- The ZEC’s compression persists till the upper bass is maintained, displaying steadiness earlier than a definitive breakout.

- Rising futures open curiosity close to the height signifies larger liquidation threat and better volatility.

- The uneven spot circulate suggests rearrangement, and ZEC depends on a clear catalyst.

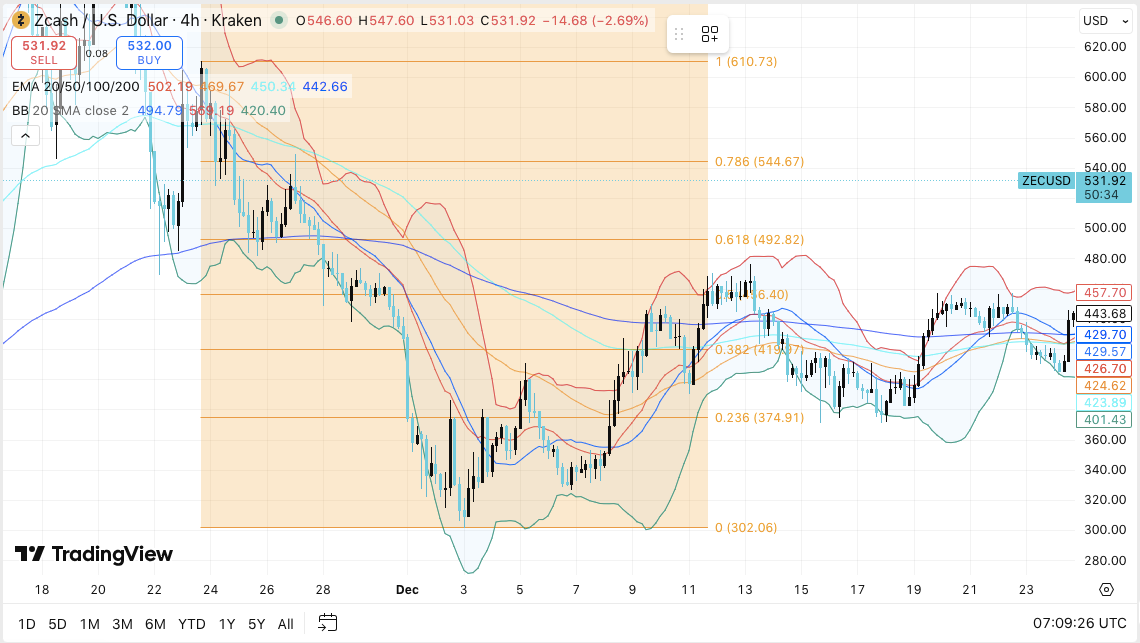

Zcash worth motion exhibits rising tensions as merchants assess whether or not the consolidation will resolve larger or decrease. ZEC is buying and selling close to the mid-$430s after failing to maintain positive aspects above current highs. Market contributors are at the moment searching for clues by understanding key technical ranges, spinoff positioning, and circulate actions.

The broader construction nonetheless displays steadiness quite than development depletion. Nevertheless, the tightening in worth actions means that extra strikes might observe within the close to time period. Analysts describe the present scenario as a pause quite than a reversal. In consequence, consideration shifted to the affirmation sign on the 4-hour timeframe.

Value construction suggests compression part

ZEC worth stays range-bound after being rejected round $455-$460. This rejection slowed the upside momentum however didn’t injury the broader construction.

Importantly, the value continues to kind larger lows above the $410 space. This motion means that consumers are nonetheless defending the pullback.

Nevertheless, the short-term momentum weakened as ZEC fell under the sooner transferring common. Subsequently, merchants view the short-term development as cautious quite than bearish.

Moreover, volatility has narrowed throughout the vary. Bollinger Bands are narrowing, which regularly signifies an upcoming enlargement part. Fibonacci positioning additionally displays indecision.

The worth is transferring between the 0.382 retracement close to $410 and the 0.5-0.618 zone between $450 and $495. Subsequently, the market wants a catalyst to find out its route.

