- Whereas six crypto sectors declined in This autumn 2025, privateness tokens outperformed.

- Capital was directed to privateness property similar to ZEC, XMR, and DASH.

- Community utilization in key privateness chains has elevated, Grayscale stories.

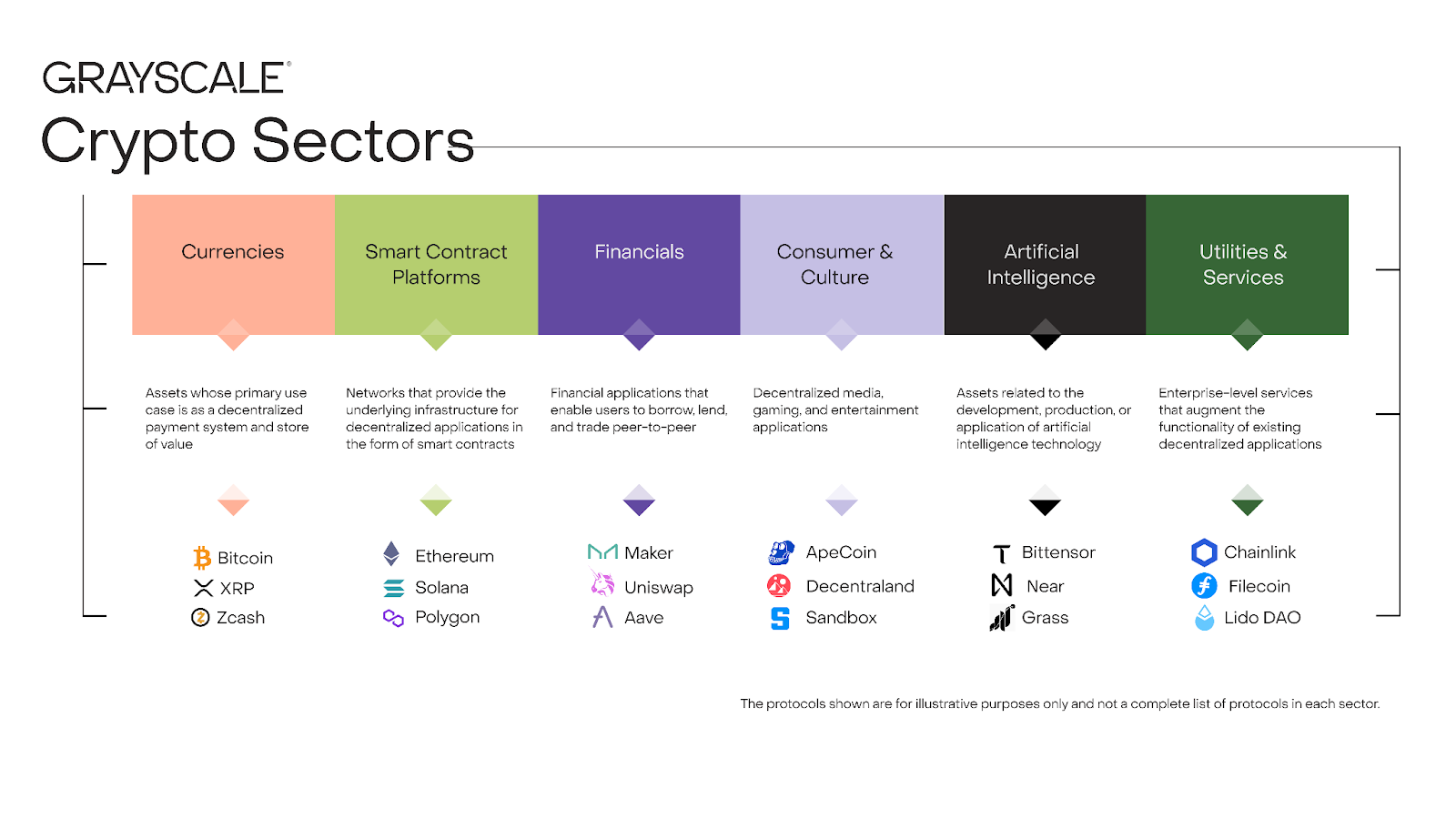

In line with digital asset administration agency Grayscale, the fourth quarter of 2025 broke the optimistic development from the third quarter. All six crypto sectors posted losses because the market cooled and merchants locked in earlier beneficial properties.

As of this writing, the market capitalization of cryptocurrencies is near $2.96 trillion, as costs have plummeted prior to now 24 hours. BTC is down greater than 2%, however different altcoins are additionally within the pink.

In its “Crypto Sector Quarterly” report, Grayscale famous that charges throughout sensible contract platforms have declined quarter-over-quarter and year-over-year. Energetic addresses decreased in each the foreign money and sensible contract sectors.

“Whereas on-chain exercise slowed in This autumn 2025, related declines in used metrics have traditionally occurred throughout market drawdowns and aren’t essentially indicative of a long-term structural deterioration in blockchain fundamentals,” Grayscale added.

Privateness tokens lead protection rotation

Inside a unfavourable quarter, privacy-focused property outperformed. The foreign money sector has held up higher than software layer property, with privateness cash driving a lot of the relative power.

This was not a widespread gathering. It was a rotation of capital into property deemed helpful, topic to stricter guidelines and larger oversight.

Supply: Grayscale

Zcash (ZEC) led the group. Demand for shielded balances elevated by 2025. Monero (XMR), Sprint (DASH), Decred (DCR), Fundamental Consideration Token (BAT), and Verdex (BDX) additionally ranked among the many best-performing risk-adjusted shares in the course of the quarter.

Sprint’s each day transactions doubled in the course of the fourth quarter. Courageous’s browser ecosystem has grown to over 100 million month-to-month customers and BAT. Zcash and Sprint each noticed their community utilization improve similtaneously their costs skyrocketed.

Associated: Ethereum proposes ERC-8092 to strengthen privateness and speed up Web3 adoption

Laws carry privateness into focus

As blockchain approaches conventional finance, transparency has grow to be a basic situation. A public ledger exposes balances, flows, and conduct by default. This doesn’t apply to payroll, company finance, or regulated funds.

Grayscale expects the US Cryptocurrency Market Construction Act to be handed in 2026. As soon as reporting guidelines and asset classifications are in place, regulated corporations are seemingly to make use of blockchain straight. This will increase the worth of programs that may be verified with out exposing information.

In the meantime, former Coinbase CTO Balaji Srinivasan stated that the crypto market will enter the privateness period in December 2025. He added at Binance Blockchain Week that the business is presently evolving from proof-of-work to sensible contracts.

Privateness tokens dominated in This autumn, however most giant sensible contract property lagged behind. Balaji claimed that the rally was pushed by zero-knowledge proofs that shield customers’ information and privateness.

Associated: Privateness layer zkPass debuts on KuCoin with “non-vesting” Airdrop

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.