- In a single day, the lows stay above key helps, protecting the delicate bullish construction intact.

- Derivatives have reset leverage and cautious open curiosity restructuring suggests threat is underneath management.

- As Cardano’s sidechain imaginative and prescient unfolds, Midnight’s adoption story might prime the charts.

Midnight and its native token NIGHT enter the market at a time when each merchants and builders are searching for clearer course. Value motion signifies a restoration from December lows, and ecosystem commentary provides to the long-term story.

These elements place NIGHT at an early crossroads between technical construction and strategic implementation. Market members are presently weighing short-term chart alerts towards broader expectations relating to Cardano’s increasing sidechain imaginative and prescient.

In a single day worth construction is above main assist

NIGHT is buying and selling in a short-term uptrend on the 4-hour chart after a pointy rebound from December lows. Importantly, costs proceed to kind lows, reflecting elevated purchaser confidence. Rising short- and medium-term transferring averages verify this construction and make sure the energy of the development.

Nevertheless, momentum is slowing as the value falls under the important thing Fibonacci retracement zone round $0.10. This space attracts repeat sellers and has a transparent determination stage. Because of this, a powerful 4-hour shut above $0.102 might open an upside in direction of $0.125.

On the draw back, the $0.091-$0.092 space stays necessary. This zone coincides with development assist and the 20-period EMA. Due to this fact, sustaining above it is going to preserve the bullish construction. An additional pullback in direction of $0.085 will check the resilience of the development, whereas a break under $0.074 will invalidate the present restoration.

Derivatives and spot flows recommend cautious restructuring

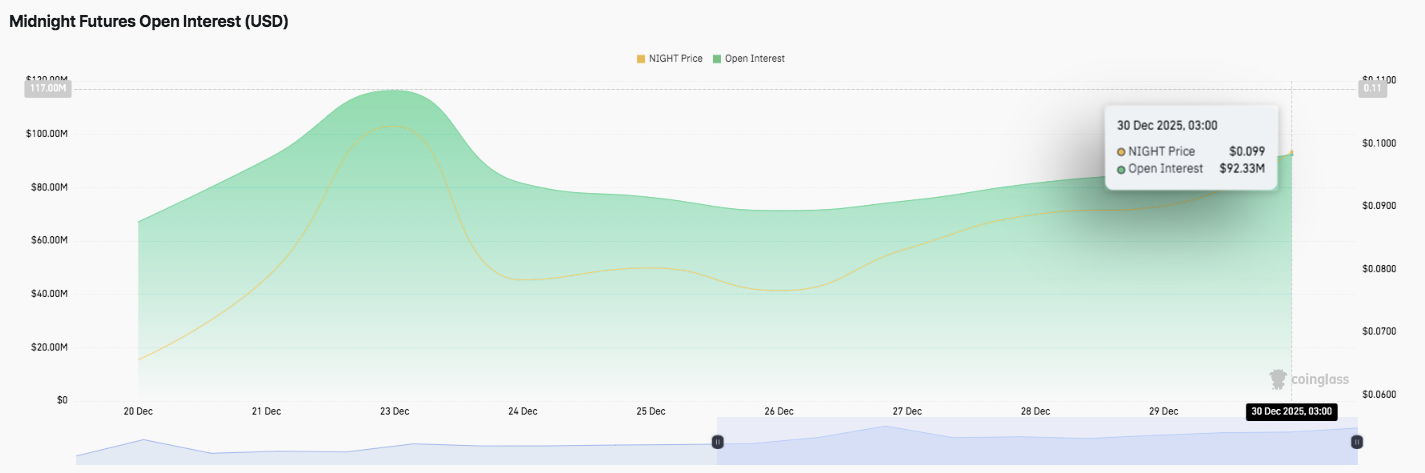

Derivatives knowledge displays modifications in dealer conduct by late December. Open curiosity spiked aggressively by December twenty third after which corrected sharply together with the value. This reset diminished extreme leverage and cooled speculative stress.

Associated: Dogecoin Value Prediction: Downward Channel Tightens on DOGE…

Since then, open curiosity has steadily recovered in direction of $92 million. This sample means that merchants are returning with extra managed publicity. Moreover, a slower tempo signifies warning slightly than aggressive positioning.

Spot circulate knowledge tells a extra defensive story. Latest buying and selling exhibits continued web outflows, together with a notable outflow round $391,000 on December thirtieth. Nevertheless, costs are nonetheless trying a short-term rebound.

This divergence signifies that regardless that distribution continues, there’s rising curiosity in shopping for on the spur of the second. Because of this, the liquidity state stays delicate and any change in amount can lead to an abrupt response.

Midnight’s function in Cardano’s long-term technique

Past the charts, Midnight’s wide-ranging function shapes the feelings round NIGHT. Cardano founder Charles Hoskinson just lately framed the Glacier Drop initiative as an ongoing mechanism slightly than a single occasion. Moreover, he positioned Midnight as central to this evolving mannequin of participation.

Midnight acts as a privacy-focused sidechain designed to allow cross-blockchain companies. Its success depends upon developer adoption and continued neighborhood engagement. Moreover, Hoskinson prompt that robust adoption might set up a blueprint for future associate sidechains.

He outlined a state of affairs through which Midnight reaches a $10 billion valuation, adopted by comparable development on different Cardano sidechains. Due to this fact, NIGHT’s trajectory might finally mirror ecosystem efficiency slightly than short-term volatility.

Technical outlook for NIGHT costs

The important thing in a single day ranges stay effectively outlined because the night time trades inside a bullish consolidation zone on the 4-hour chart. The token continues to carry low costs supported by rising short-term averages. Due to this fact, merchants see the present vary as a lull following the December impulse slightly than a development reversal.

- High stage: Instant resistance is between $0.1010 and $0.1020, in step with the 0.5 Fibonacci stage and former rejection. If a 4-hour shut above this zone is confirmed, the value might prolong in direction of $0.1250. Past that, the following main hurdles are close to $0.1580 and $0.2020, indicating a deeper Fibonacci extension.

- Lower cost stage: On the draw back, $0.0910 to $0.0920 serves as preliminary assist and is bolstered by the 20-period EMA and development construction. A deeper pullback might check $0.0850 close to the 50 EMA. Failure right here will shift focus to $0.0740, the extent that defines a broader development invalidation.

- Higher restrict of resistance: The $0.1010 space stays the important thing ceiling for a reversal for continuation. Repeated rejections right here emphasize the availability stress, which turns into the choice zone.

From a structural perspective, NIGHT is buying and selling above the 20, 50, and 100 EMAs, confirming the energy of the short-term development. Moreover, the supertrend indicator stays bullish, indicating {that a} pullback will entice consumers whereas assist holds. Nevertheless, the repeated promoting response round $0.10 means that the value might proceed to consolidate.

Will Midnight rise even greater?

Midnight’s near-term prospects rely upon whether or not consumers defend the $0.091 space lengthy sufficient to problem $0.102. Technical compression under resistance alerts extra volatility forward. If we preserve our positioning and momentum improves, NIGHT might transfer in direction of $0.125.

Then again, if the value falls under $0.085, the bullish management will weaken and $0.074 will probably be uncovered. For now, NIGHT is buying and selling in a pivotal vary the place affirmation slightly than hypothesis will decide the following transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.