- ADA holds $0.35 help amid continued lows and maintains short-term management by sellers

- Falling open curiosity and inflows into weak spots point out threat aversion fairly than aggressive quick promoting

- Founder’s feedback failed to maneuver value as merchants prioritize construction and liquidity

Cardano value motion stays below stress in latest classes as merchants concentrate on whether or not key helps can maintain. ADA is buying and selling close to the mid-$0.35 vary, reflecting a broader short-term downtrend. Market individuals proceed to judge technical alerts, derivatives exercise, and ecosystem commentary.

These components mix to form near-term expectations for ADA as volatility decreases and conviction weakens. The present section due to this fact displays warning fairly than aggressive positioning from both aspect.

Technical construction to regulate bears

On the 4-hour chart, ADA continues to make new highs and lows following December’s rejection close to $0.48. Costs are nonetheless under the 20, 50, 100, and 200 exponential shifting averages.

In consequence, the broader construction stays advantageous to sellers within the occasion of a bailout. ADA is at present buying and selling simply above a key demand zone between $0.35 and $0.34. This space has been swinging low lately, indicating an necessary turning level.

If patrons fail to defend this vary, the draw back momentum might speed up in the direction of the $0.32 to $0.30 area. That zone comprises each psychological relevance and historic demand. Nonetheless, sustaining present ranges might end in a short-term rebound.

Speedy resistance lies between $0.37 and $0.38, the place the earlier consolidation and short-term averages converge. Moreover, stronger resistance seems close to or above $0.40, the place the Fibonacci retracement degree is concentrated.

Watch out for derivatives and spot circulate alerts

Derivatives information reveals a cooling of individuals fairly than aggressive bearish bets. Open curiosity in Cardano futures decreased to roughly $630 million as the value stabilized close to help.

Beforehand, open curiosity expanded quickly throughout the rally, however then contracted round native highs. Importantly, the latest decline suggests merchants have lowered leverage and publicity. This motion displays a discount in threat fairly than a brand new quick place.

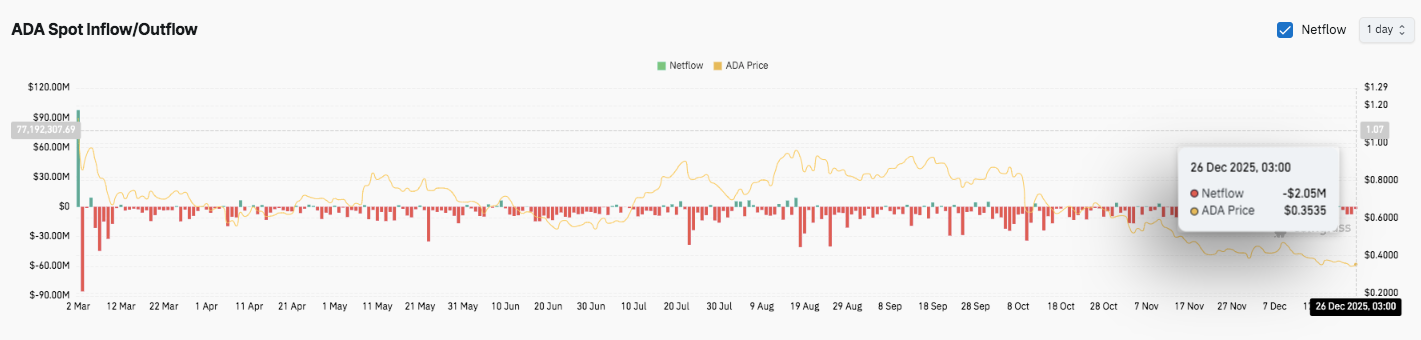

Spot circulate information reinforces our cautious view. Internet flows remained unfavorable for a lot of the interval, indicating extra withdrawals than deposits. Moreover, it was discovered that the influx spikes have been short-lived and couldn’t point out sustained accumulation.

Current information reveals every day outflows are near $2 million. In consequence, demand restoration for exchanges stays restricted whereas provide stress continues.

Founders’ responses add context, not momentum

Cardano founder Charles Hoskinson’s new claims about previous ADA gross sales additionally drew consideration to sentiment. Hoskinson denied the allegations and emphasised his long-term outlook.

Nonetheless, the market had little response to this alternate charge. Mr. Worth continued to worth the extent of ability over the event of the story. Moreover, merchants appear to be inserting extra emphasis on the construction and liquidity scenario.

Technical outlook for Cardano (ADA) value

Cardano’s key ranges stay well-defined as the value trades near the all-important demand zone.

Prime degree: Speedy resistance ranges are $0.370 and $0.382. If the breakout continues, it might pave the best way for $0.395 and $0.413. Additional energy might result in a transfer to the $0.430-$0.455 zone, the place a pattern reversal sign would seem.

Cheaper price degree: The primary help is positioned at $0.350, adopted by the $0.340 degree. If the breakdown is confirmed, ADA can be uncovered to $0.320 and psychological $0.300 territory.

Higher Resistance: The $0.430-$0.455 vary is in line with a serious Fibonacci retracement and stays a key degree for a transition to medium-term bullish momentum.

The technical construction reveals ADA under its declining shifting common, reflecting a weak restoration try. Costs stay under key Fibonacci zones, indicating restricted purchaser confidence.

Will Cardano go up?

ADA’s near-term path will rely on whether or not patrons can defend the $0.34-$0.35 help band. Holding this zone might enable for an accommodative transfer in the direction of $0.38-$0.40. Nonetheless, if the help shouldn’t be maintained, there’s a threat that the value will as soon as once more be on the draw back in the direction of $0.32 and $0.30. For now, ADA continues to be within the choice zone and volatility might improve if the value breaks out of this vary.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.