- XRP stays below bearish strain as falling highs and clustered averages restrict positive aspects.

- Regular open curiosity and spot inflows point out that promoting is easing and shopping for is cautious.

- Ripple’s escrow launch reduces provide shocks and helps predictable token distribution.

XRP is dealing with a key technical second as the value stabilizes on the 4-hour chart amid modifications in derivatives and on-chain alerts. Whereas the short-term rebound is reassuring, the broader construction nonetheless favors warning. Merchants at the moment are weighing the overhead of resistance in opposition to weakening promoting strain as Ripple’s escrow exercise additional shapes provide expectations.

Technical construction permits sellers to take care of management

XRP continues to respect the broader bearish pattern on the 4H timeframe. Decrease highs and decrease lows nonetheless outline the market construction. Though costs have rebounded not too long ago, consumers haven’t regained decisive technical footing. Moreover, costs stay constrained under the cluster shifting common, persevering with to draw sellers.

Resistance between $1.93 and $1.95 exists as the primary provide zone. Sellers defended the sector in latest makes an attempt to boost costs. Because of this, the upward momentum quickly diminished. The extra vital barrier is close to $2.02, the place a decline within the long-term common is including to pattern strain. Bulls want to beat this degree to vary sentiment.

Past that zone, the Fibonacci resistance between $2.09 and $2.18 turns into extra complicated. This space has traditionally attracted distribution. Subsequently, any rally into that vary is prone to face intense scrutiny. Solely a restoration in direction of $2.28 would sign a real pattern reversal.

Sign cooling threat for derivatives and spot flows

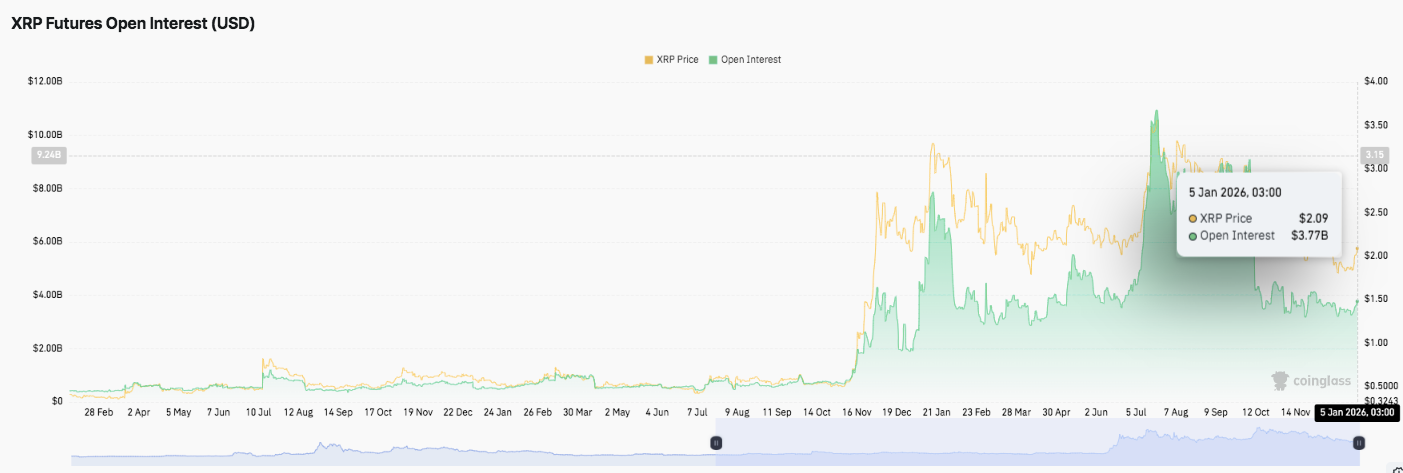

Futures positioning helps a extra balanced outlook. Open curiosity expanded aggressively throughout the late 2024 breakout and tracked rising volatility. Nonetheless, the leverage peak typically coincides with the native prime. The following contraction mirrored liquidations and revenue taking. By way of early 2026, open curiosity stabilized at practically $3.7 billion.

Associated: Bitcoin Value Prediction: BTC Momentum Good points as Derivatives and Flows Stabilize

This plateau means that merchants have lowered extreme leverage. Moreover, the market seems to be more healthy, with much less speculative strain driving worth actions. The consolidation round $2.10 displays this benign setting.

