- ETH has fallen under the downtrend line and the total EMA stack, and the construction stays bearish.

- Consumers are defending the $2,900 help, however the rebound nonetheless lacks follow-through.

- Continued spot spills will restrict restoration makes an attempt till December twenty seventh.

Ethereum worth is buying and selling round $2,970 at present after rebounding modestly from current lows, however the broader construction stays beneath stress. Consumers stay defensive as the value stays under the downtrend line and powerful resistance on the EMA. Tensions heading into December twenty seventh are targeted on whether or not ETH can stabilize above key helps or whether or not the market will return to a corrective trajectory.

Downtrend stays under EMA resistance

On the day by day chart, Ethereum stays pinned under the downtrend line that has capped any features since late August. Decrease highs proceed to outline the construction, indicating that the restoration try stays correctional moderately than trend-forming.

ETH is buying and selling under the 20-day, 50-day, 100-day, and 200-day EMA. The 20-day EMA close to $2,999 and the 50-day EMA close to $3,157 kind the primary resistance zone. Past that, the 100-day EMA close to $3,368 and 200-day EMA close to $3,387 outline broader bearish ceilings.

Bollinger Bands stay at a low angle, reflecting continued draw back stress. Costs proceed to commerce under the intermediate band, indicating that momentum has not but returned in favor of patrons. Sellers will keep management of the pattern till ETH regains the EMA cluster.

Assist close to $2,900, however construction is weak

The $2,900-$2,850 zone has emerged as an important short-term help. The area has absorbed a number of declines by way of December, coinciding with current swing lows.

Costs briefly fell to round $2,760 originally of the month, however have since rebounded, suggesting demand is at decrease ranges. Nevertheless, every rally has shortly stalled, highlighting weak follow-through from patrons.

Associated: Solana Worth Prediction: Downtrend holds as spot flows stabilize close to key helps

A day by day shut under $2,850 would expose the subsequent draw back to $2,700, adopted by a broader demand zone round $2,600. So long as ETH stays above $2,900, the draw back stays contained, however this construction has little margin for error.

Intraday chart exhibits stabilization with out breakout

On the hourly chart, Ethereum is consolidating between $2,930 and $2,990 after rebounding sharply from current lows. The supertrend has turned barely constructive close to $2,912, offering short-term help.

The parabolic SAR dot stays under the value, confirming intraday stabilization. Nevertheless, momentum stays sluggish. Costs are nonetheless struggling round small resistance ranges and quantity stays low, reflecting extra hesitation than conviction.

These intraday indicators point out a stability moderately than a reversal. Barring a decisive break above $3,000, the short-term power dangers reversing into the broader downtrend.

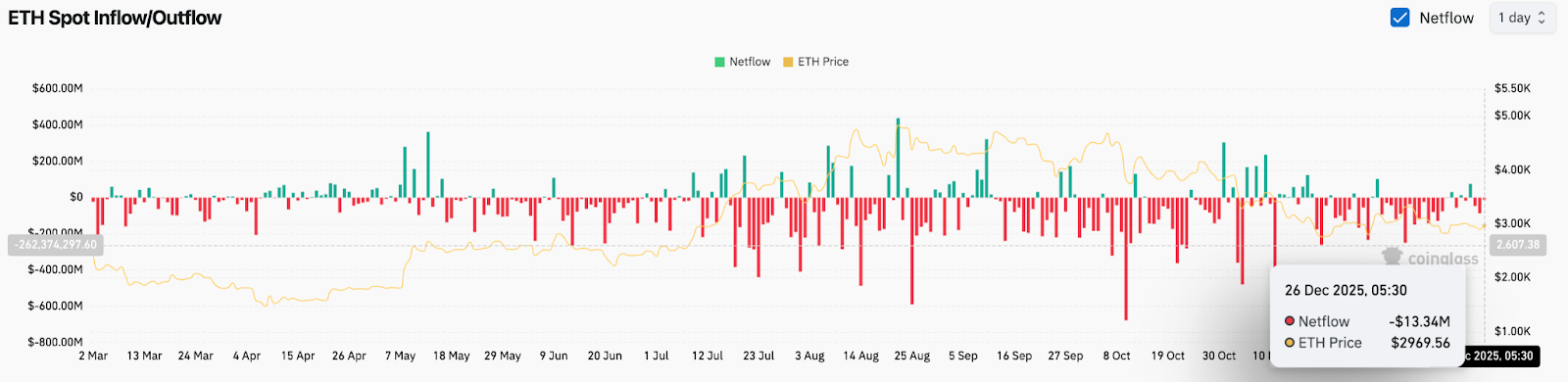

Spot flows proceed to weigh on costs

Spot circulation information continues to indicate a bearish pattern. On December twenty sixth, Ethereum recorded internet outflows of roughly $13.3 million whereas the value hovered round $2,970. Though smaller in measurement than earlier distribution waves, the continued outflow means that sellers stay lively.

Associated: XRP Worth Prediction: XRP faces important check as derivatives exercise declines

Sustained unfavourable flows typically restrict upside throughout corrections. And not using a constant transition to influx, rallies will battle to construct traction. The present circulation profile is in keeping with a market targeted on threat discount moderately than accumulation.

What bulls want to alter momentum

For Ethereum to indicate significant change, the value must regain $3,000 and maintain above the 20-day EMA. That will be the primary signal of a shift in near-term momentum.

A sustained transfer above $3,157 will problem the downtrend line and open the door to $3,368. Solely a breakout of the 200-day EMA close to $3,387 would sign a broader pattern reversal.

Failure to maintain $2,900 will shift focus again to the draw back, growing the danger of a deeper correction.

outlook. Will Ethereum go up?

Ethereum remains to be at a crucial junction.

- Bullish case: ETH holds $2,900 and can recuperate $3,000 when quantity will increase. Momentum will enhance above $3,157 and a transfer in direction of $3,350 will start.

- Bearish case: A day by day shut under $2,850 confirms help failure and might be $2,700, with the subsequent draw back zone at $2,600.

The broader bias stays cautious till Ethereum clears the EMA resistance and trendline. There’s a chance of stabilization, but it surely has not but been confirmed.

Associated: Shiba Inu worth prediction: Downtrend continues as patrons battle to guard year-end help

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.