- XRP maintains the $1.80 to $1.85 demand zone however remains to be constrained under the downtrend line.

- Sustained spot outflows proceed to soak up ETF-driven demand close to resistance.

- Document ETF inflows act as a value ground slightly than a catalyst for a development reversal.

XRP value is buying and selling round $1.85 at this time because the token stabilizes past a well-defined demand zone after months of regular downward stress. The market is balancing report ETF inflows with persistent technical weak point, with costs remaining pinned close to assist slightly than breaking out to highs.

Downtrend line continues to constrain restoration

On the every day chart, XRP is firmly under the downtrend line that defines its lowest value since its summer time peak. All makes an attempt to maneuver as much as this line have been offered, confirming that sellers stay accountable for the broader construction.

The value stays barely above the $1.80 to $1.85 assist zone that attracted repeated bids all through December. This stage is consistent with earlier demand and marks the final line that the bulls have persistently defended.

The supertrend stays bearish close to $2.07, confirming that development management stays unchanged. The parabolic SAR dot stays above value, indicating that draw back stress stays energetic regardless of current stabilization.

So long as XRP trades under the downtrend line and supertrend, the rally stays corrective slightly than development forming.

Enhance overhead provide with EMA clusters

A shorter timeframe exhibits why upward progress has stalled. On the 2-hour chart, XRP is buying and selling under the total EMA stack, with the 20, 50, 100, and 200 interval averages clustered between $1.85 and $1.93.

All makes an attempt to regain this zone failed and the EMA band become an space of promoting energy. Bollinger Bands have narrowed, reflecting decrease volatility and continued compression.

This setup means that the market is rolling, however the path stays unresolved. Patrons want a clear break and maintain above the EMA cluster to shift momentum from impartial bearish territory.

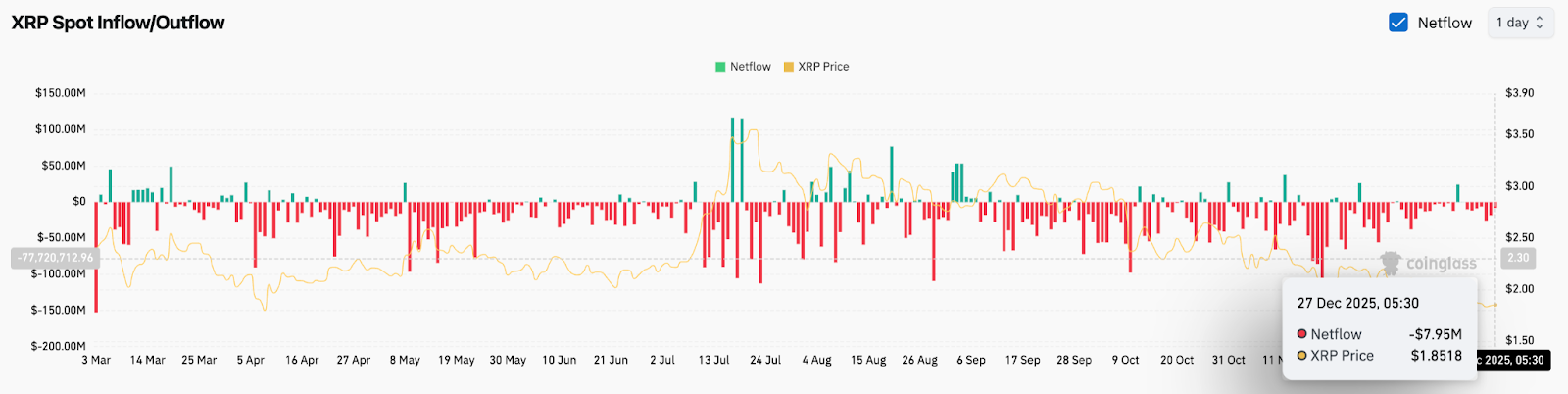

Spot circulation exhibits distribution in resistance values

On-chain knowledge explains why costs have remained depressed regardless of sturdy demand from institutional buyers. XRP Spot internet outflows have remained adverse all through most of this 12 months, together with a $7.95 million internet outflow recorded on December twenty seventh.

These sustained outflows point out that current holders are capitalizing on the rally and returning their tokens to the market. This sell-side exercise has absorbed ETF-driven demand and saved costs near resistance.

The sample is constant. ETF inflows have stabilized costs throughout downturns, however haven’t been massive sufficient to overwhelm distributions from conventional holders.

ETF inflows act as a ground, not a set off.

XRP ETF efficiency stands out throughout the digital asset market. Since its launch, the XRP ETF has recorded 27 consecutive days with no internet outflows and amassed property below administration from $1.25 billion to $1.29 billion.

At present, between 686 and 746 million XRP tokens are locked inside ETF buildings. The latest influx was $11.93 million on December twenty fourth, and that steady influx continued into the vacation interval.

However costs haven’t but reacted. The reason being structural. Many holders who’ve amassed above $1.86 stay under the floor and wish to use drive to exit. Lengthy-term holders are additionally locking in residual income after a risky 12 months, rising oblique provide.

Whereas ETF purchases prevented a free fall, they weren’t sufficient to reverse the development and not using a broader change in market sentiment or a discount in stress on the promote facet.

outlook. Will XRP go up?

XRP maintains assist, however the development stays unchanged.

- Bullish Case: A every day shut above $1.93 that converts the EMA cluster into assist may open the door to $2.05 and retest the downtrend line. A break above $2.07 would mark the primary structural change because the summer time.

- Bearish case: A lack of $1.80 invalidates the present norm and exposes the subsequent demand zone round $1.65. Under that, draw back dangers speed up towards earlier consolidation ranges.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.