspects of about 23% over the previous week and greater than 1,300% within the final month. 12 months-over-year, PIPPIN is up over 5,000%.

The token has a reported market capitalization of practically $497 million, with a 24-hour buying and selling quantity of roughly $77 million. In keeping with information from CoinMarketCap, the overall provide of PIPPIN is reported to be just below 1 billion tokens, with virtually all of it in circulation.

Merchants query provide construction

As the worth rose, a number of merchants and market commentators expressed issues about PIPPIN’s provide dynamics. Critics argue that the token is operated as a “low float” asset, which means that a lot of the availability could also be held by insiders, regardless of being proven to be in circulation.

Cryptocurrency commentator Leonidas publicly urged CoinMarketCap to rethink itemizing PIPPIN. He argues that insider-held provide could make tokens seem bigger and extra liquid than they really are, doubtlessly deceptive retail traders who depend on headline information.

In keeping with CoinMarketCap information, PIPPIN’s provide is presently reported to be 100% in circulation. The platform doesn’t touch upon whether or not circulating provide precisely displays market availability.

sauce: coin market cap

Suspicion of synthetic buying and selling exercise

Some merchants have expressed concern over PIPPIN’s buying and selling patterns, noting the sudden worth spike adopted by a fast decline. One dealer referred to as this worth transfer a “felony candle.” This can be a time period used informally to explain a sudden reversal available in the market.

Critics additionally level out that market makers could also be rising buying and selling volumes to extend demand for the tokens, however these claims haven’t been verified. Further claims embrace funding charges and transaction charges on sure platforms.

The dealer additionally questioned the mission’s improvement, claiming there have been few technical updates or ecosystem enhancements in current months. The PIPPIN workforce has not publicly responded to those claims.

Platforms that have not taken motion but

A number of commentators referred to as on Binance to analyze PIPPIN buying and selling exercise and think about enforcement motion if fraudulent exercise is confirmed. On the time of publication, Binance, CoinMarketCap, and different main platforms haven’t introduced any actions associated to the token.

In keeping with CoinMarketCap information, PIPPIN has roughly 32,800 holders and a profile rating of 44%, which displays the completeness of disclosure moderately than the legitimacy of the mission.

Associated: Pippin Value Forecast: Pippin worth maintains bullish construction as open curiosity hits new highs

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.