- Uniswap’s each day charge revenue soared to $1.4 million as a result of Truebit protocol hack.

- Truebit Protocol misplaced 8.5,000 ETH (roughly $26.6 million) in a hack that brought on the TRU value to plummet by 100%.

- Uniswap DEX recorded round $1 trillion in buying and selling quantity final 12 months and is predicted to see this development in 2026.

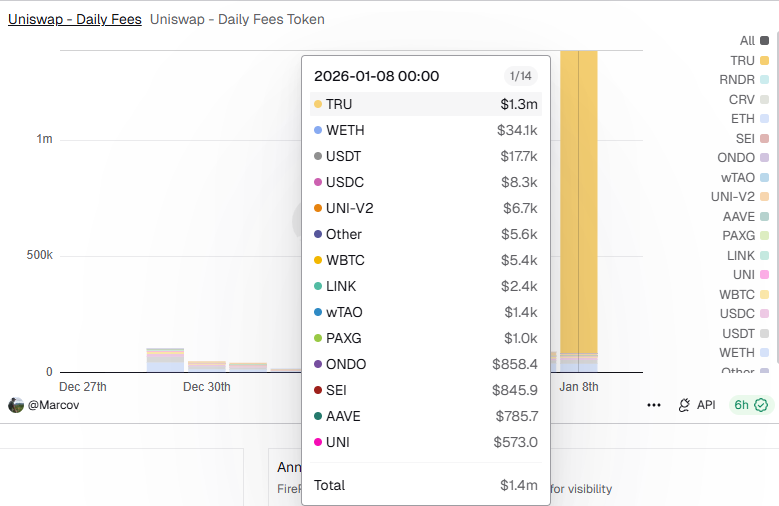

Uniswap (UNI)’s each day charge revenue soars to a document $1.4 million within the wake of the Truebit Protocol (TRU) hack. TRU’s common each day buying and selling exercise elevated greater than 43% to $83,000, contributing almost 90% of Uniswap’s document charge revenue, in line with market knowledge from CoinMarketCap.

Uniswap sees each day income soar after Truebit hack

In accordance with on-chain detectives led by PerkShieldAlert, the Truebit protocol was attacked and eight.5K Ethereum (ETH) price roughly $26.6 million was stolen from its liquidity pool. After this assault, investor confidence within the Truebit protocol collapsed, with TRU value dropping 100% up to now 24 hours.

The TRU token is being traded closely throughout a number of pairs on Uniswap, and the DEX has benefited tremendously from the push of buyers trying to promote this altcoin. In accordance with Dune Analytics market knowledge evaluation, Uniswap collects roughly $1.3 million in charges each day from TRU tokens, which is even greater than Wrapped ETH (WETH) and Tether USDT.

The Truebit Protocol crew is presently working with regulation enforcement to research the assault. It’s because the attacker shops the stolen funds in two completely different wallets.

What’s subsequent?

The Uniswap protocol has tremendously benefited from the elevated adoption of digital belongings. Final 12 months, Uniswap DEX buying and selling quantity was reported to be round $1 trillion, an exponential improve from lower than $250 billion in Q1 2025. The Uniswap protocol is well-positioned heading into 2026 as elevated adoption of altcoins and anticipated US regulatory readability by the CLARITY Act will improve buying and selling and income.

The Truebit assault highlighted the persevering with dangers in DeFi protocols. Though Uniswap noticed a notable improve in charge revenue attributable to excessive TRU buying and selling volumes, TRU buyers suffered important losses. Individuals, each retail and institutional, ought to proceed to observe the safety of their protocols and undertake threat administration practices.

Associated: Uniswap burns 100 million UNI tokens on launch of paid upgrades

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.