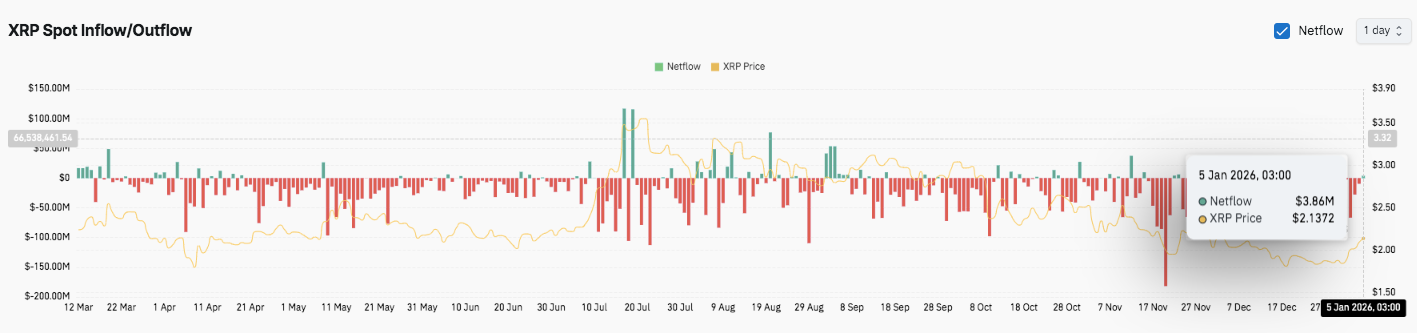

Spot circulate knowledge provides one other layer. XRP continued to have web outflows all through a lot of the 12 months, indicating secure circulation. The mid-year surge in inflows was per a short-term enhance and never a sustained accumulation. What’s noteworthy is that capital outflows intensified in late November as costs plummeted.

Not too long ago, flows have stabilized and turned barely constructive. There was a small web influx because it rebounded above $2.13. This alteration suggests easing promoting strain and cautious bullish shopping for curiosity.

Escrow administration marginal provide shock

Ripple’s newest escrow exercise additional reduces short-term provide threat. The corporate accomplished its January launch cycle and returned 700 million XRP to escrow. Because of this, a lot of the unlocked tokens prevented market circulation.

Presently, roughly 34.185 billion XRP stays in programmatic escrow. This managed launch construction reduces issues about sudden dilution. Moreover, predictable provide administration helps long-term market stability.

Technical outlook for XRP worth

XRP enters the following session with worth firmly compressed inside a correction construction. Whereas the general pattern stays bearish, the latest stabilization suggests the market is nearing a call level.

Volatility has subsided, leverage has reset and spot flows are displaying early indicators of stability. Because of this, the significance of key technical ranges in confirming path has elevated.

Associated: Shiba Inu’s 2026 Predictions: Second Quarter Privateness Improve, Combating Meme Stigma After $4 Million Exploitation

Prime degree: Fast resistance is between $1.93 and $1.95, with a number of rejections occurring. A break above this zone would pave the way in which for $2.02, which is per the decline within the long-term shifting common. Acceptance above $2.10 would point out bettering momentum and will lengthen the upside in direction of the Fibonacci resistance band at $2.18. An entire pattern shift would require a return to the earlier swing excessive of $2.28.

Cheaper price degree: On the draw back, $1.86 to $1.88 serves as a serious assist vary and the decrease certain of the present consolidation. Beneath that, $1.83 represents the final short-term high-low protection. Failure to maintain this space will possible expose it to a big low of $1.77. A decisive break right here may set off one other bearish continuation.

Higher restrict of resistance: The $2.02 degree stays an important barrier to a medium-term restoration. The pullback is prone to stay corrective quite than impulsive till worth closes above this zone on sturdy quantity.

Will XRP escape of the highs or resume its downtrend?

XRP’s near-term outlook relies on whether or not consumers can defend the $1.86 assist whereas constructing momentum in direction of the $1.93-$2.02 resistance cluster. Technical compression and cooling derivatives exercise suggests extra volatility forward.

If inflows strengthen and the value regains $2.02, XRP may try a broader restoration in direction of $2.18 and above. Nonetheless, if the assist isn’t maintained, there’s a threat that the draw back worth goal can be set once more round $1.77. For now, XRP stays at a important inflection level, the place affirmation quite than anticipation will decide its subsequent transfer.

Associated: Ethereum Value Prediction: ETH Stays Bullish Construction As Community Imaginative and prescient Expands

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.