- XRP is buying and selling beneath the important thing EMA, indicating near-term bearish stress and a stalled restoration.

- Consolidation round $1.89-$2.10 suggests a cautious commerce with no affirmation of a reversal but.

- Retail companies face increased obstacles to entry as massive holders dominate the availability dynamics of XRP.

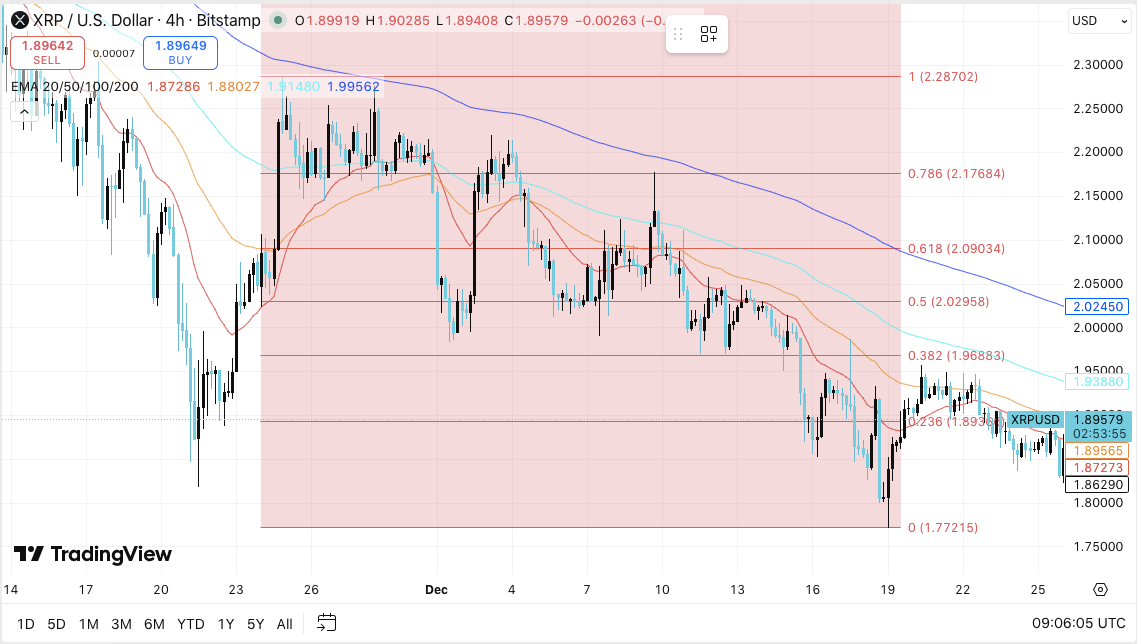

XRP value motion has entered a cautious part as merchants reassess dangers after weeks of volatility. On the 4-hour Bitstamp chart, XRP continues to mirror near-term weak point regardless of makes an attempt at stabilization.

Current buying and selling reveals that XRP is struggling to get well misplaced floor after a pointy drop. Value stays beneath the most important shifting averages, indicating that sellers are nonetheless accountable for the short-term route. Nonetheless, decrease leverage and regular consolidation counsel that the market could also be getting ready for a clearer transfer.

XRP Value Construction Is Alarming

On the 4-hour timeframe, XRP is buying and selling beneath the 50, 100, and 200 exponential shifting averages. All three averages are trending down, reinforcing the short-term bearish construction. Any assortment makes an attempt rapidly stall, with restricted follow-through from patrons.

Importantly, XRP continues to respect the descending channel that shaped after the latest decline. This sample displays consolidation somewhat than reversal. So long as the value stays beneath the $2.03-$2.10 zone, the rally seems to be correcting. Due to this fact, merchants deal with upside value actions with warning.

Assist close to $1.89 is necessary for short-term stability. A break beneath $1.87 might put downward stress again towards the $1.82 space. Nonetheless, sustaining above the present assist might present one other check of overhead resistance.

