- XRP consolidates close to $1.87 as demand continues, however slim vary indicators pending volatility

- Worth stays under the falling EMA, short-term pattern stays bearish to impartial

- Declining open curiosity and secure outflows point out merchants desire warning over leverage

XRP continued to commerce inside a slim vary as the worth motion stabilized round $1.87 on the 4-hour chart. The token has beforehand rebounded from a well-defined demand zone between $1.77 and $1.80. Nonetheless, follow-through on the upside stays restricted.

Market members seem like turning into cautious as XRP falls under a number of technical boundaries. The short-term construction subsequently displays steadiness moderately than conviction on both facet. Merchants at the moment are watching to see if this pause develops right into a sustained transfer or a deeper retracement.

Technical construction stays under main averages

XRP is positioned under the foremost 4-hour exponential transferring common. The 20, 50, 100, and 200 EMAs proceed to pattern downward. Subsequently, the broader pattern stays bearish to impartial. The 200 EMA is positioned close to $2.02, putting a recurrent cap on any restoration makes an attempt.

Moreover, the Bollinger Bands have tightened considerably, indicating decreased volatility. Such compression is commonly preceded by a motion in a stronger path. Nonetheless, the path stays unsure till the worth breaks out of the present vary.

Quick assist develops between $1.84 and $1.80, coinciding with the decrease certain of the Bollinger Bands. Moreover, the $1.77 stage marks a latest swing low that merchants think about necessary. A breakdown under this zone may result in contemporary promoting stress.

On the upside, short-term resistance lies round $1.89 to $1.90, the place the short-term averages converge. Above that, $1.94 acts as a pre-reaction stage. Importantly, the $2.00 to $2.03 zone represents each psychological resistance and the ceiling of a long-term pattern.

Derivatives buying and selling indicators cool hypothesis

Futures market information exhibits adjustments in dealer habits. XRP open curiosity expanded quickly beginning in mid-November as leveraged positions elevated together with volatility. Beforehand, open curiosity exceeded $3 billion throughout a breakout try.

Associated: Cardano Worth Prediction: ADA Worth Outlook turns into Cautious as Derivatives Cool

Nonetheless, it was not potential to keep up a excessive stage. Because of this, open curiosity has been trending downward, reflecting the unwinding of positions moderately than new accumulation. The present studying is near $3.37 billion, suggesting a decline in leverage participation. This decline reduces near-term liquidation danger, but in addition limits aggressive upward momentum.

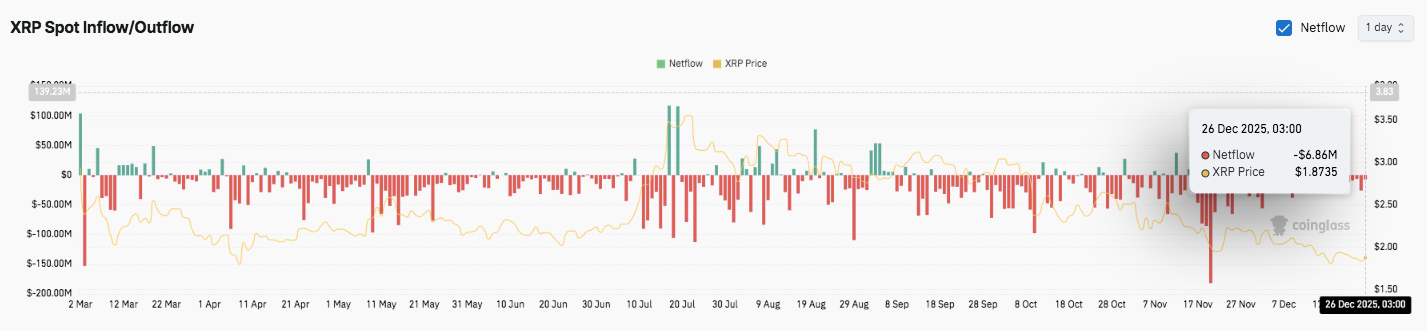

Spot stream displays cautious positioning

Spot change stream information provides additional context to XRP consolidation. Outflows have constantly exceeded inflows in latest months. Subsequently, distribution stress nonetheless exists. Though there have been occasional spikes in inflows through the temporary rally, follow-through shopping for stays weak.

Moreover, latest web outflows have reached practically $6.9 million, reinforcing warning. Merchants seem like lowering their publicity to energy investments. Because of this, except demand decisively strengthens, XRP will stay trapped inside a broader correction construction.

Technical outlook for XRP value

XRP’s key ranges stay effectively outlined as value consolidates into key zones.

The present upside ranges are $1.90 and $1.94. A clear break above this vary may begin a transfer in direction of $2.00 and $2.03, the place the higher pattern of the 200-day EMA continues.

On the draw back, $1.80 serves as necessary short-term assist, adopted by $1.77 as a latest low. Failure to keep up this space dangers growth into zones with decrease demand.

The technical construction exhibits that XRP is compressing under the descending transferring common, indicating that though momentum is lowering, the chance of a breakout is growing. Bollinger Band tightening helps the case for elevated volatility.

Will XRP go up?

XRP’s near-term path will depend upon whether or not patrons can defend $1.80 lengthy sufficient to problem the $1.90-$1.94 resistance cluster. A profitable restoration to $2.00 will shift the medium-term bias to the bullish facet.

Nonetheless, a break under $1.77 would invalidate any restoration try and strengthen the broader correction pattern. For now, XRP remains to be at a choice level and a stream of confidence may decide the subsequent leg.

Associated: Shiba Inu value prediction: Downtrend continues as patrons wrestle to guard year-end assist

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.