- SHIB stays under the most important EMA and stays in command of sellers regardless of slowing draw back momentum

- Declining open curiosity and outflows counsel leverage reset somewhat than panic promoting

- Shiba Inu’s restoration framework might enhance belief as ecosystem revenues go towards repaying customers

The Shiba Inu enters its closing days in 2025 underneath seen strain as technical weaknesses dictate its short-term prospects. Market information reveals that SHIB/USD is locked in a sustained downtrend on the 4-hour chart. Costs stay under main shifting averages, reflecting fragile momentum and cautious dealer conduct.

Nonetheless, derivatives information and on-chain flows counsel a possible positioning reset forward of 2026. Along with technological components, ecosystem developments are enjoying an more and more vital position in shaping expectations.

SHIB worth construction suggests continuation of bearish management

The Shiba Inu continues to commerce under the 20, 50, 100, and 200 interval exponential shifting averages on the 4-hour time-frame. Because of this, the vendor maintains structural management. The token has been experiencing constant highs and lows since early December. This sample confirms a managed decline somewhat than panic promoting.

The breakdown under the 0.236 Fibonacci retracement round $0.00000760 indicated an vital technical change. Its degree now limits ascending makes an attempt. Moreover, SHIB is buying and selling close to $0.00000708, above cycle assist close to $0.00000701. This zone stays vital for short-term route.

A decisive transfer under $0.00000700 would doubtless open draw back room in the direction of $0.00000680 and presumably $0.00000650. Nonetheless, consumers could attempt to stabilize close to present ranges.

Any restoration will face quick resistance between $0.00000722 and $0.00000730. A stronger reversal would require a return of $0.00000757 after which $0.00000800. Till then, the rebound seems to be fastened.

Associated: Cardano Worth Prediction for 2026: Midnight Launch and Solana Bridge Might Push ADA Above $2.50

Directional indicators assist this view. The DMI studying reveals ADX under 20, indicating weak development energy. Consolidation is due to this fact more likely to proceed except volumes broaden decisively.

Derivatives and on-chain information will help reset the market

Shiba Inu futures open curiosity reveals a transparent leverage cycle extending from 2024 to 2025. The sudden spike in open curiosity coincides with a worth rebound and a short-term ceiling. These durations resulted in speedy deleveraging. By mid-2025, open curiosity stabilized between $100 million and $250 million, reflecting cautious participation.

Notably, open curiosity decreased by almost $80.9 million in late December. This lower suggests decrease leverage and decrease liquidation danger. Moreover, the market seems to be resetting somewhat than capitulating.

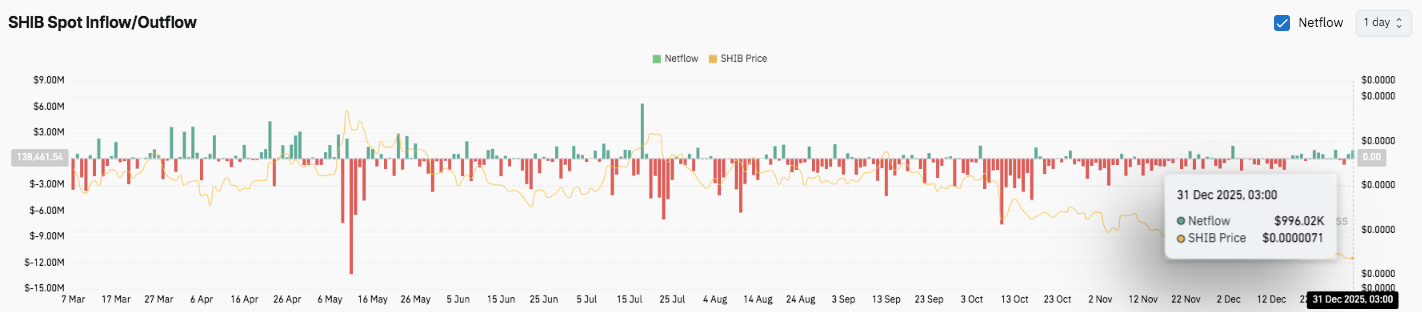

Spot movement information assist this interpretation. Internet outflows have accounted for almost all in current months, indicating regular progress in foreign money withdrawals. Moreover, the momentary surge in inflows in Could and July shortly dissipated with a short-term rebound.

Since October, outflows have intensified as costs have fallen. It recorded one other web outflow of almost $1 million in late December. This motion suggests accumulation and a discount in quick promoting strain.

Shiba Inu ecosystem introduces structured restoration plan

Past worth fluctuations, the Shiba Inu ecosystem introduced a proper restoration framework associated to the plasma bridge incident. The initiative, often called Shib Owes You, introduces a wise contract-based compensation construction. Affected customers will obtain an Ethereum-based NFT that information their expenses on-chain.

Moreover, this framework permits for versatile billing administration. Customers can consolidate a number of receivables or cut up holdings for partial liquidity. Funding will come from tighter oversight of ecosystem income streams. Due to this fact, all tasks utilizing the Shiba Inu model should contribute to the gathering pool.

Technical prospects for Shiba Inu

Shiba Inu’s worth construction stays technically compressed as key ranges stay properly outlined heading into October.

On the upside, quick resistance lies at $0.00001238, adopted by $0.00001264 and $0.00001286, the place sellers had beforehand decided the higher sure of the rebound. A confirmed breakout above this cluster might change momentum and pave the way in which to $0.00001472, with $0.00001600 serving as the following main extension zone.

On the draw back, $0.00001180 continues to behave as trendline assist, and consumers on the main degree ought to defend. Persevering with losses on this space might weaken the construction and expose SHIB to $0.00001100, with deeper draw back danger in the direction of $0.00000999. In the meantime, the 200-day EMA close to $0.00001364 stays an vital higher resistance restrict. A clear break above this degree would strengthen our bullish view over the medium time period.

Technically, SHIB seems to be compressing inside a descending wedge sample. This setup is commonly executed when worth exits a variety and earlier than volatility will increase.

Because of this, confidence within the route stays restricted till a breakout or breakout confirms the bias. Momentum indicators counsel stability somewhat than development dominance, highlighting the significance of quantity affirmation.

Will Shiba Inu rise?

Shiba Inu’s outlook for October relies on whether or not consumers can maintain $0.00001180 lengthy sufficient to problem the $0.00001264 to $0.00001286 resistance zone. If inflows strengthen and costs rise, SHIB might try a transfer in the direction of $0.00001472 and even $0.00001600.

Nonetheless, failure to defend assist invalidates the buildup base and will increase draw back danger. For now, SHIB is buying and selling in a definitive zone, with technical affirmation set to find out the following leg.

Associated: Solana Worth Prediction for 2026: Firedancer, Western Union USDPT, and $476M ETF Influx Targets Above $350

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.