Including context with derivatives and trade flows

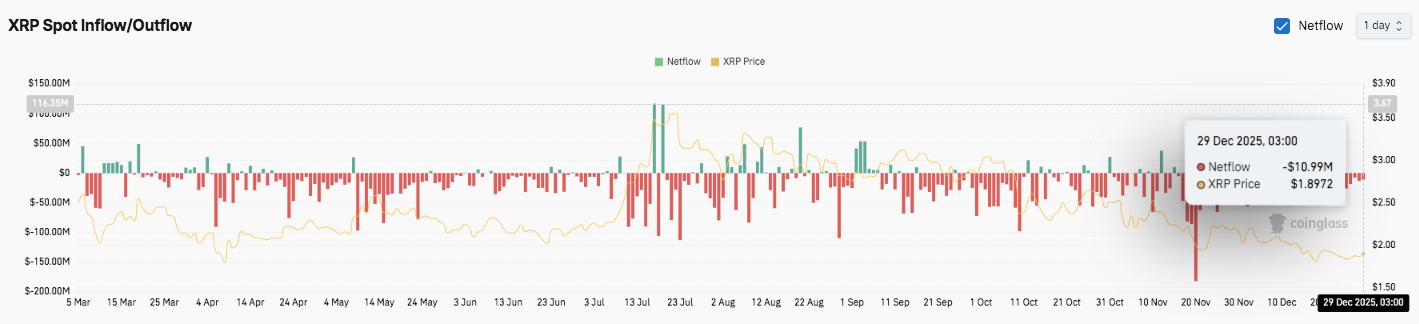

XRP futures knowledge supplies additional perception into market tendencies. Open curiosity expanded quickly throughout the November rally, confirming the energy of speculative participation. This part ended with a noticeable unwinding as costs fell.

Associated: Bitcoin value prediction: BTC maintains vary as open curiosity cools…

Open curiosity is at the moment steady at almost $3.4 billion. This degree suggests decrease leverage and decrease liquidation threat. Due to this fact, the present market seems to be more healthy than throughout earlier peaks. A brand new enhance in open curiosity as costs rise would sign higher conviction.

Spot buying and selling knowledge paints a extra cautious image. XRP has recorded an extended interval of web outflows, indicating constant stress on the vendor facet. A short lived spike in inflows occurred throughout the rebound, however rapidly dissipated. Moreover, latest capital outflows of almost $11 million coincide with continued value declines.

Possession tendencies increase considerations for retailers

Past charts and flows, pockets circulation is sparking new debates. Based on knowledge circulating on-line, most XRP wallets have comparatively small balances. Over 6 million wallets are reported to comprise lower than 500 XRP.

Moreover, a small variety of massive wallets management many of the provide. As the value of XRP rises, it turns into tougher for small traders to build up. Shopping for 1,000 XRP now prices considerably greater than it did a yr in the past.

Associated: Cardano Value Prediction: ADA Makes an attempt Base as Consumers Shield Low of Vary

Because of this, retail individuals face increased obstacles to entry, whereas massive holders simply soak up value fluctuations. This imbalance raises accessibility considerations as XRP matures.

Technical outlook for XRP value

The important thing ranges stay clearly outlined as XRP buying and selling inside a short-term correction construction.

Upside ranges embrace speedy resistance at $1.95, adopted by $2.03 and $2.10, the place sellers beforehand regained management. A confirmed breakout above $2.10 might open room for a transfer in the direction of $2.18 and $2.25.

On the draw back, $1.90 stays the primary assist, adopted by $1.87 and the necessary $1.82 zone. The principle draw back threat lies round $1.77.

The technical state of affairs reveals that XRP is consolidating inside a descending channel after a pointy decline. This setting is usually accomplished previous to volatility enlargement.

Will XRP go up?

The route of XRP value is dependent upon whether or not patrons can defend $1.89 and get well $2.03. Stronger capital inflows and elevated open curiosity will assist continued upside.

Nonetheless, failure to maintain $1.87 might negate the pullback and expose decrease ranges. For now, XRP stays at an necessary inflection level.

Associated: Zcash Value Prediction: Zcash consolidates after rejection as merchants brace for breakout

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.