- Though Ethereum faces short-term promoting stress, it has held additional lows, indicating development assist.

- Derivatives and spot flows point out cautious revenue taking and never a whole exit from the market.

- Company treasuries adopting ETH will strengthen structural demand and long-term confidence.

Ethereum stays within the highlight as merchants assess near-term worth weak spot for indicators of deepening market engagement. The asset entered a correction section on the 4-hour chart after failing to maintain above the $3,300 space.

Nevertheless, broader market actions counsel that this decline displays a change in place quite than a structural change. Worth traits, derivatives information, spot flows, and company finance exercise taken collectively counsel that the market is in transition quite than decline.

ETH not too long ago retreated in direction of the $3,090 space the place patrons began defending key ranges. Consequently, market members are weighing short-term warning in opposition to long-term conviction. This stability defines Ethereum’s present outlook.

Quick-term worth construction faces stress

Ethereum stays beneath its latest swing highs, indicating that momentum is weakening on the shorter time-frame. The value is buying and selling beneath the 20 and 50 exponential transferring averages, confirming short-term promoting stress. Nevertheless, the 100 EMA close to $3,080 continues to behave as dynamic assist.

Moreover, a wider construction nonetheless displays increased highs and better lows. This sample means that the prevailing bullish development stays intact above $2,970. Subsequently, present worth motion seems to be correcting quite than breaking the development.

The primary resistance lies between $3,125 and $3,170, the place a rejection occurred earlier. A transfer above $3,240 would point out renewed upward momentum. Conversely, a break beneath $3,050 might result in a deeper retracement of ETH in direction of $2,995.

Derivatives and spot flows are sounding a warning, not an exit

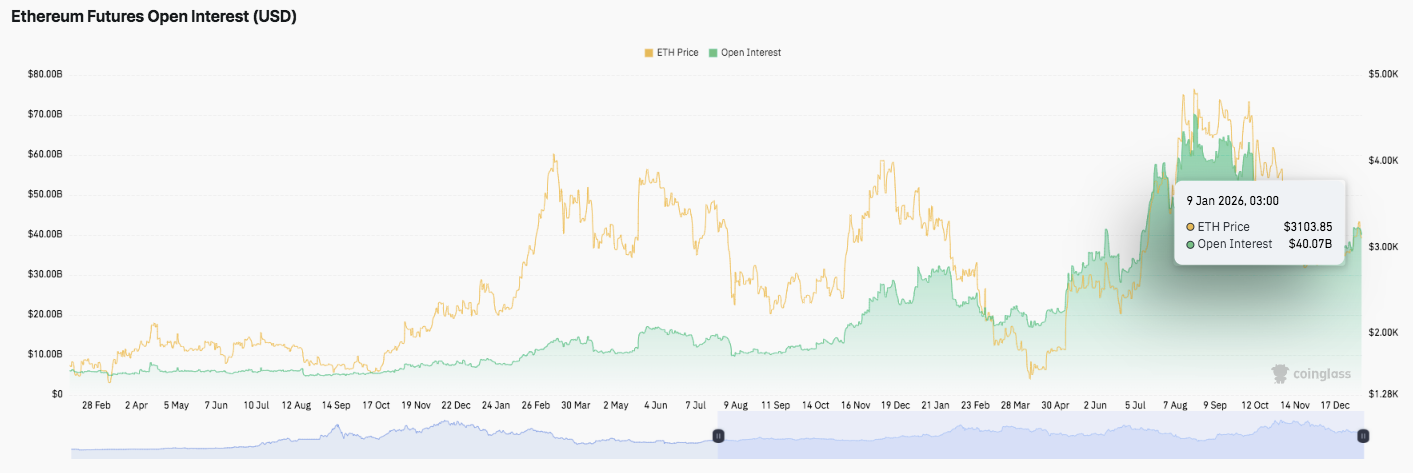

Ethereum futures open curiosity steadily expanded from 2024 to early 2026. This development coincided with a major improve in costs, reflecting elevated leverage and participation by institutional traders. According to falling costs, open curiosity has been lowering often, indicating a protracted liquidation quite than an exit from the market.

