- SOL maintains help above $122, however widening correction continues to restrict upside stress.

- Leverage flushes as open curiosity stabilizes, suggesting a more healthy short-term setup

- Persistent spot outflows sign alarm, rebound fails to draw robust accumulation

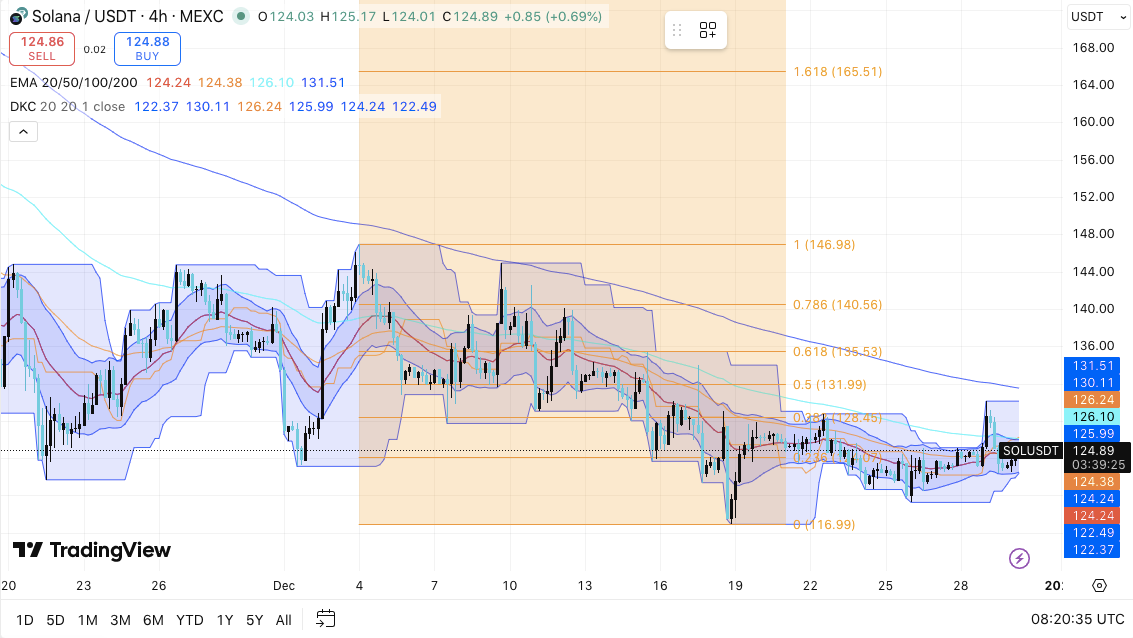

Solana stays within the highlight as merchants wait to see if its latest rally develops right into a sustained transfer. On the 4-hour chart, SOL is exhibiting indicators of a short-term restoration, however the broader construction nonetheless displays a correction.

Market members are presently balancing enhancing momentum with continued overhead resistance. Because of this, value actions round key technical zones are central to near-term forecasts. Analysts say this step might decide whether or not Solana stabilizes or returns to its earlier decline.

Brief-term value construction and key ranges

Latest buying and selling exercise reveals that SOL is recovering from a well-tested demand space across the $117 to $119 vary. This rebound led to increased lows and the value shifting above the short-term shifting common.

Subsequently, consumers appear to be extra energetic in comparison with earlier periods. Nevertheless, falling averages and Fibonacci retracement ranges nonetheless restrict upside makes an attempt. Analysts report that the $122-$123 space has been strengthened by latest consolidation and is appearing as fast help. A stable break above this vary will preserve the restoration story intact.

Importantly, sentiment might change quickly if $122 will not be defended. In that state of affairs, the value might revisit the $117 to $119 zone that beforehand absorbed the heavy promoting. Under that space, analysts have recognized $112 to $113 as the subsequent draw back threshold.

Associated: Bitcoin Worth Prediction: BTC Holds $84,000 Help, However ETFs Outflow…

On the upside, merchants proceed to watch $128 as near-term resistance. Moreover, a stronger barrier types close to $132, the place Fibonacci and the shifting common converge. A sustained transfer above this zone might pave the best way for the $140 space.

Derivatives information reveals leverage reset

Along with value construction, by-product indicators present perception into dealer conduct. Open curiosity in Solana futures expanded quickly through the earlier rally, reflecting aggressive speculative positioning. This enhance peaked through the year-end surge after which declined quickly.

Because of this, overleverage decreased as costs fell resulting from extended liquidations. Present open curiosity ranges point out stabilization moderately than new enlargement. Analysts interpret this as a more healthy setup the place merchants re-enter positions extra selectively.

Spot flows replicate cautious participation

Moreover, spot circulate information paint a suppressed image. All through many of the yr, SOL has skilled constant outflows, suggesting continued circulation. A short lived spike in inflows was noticed throughout robust upswings, particularly on the finish of summer season.

Nevertheless, as volatility elevated, these inflows rapidly dissipated. Because of this, capital outflows resumed within the closing months, highlighting stress to take income. Market watchers say the sample displays cautious positioning moderately than widespread accumulation.

Associated: Midnight Worth Prediction: NIGHT Stays Bullish Construction As Cardano Imaginative and prescient Expands

Technical outlook for Solana (SOL)

Solana trades inside a consolidation section on the upper timeframe, so the important thing ranges are nonetheless clearly outlined.

Upside ranges embody the primary hurdle at $128.45, adopted by the $131.90-$132.50 zone the place Fibonacci resistance and the shifting common converge. A confirmed breakout above this cluster might pave the best way to $135.50-$140.50, with $146.90 changing into the first upside goal if momentum picks up.

On the draw back, $122.00-$123.00 will act as fast help and be an vital degree to keep up short-term stability. Under that, the $117.00 to $119.00 demand zone that beforehand triggered a powerful rebound stays vital. Shedding this space might expose SOL to deeper draw back in direction of $112.00-$113.00.

Technical situations counsel that SOL is compressing inside a broader correction construction, which might result in elevated volatility following a decisive break.

Will Solana go up?

Solana’s near-term value prediction hinges on whether or not consumers stick with $122 and return to $132 with confidence. Rising capital inflows and enhancing derivatives sentiment might help a transfer in direction of $140.

Nevertheless, failure to keep up key help dangers an extension of the adjustment. For now, SOL continues to be at an inflection level and wishes affirmation to find out its subsequent course.

Associated: Dogecoin Worth Prediction: Downward Channel Tight for DOGE Under $0.14

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.