- ETH stays capped under the tight EMA resistance cluster round $3,130-$3,350, with the broader construction persevering with to right moderately than pattern reversal.

- Continued spot outflows proceed to hamper the rebound, suggesting that the bull market is uncovered to promoting moderately than accumulation.

- Quick-term value actions are nonetheless confined to a descending channel, and momentum indicators are unable to verify a continuation of the upside.

Ethereum value is buying and selling round $3,115 immediately, marking a gradual decline after failing to increase the rebound in early January. Value stays trapped inside a descending channel on shorter time frames, however the each day chart exhibits that ETH is struggling under the most important transferring averages, with sellers remaining in management regardless of bettering long-term institutional alerts.

Upward stress on costs continues as a consequence of spot outflows

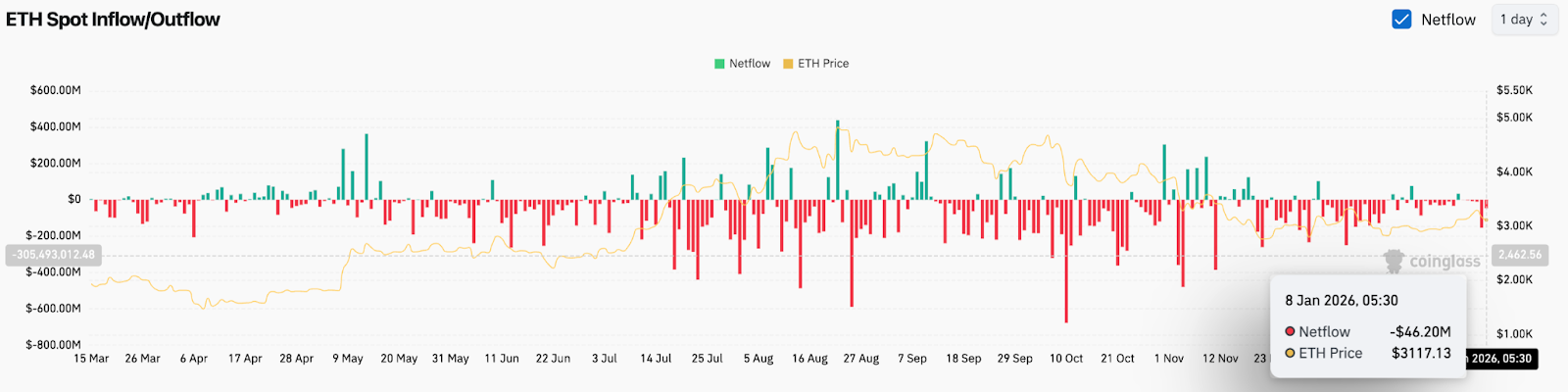

Spot circulate information continues to weigh on Ethereum’s restoration. On January 8, ETH recorded a internet spot outflow of $46.2 million, extending a multi-week sample of capital leaving the alternate throughout rallies moderately than accumulating on rallies.

This motion is essential. ETH has rebounded from its December lows, however every rally lacked sustained inflows. When costs rise with out spot participation, the transfer tends to stall as sellers use their leverage to unwind their positions.

EMA cluster acts as an overhead resistor

On the each day chart, Ethereum is buying and selling under all main transferring averages. The 20-day EMA close to $3,078 is flat, however the 50-day EMA close to $3,128, 100-day EMA close to $3,302, and 200-day EMA close to $3,349 are forming tight resistance zones above the value.

Associated: Bitcoin Value Prediction: BTC Stays Bullish Bias Regardless of Slowing Momentum

ETH has examined this cluster a number of occasions since mid-December, but it surely failed every time. This repeated rejection confirms that the market continues to be in a correction section moderately than a pattern restoration.

Bollinger bands reinforce that view. Costs stay compressed close to the decrease half of the band vary, suggesting consolidation beneath stress moderately than enlargement.

Descending channels outline short-term management

A shorter time-frame signifies that sellers are sustaining construction. On the 30-minute chart, Ethereum is buying and selling inside a well-defined descending channel, with low highs and regular provide close to the highest.

Momentum indicators are in step with that pattern. The RSI stays under 45, reflecting weak shopping for stress, whereas the MACD stays unfavorable regardless of a gradual restoration within the histogram. As ETH approaches channel resistance, every bounce lacks follow-through.

Institutional alerts construct under value

On January 7, Morgan Stanley filed for SEC approval for the Ethereum Belief, following the filings for Bitcoin and Solana. This transfer alerts elevated institutional consolation with ETH as a yield-producing asset, notably by means of staking.

Associated: Cardano Value Prediction: $0.39 Assist Faces Breakout Threat as Sellers Stay in Management

On the identical time, Bitmine is looking for shareholder approval to considerably develop its stake to fund the Ethereum acquisition. The corporate already holds 4.14 million ETH (equal to about $13.3 billion) and plans to launch the MAVAN validator community in 2026, aiming for $374 million in annual staking income.

These developments strengthen Ethereum’s long-term demand story, however haven’t but led to instant spot purchases.

Community upgrades enhance effectivity and enhance dialogue

Ethereum’s Fusaka improve, which went reside in December, launched PeerDAS to enhance layer 2 information processing. Preliminary outcomes present that transaction charges for main rollups might be considerably decrease, decreasing community congestion and bettering economics for customers.

Nonetheless, the controversy surrounding Ethereum’s scaling roadmap continues. Critics argue that the elevated {hardware} prices required for superior ZK-EVM implementations might pose a danger of centralization over time.

Whereas this dialogue would not straight influence costs, it is nonetheless a part of a broader narrative that traders are contemplating.

outlook. Will Ethereum go up?

Ethereum is caught between bettering fundamentals and weak short-term construction.

- Bullish Case: A decisive shut above $3,350, supported by elevated quantity and bettering spot flows, would sign a pattern restoration and resume the upside in the direction of $3,600.

- Bearish case: Failure to carry $3,000 will lead to ETH remaining inside a descending construction and exposing the $2,800 space.

Ethereum will stay robust till the value breaks above the EMA cluster and spot flows flip optimistic. Though curiosity from institutional traders is growing, the chart nonetheless requires endurance.

Associated: Dogecoin Value Prediction: DOGE Holds Floor Even As Market Enters Key Correction Part

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.