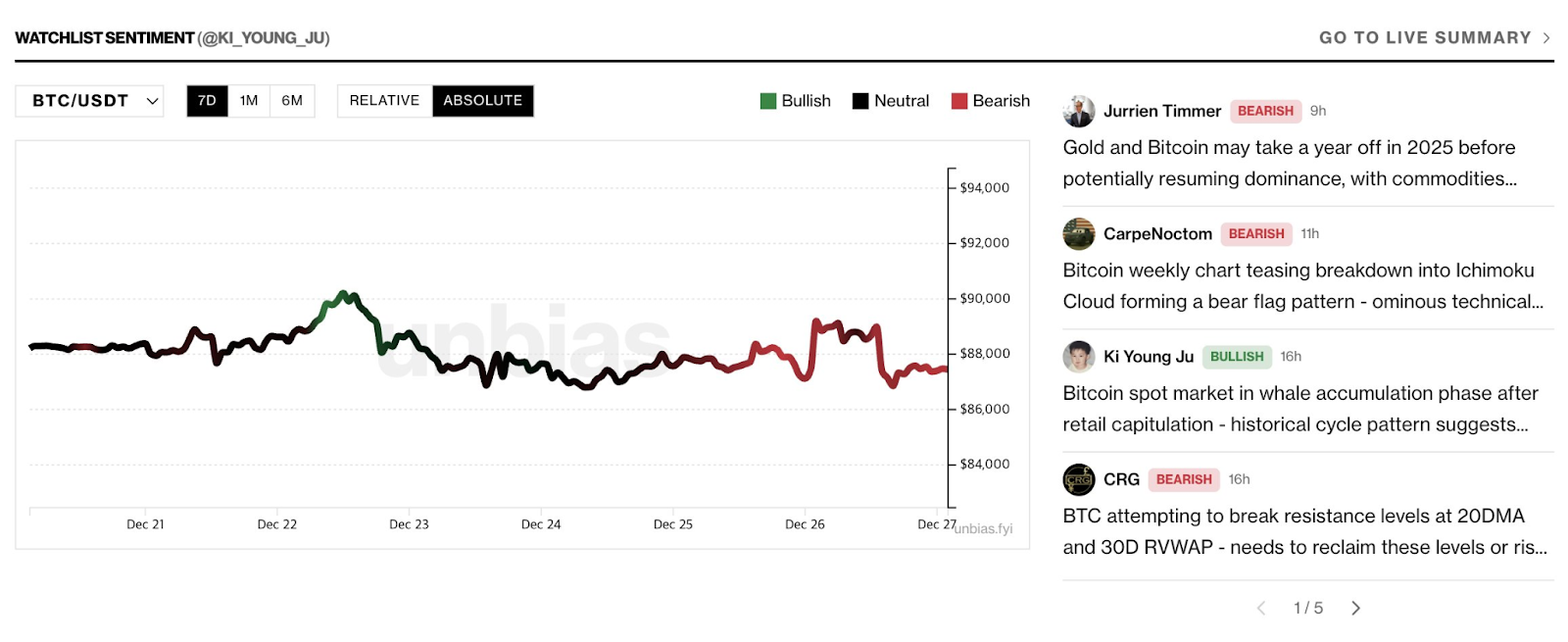

- Regardless of there being no main worth breakdown, the AI sentiment software turned bearish on Bitcoin after analysts confirmed resistance.

- Merchants are debating whether or not AI sentiment fashions are misreading regular technical warning.

- Bearish sentiment suggests warning, whereas on-chain knowledge suggests Bitcoin stays in market reset.

Bitcoin market sentiment turned pink at this time after a number of broadly adopted analysts have been tagged as bearish by an AI-powered sentiment tracker.

Remarkably, this outcome was not attributable to a major worth decline, however moderately by a wave of cautious technical commentary highlighting resistance ranges and draw back dangers within the BTC worth. Following weeks of range-bound buying and selling for Bitcoin, the value often falls.

This transformation sparked debate on crypto Twitter about whether or not the AI was misreading extra delicate market feedback.

Rebellious speech lowers feelings

The change in sentiment got here after a number of technical posts identified that Bitcoin has didn’t get better key resistance ranges corresponding to short-term transferring averages and volume-weighted worth bands.

Analysts warned that this might result in additional consolidation and decrease costs. Whereas this sort of evaluation is frequent in vary markets, AI flagged the resistance and danger focus as bearish, pushing general sentiment into damaging territory.

Alternatively, some analysts disagreed, saying that mentioning resistance is a traditional a part of technical evaluation and isn’t a transparent bearish sign. It added that it’s customary to debate each draw back dangers and upside potential, particularly in unsure markets.

This highlights the rising hole between how people analyze markets and the way AI methods label sentiment.

Ki Younger Joo explains how AI reads tweets

Ki Younger Ju, founding father of CryptoQuant, defined that the sentiment mannequin evaluates whether or not a put up is leaning towards a breakout, breakout, or range-bound end result.

Posts that point out each bullish and bearish situations are handled as delicate and have much less significance, however the wording can nonetheless tip sentiment in a single route or the opposite.

Because of this, a nuanced put up can extra simply reverse sentiment than a transparent directional name. Ju added that the system continues to be in beta and the staff is working to enhance these points.

Bearish sentiment does not imply a bearish market

This episode reveals that emotional dashboards measure tone, not certainty. A bearish label normally signifies heightened warning and doesn’t name for a major decline. Bitcoin continues to be buying and selling inside a spread, with merchants seeking to see if it can break above resistance or fall.

As this case reveals, how analysts speak about a market might be as vital because the market itself.

Bitcoin is in a bear market: How far will it fall?

In the meantime, these discussions come as broader crypto market sentiment stays cautious, with Bitcoin buying and selling beneath key psychological ranges corresponding to $100,000 and $90,000 for a number of weeks, regardless of gold and silver hitting all-time highs.

Final week, CryptoQuant knowledge steered that Bitcoin could also be coming into a bear market moderately than experiencing a short lived correction. Analyst Wu Mingyu factors out that Bitcoin’s Cycle Momentum Index (BCMI) returned to the 0.5 zone in October and has since fallen with a worth decline of greater than 30%, suggesting a broader market reset.

Bitcoin is presently buying and selling round $86,900, down 32% from its all-time excessive of $126,198. Traditionally, main cycle bottoms are fashioned when the BCMI drops to the 0.25-0.35 vary, however this vary has not but been reached, indicating that the market should still be in transition.

Individually, CryptoQuant analyst GugaOnChain factors to decrease community exercise, decrease charges, and fewer lively addresses (traditional bear market indicators just like 2018), however at this time’s stronger person base might assist restrict draw back dangers.

Trying forward, analyst Ali Martinez means that Bitcoin’s closing backside might be reached round October 2026, with a 70% drop to round $37,500.

Associated: Bitcoin enters a quiet accumulation section. Analysts predict 2026 lows

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.