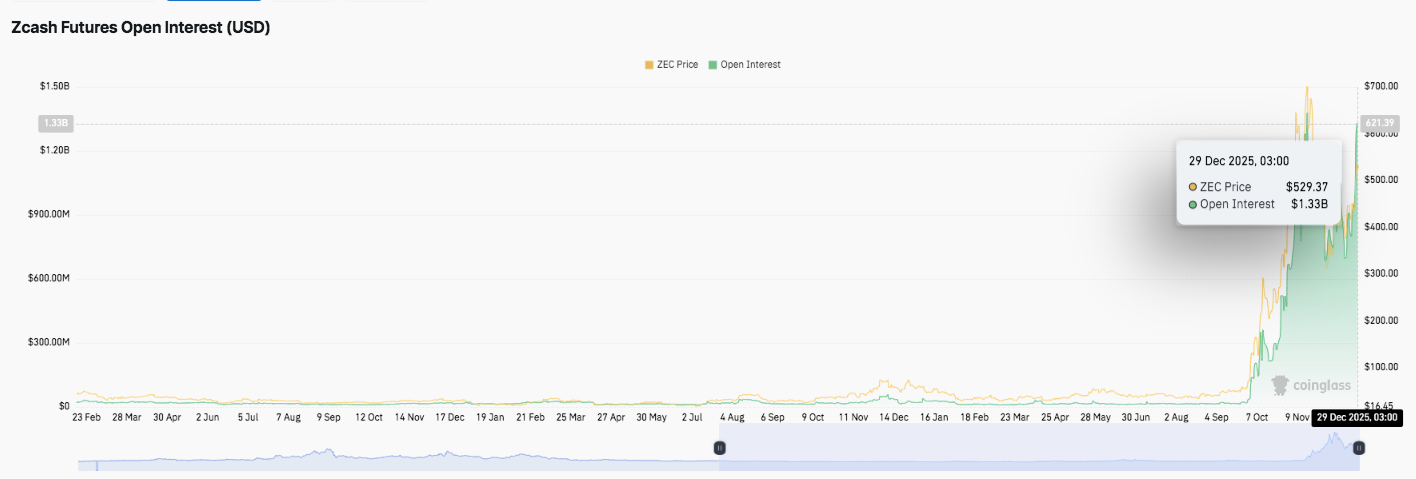

Derivatives buying and selling reveals elevated threat

Zcash futures knowledge exhibits a transparent change in dealer habits late within the fourth quarter. Open curiosity remained subdued all through many of the yr, reflecting restricted leveraged participation. Nevertheless, exercise all of a sudden surged as worth will increase accelerated.

Open curiosity has grown together with the value, reaching round $1.33 billion close to its current peak. This sample sometimes displays a brand new leveraged place quite than quick overlaying.

Associated: Shiba Inu worth prediction: SHIB stabilizes near-term lows as provide alerts enhance

Moreover, rising open curiosity usually will increase liquidation sensitivity. Merchants at the moment are working in a extra reactive atmosphere. A pointy transfer might lead to a compelled sending off for both facet. Subsequently, expectations for elevated volatility quite than sustained consolidation have been bolstered in derivatives markets.

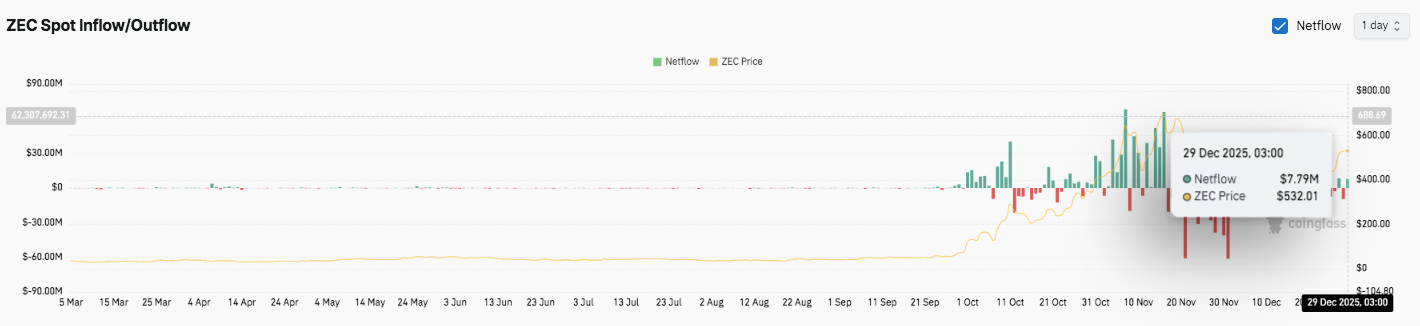

Spot flows present lively relocations

Spot circulate knowledge provides one other layer to the outlook. From March to September, inflows and outflows had been virtually balanced. Throughout this era, costs confirmed minimal response. Nevertheless, October noticed a change. Sustained inflows had been accompanied by robust breakouts, indicating lively accumulation. The speedy improve in inflows continued till early November.

Nevertheless, there was then a noticeable outflow of capital, indicating profit-taking after the rally. In December, the circulate turned uneven. Inflows and outflows change continuously, suggesting uncertainty. Furthermore, this habits displays relocation quite than clear accumulation or dispersion.

Zcash (ZEC) technical outlook

Zcash worth enters a big compression part as key technical ranges stay nicely outlined heading into the subsequent buying and selling window.

- Prime stage: Speedy resistance lies at $443-447, adopted by a rejection zone at $457-460. If a break above this space is confirmed, the rally might prolong in the direction of $492-$495, with $545 serving as an upside goal on the upper time-frame.

- Cheaper price stage: Preliminary assist is round $424-$426, which is consistent with the short-term common. Under that, the $410-$415 zone stays crucial structural stage. As soon as the breakdown is set, there’s a threat of heading in the direction of $375-$380, with $302 appearing as the important thing macro assist.

- Higher restrict of resistance: The $457-$460 space represents a key stage that ZEC should recuperate to regain bullish momentum on the 4-hour time-frame.

Technically, ZEC seems to be compressed in a spread with diminished volatility. This setup usually precedes an enlargement transfer after worth breaks out of a spread with quantity.

Will Zcash rise?

Zcash worth route will depend upon whether or not consumers can defend the $415 space lengthy sufficient to problem the $457 resistance cluster. If momentum improves with sustained inflows, ZEC might retest $492 and even $545.

Nevertheless, failure to carry $410 would weaken the construction and expose it to extra critical draw back dangers. For now, Zcash stays within the crucial zone, the place the leverage scenario and spot flows might decide the subsequent decisive transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.