- SOL stays inside the descending channel and the EMA continues to suppress the rebound.

- Patrons are defending the $120 assist zone, however momentum stays weak.

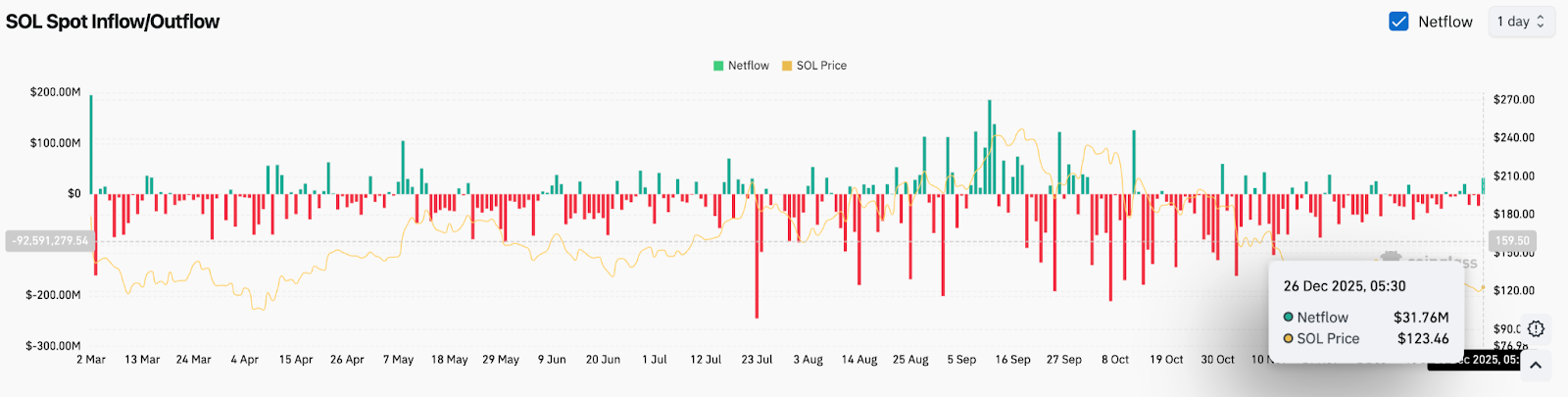

- Spot inflows have been regular, suggesting an easing of promoting strain moderately than a reversal.

Solana value is buying and selling round $123.4 at the moment after rebounding barely from latest lows, however remains to be trapped in a broad correction construction. Though the worth is above short-term assist close to $120, sellers proceed to regulate the pattern as SOL is buying and selling properly beneath the falling EMA stack. Tensions forward of December twenty seventh are targeted on whether or not stabilization could be achieved or whether or not the downtrend resumes.

Descending channels hold strain on patrons

On the each day chart, Solana continues to commerce inside a transparent descending channel that has been driving the worth down since October. Every restoration try stalls beneath downward resistance, reinforcing the bearish construction.

SOL stays beneath the 20-day, 50-day, 100-day, and 200-day EMA. The 20-day EMA close to $127.6 and the 50-day EMA close to $139.9 presently kind the primary main resistance bands. Past that, the 100-day EMA close to $155.7 and 200-day EMA close to $165.9 outline the higher bounds of the broader pattern.

The Bollinger Bands are nonetheless extending downwards, reflecting continued volatility throughout the decline. Value is approaching the underside half of the band, indicating that sellers nonetheless management the route. The pattern will stay corrective till SOL is ready to regain at the very least the 20-day EMA.

Assist at $120 is on the road.

The $120-$117 zone has emerged as an important short-term assist. This space has absorbed repeated declines all through December and coincides with the decrease sure of the descending channel.

Costs briefly fell beneath the area in the beginning of the month, however failed to draw sustained promoting. This response, though nonetheless cautious, means that demand exists. If the day closes beneath $117, the following draw back publicity is in the direction of $105, and doubtlessly $95 if momentum picks up.

Associated: XRP Value Prediction: XRP faces important take a look at as derivatives exercise declines

For now, patrons are defending the assist, however it’s shedding energy. Candlesticks proceed to shut with restricted vary enlargement, highlighting hesitation moderately than accumulation.

Intraday constructions point out stabilization makes an attempt

On the 2-hourly chart, SOL is making an attempt to construct a short-term base above $122. The supertrend stays bearish close to $124.4, limiting any upside makes an attempt. Intraday momentum stays impartial to weak till value reverses to that stage.

DMI measurements point out a powerful downward pattern. ADX stays subdued, reflecting much less confidence in its route after the November selloff. This usually precedes consolidation moderately than a right away reversal.

The short-term pullback is shallow, suggesting merchants are scalping the vary moderately than positioning for a pattern change. The motion matches the market awaiting approval.

Spot flows present preliminary constructive indicators

Spot movement information reveals slight enchancment. On December 26, Solana traded at a value round $123.5, with web inflows of roughly $31.7 million. Whereas not a sudden surge, it marks a change from the excessive outflows seen in October and November.

Associated: Shiba Inu value prediction: Downward pattern continues as patrons wrestle to defend…

Sustained inflows are wanted to vary the pattern, however stabilization is vital. When aggressive promoting subsides, draw back strain usually subsides, permitting value to kind a base. Thus far, the movement means that the distribution is slowing moderately than reversing.

Fundamentals are enhancing amid rising costs

Regardless of weak value traits, Solana’s community exercise continues to develop. Solana’s DEX spot buying and selling worth greater than doubled yr over yr, growing from $159 billion in Q3 2024 to $343 billion in Q3 2025. This progress confirms on-chain demand and robust developer traction.

The divergence between fundamentals and costs displays broader risk-off circumstances moderately than community deterioration. The market prioritizes technical construction, leaving fundamentals as a secondary issue within the brief time period.

This divergence continues to draw long-term members, however merchants are nonetheless targeted on charts and liquidity.

outlook. Will Solana go up?

Solana is confronted with a call.

- Bullish Case: SOL holds $120 and can recoup $127.6 with improved quantity and continued spot inflows. A break above $140 will affirm the stabilization of the pattern and supply extra room for a transfer in the direction of $155.

- Bearish case: A each day shut beneath $117 confirms assist failure, with a doable $105 and subsequent draw back zone at $95.

The broader pattern stays underneath strain till costs regain resistance on the EMA. Stabilization is feasible, however not confirmed but.

Associated: Cardano Value Prediction: ADA Value Outlook turns into Cautious as Derivatives Cool

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.