- ADA is making an attempt to kind a stronghold after defending the $0.326 space close to the underside of the Bollinger Band.

- Spot inflows and declining open curiosity recommend that promoting strain is easing, slightly than reversing.

- Worth stays beneath the important thing EMA, with restoration makes an attempt capped at $0.381 and $0.438.

Cardano value is buying and selling round $0.376 at present after rebounding barely from December lows, with consumers getting into close to the decrease finish of the current vary. Whereas this transfer supplies short-term aid, the broader construction stays underneath strain as ADA continues to commerce properly beneath its main transferring averages. There’s a rigidity between bettering near-term momentum and the nonetheless prevailing downtrend on greater time frames.

Every day construction stays bearish regardless of rebound

On the every day chart, ADA continues to be caught within the broad correction that began in October. The value stays beneath the 20-day, 50-day, 100-day, and 200-day EMAs, all of that are trending down. The 20-day EMA close to $0.381 and the 50-day EMA close to $0.438 kind the primary resistance zone. Above that, the 100-day EMA close to $0.526 and the 200-day EMA close to $0.610 outline the macro prime.

The current rally occurred close to the decrease finish of the Bollinger Band round $0.326, a zone that has traditionally attracted bullish consumers. That safety is necessary, nevertheless it will not change developments in and of itself. ADA must regain misplaced averages to maneuver the narrative from stabilization to restoration.

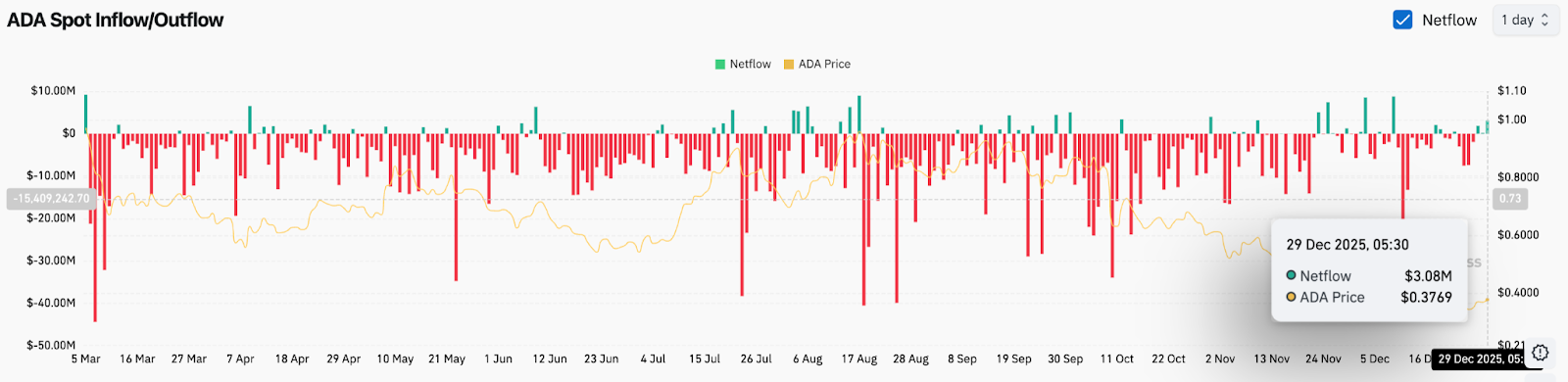

Spot circulation exhibits early enchancment

Spot circulation knowledge supplies delicate optimistic alerts. After weeks of capital outflows, Cardano recorded a internet influx of $3.08 million on December twenty ninth. This transfer stands out in comparison with the broader distribution sample seen all through the fourth quarter.

Associated: Zcash Worth Prediction: Zcash consolidates after rejection as merchants brace for breakout

Whereas a single influx doesn’t affirm accumulation, it does recommend that sellers are shedding urgency round present ranges. Spot consumers are beginning to take up provide slightly than chasing falling costs. That is in keeping with the worth stabilization seen on the chart.

For ADA to construct a sustainable basis, spot inflows should be sustained over a number of periods. With out this follow-through, the pullback dangers reverting to the overall downtrend.