Moreover, open curiosity has declined not too long ago as costs have softened. This variation means that merchants have decreased their publicity with out fully abandoning their positions. Subsequently, regardless of short-term volatility, derivatives markets proceed to show dedication.

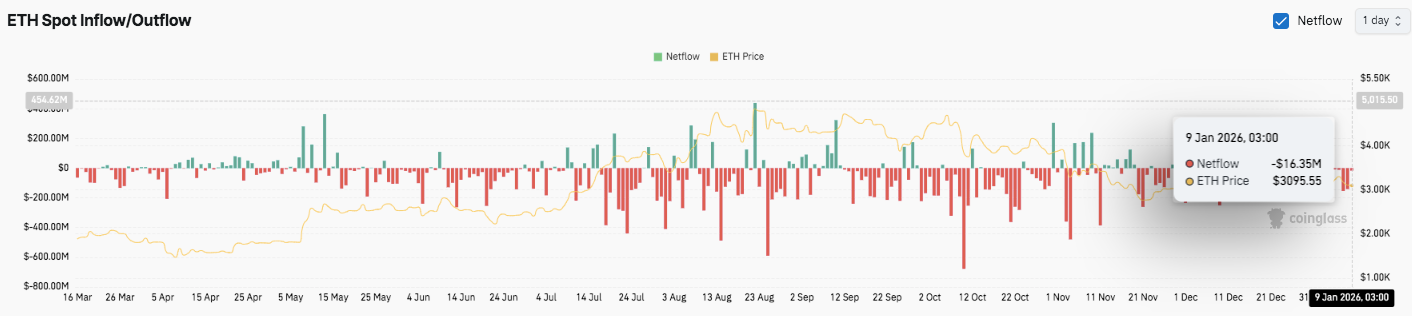

Spot circulation information reinforces this cautious stance. Internet outflows dominated for a very long time, particularly close to excessive native costs. These strikes point out profit-taking and liquidity administration quite than panic promoting. Outflows have slowed not too long ago, indicating that promoting stress has eased as ETH stabilizes round $3,000.

Company finance actions add structural assist

Past transaction information, company exercise continues to strengthen Ethereum’s long-term case. SharpLink Gaming has confirmed that it’ll deploy $170 million price of Ether right into a yield-focused monetary technique. The corporate executed its plan on Linea, which was constructed by ConsenSys.

This technique combines native staking, restaking rewards, and ecosystem incentives. Moreover, Anchorage Digital provides storage beneath a regulated construction. This transfer exhibits rising confidence in Ethereum as a long-term treasury asset.

Technical outlook for Ethereum (ETH) worth

The important thing ranges stay effectively outlined as Ethereum is buying and selling close to the $3,000 pivot zone.

The upside stage is situated at $3,125 to $3,145 as the primary resistance cluster, adopted by $3,170. If the worth continues to interrupt above this space, a transfer in direction of $3,240-$3,250 might start. A stronger continuation sign will solely emerge if ETH regains the $3,300-$3,320 swing excessive zone.

On the draw back, $3,083-$3,090 serves as rapid assist and is strengthened by the 100 EMA. Lack of this space might expose $3,050 to $3,030 as the following demand zone. Under that, $2,995-$2,970 stays essential structural assist and will maintain to maintain the broader bullish development.

Technical situations counsel that ETH is holding its worth inside a correction vary after a major rally. Costs are beneath their short-term averages, indicating that momentum is slowing. Nevertheless, above $2,970, the upper timeframe construction stays in place.

Will Ethereum rise additional?

Ethereum’s near-term path will depend upon whether or not patrons can defend the $3,080 space and reclaim $3,170. A profitable rebound might restore upward momentum in direction of above $3,240.

Failure to carry $3,050 dangers an extra retrace in direction of $2,995. For now, ETH continues to be in an essential consolidation section and volatility might improve if the worth breaks out of this vary.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.