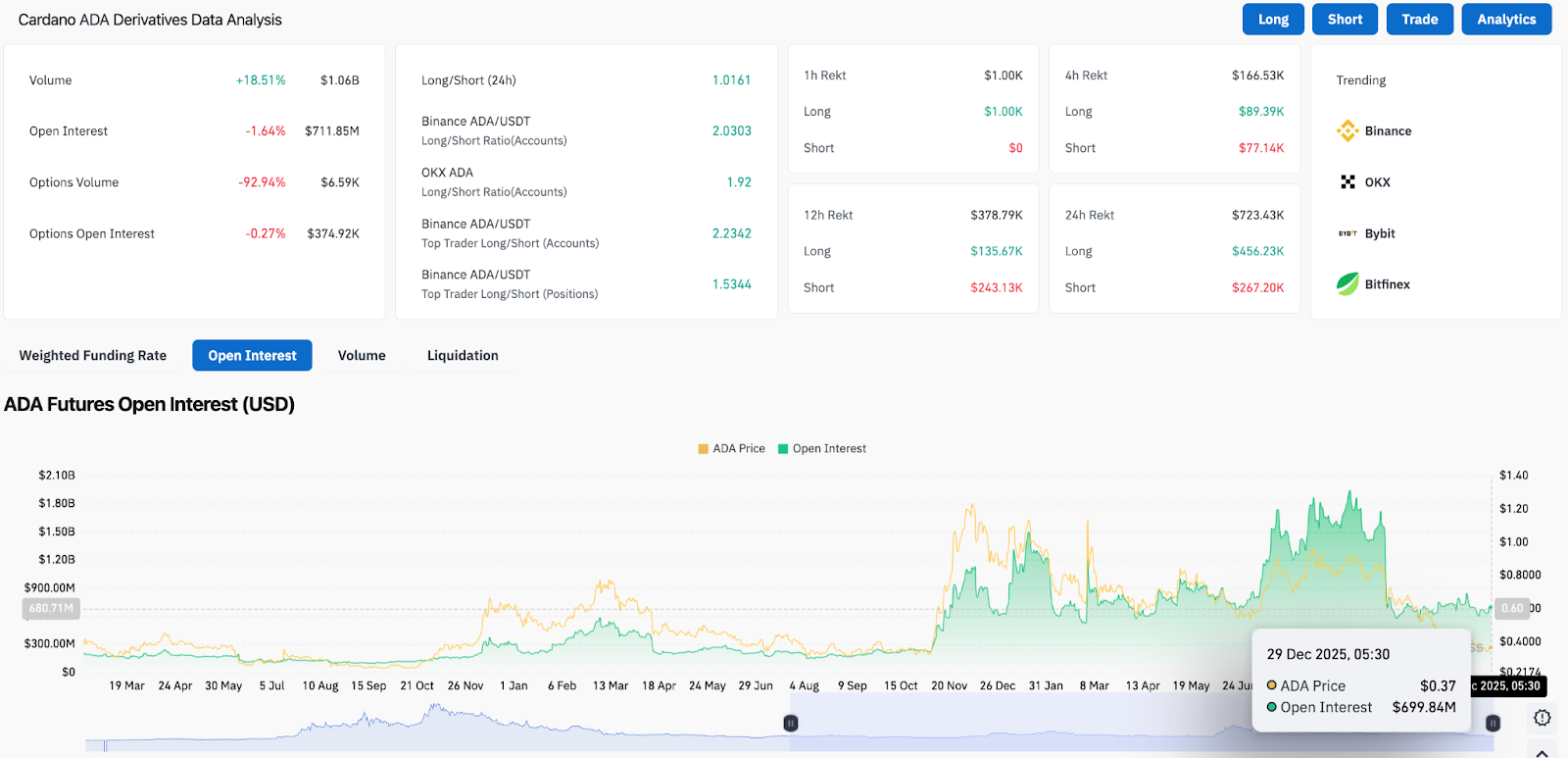

Derivatives Information Indicators Leverage Danger Mitigation

Derivatives positioning has cooled down. Regardless of quantity rising by greater than 18%, open curiosity decreased by 1.64% to roughly $712 million. This discrepancy signifies a clean-up of the place slightly than an aggressive directional wager.

Liquidation knowledge helps that view. Whole liquidations over the previous 24 hours have remained modest in comparison with earlier drawdowns, with a balanced liquidation of each longs and shorts. The long-to-short ratio is near impartial, indicating that leverage just isn’t closely biased in a single course.

This setting reduces the danger of a compelled draw back cascade. Though there is no such thing as a assure of upside, if spot demand is maintained, there might be room for costs to stabilize.

Quick time period chart exhibits bettering momentum

On the 30-minute chart, ADA has damaged out of the short-term supertrend close to $0.372 and stays above the intraday uptrend line. The RSI has recovered to the mid-50 yen stage, reflecting improved momentum with out getting into overbought territory.

The value lately rose in the direction of $0.385 and has since fallen again, indicating that provide is near that stage. That zone now acts as quick resistance. A clear break above this is able to open up house for $0.400, the place sellers had been beforehand actively intervening.

These decrease timeframe alerts recommend consumers are aggressive, however confidence stays restricted till greater timeframe resistance ranges get better.

outlook. Will Cardano go up?

ADA is making an attempt to stabilize after an extended interval of decline, however the pattern has not modified but.

- Bullish case: value sustains above $0.360 and breaks above $0.381 on rising quantity. A detailed above $0.438 confirms a change in momentum and the subsequent goal is $0.480.

- Bearish case: If $0.360 fails to carry, ADA will transfer again in the direction of $0.326. A break beneath this stage signifies a continuation of the broader downtrend.

Associated: Shiba Inu value prediction: SHIB stabilizes near-term lows as provide alerts enhance

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.