- The timeline for the Supreme Courtroom’s tariff ruling has made crypto and tariff-related markets cautious heading into Wednesday.

- Polymarket odds on Trump tariffs drop to 26% as merchants reprice authorized threat.

- Bitcoin and the broader crypto market have consolidated and proven restricted response to coverage uncertainty.

Cryptocurrency markets stay cautious after the U.S. Supreme Courtroom confirmed it should challenge its subsequent opinion on Wednesday, lingering uncertainty surrounding authorized challenges to tariffs imposed underneath President Donald Trump. Though the court docket confirmed the timing of its subsequent assembly, it didn’t point out which circumstances it’d rule on, leaving tensions throughout monetary markets delicate to commerce coverage outcomes.

Associated: Supreme Courtroom Trump tariff case focuses on liquidity and cryptocurrencies

After a quiet listening to on Friday, the justices issued just one ruling unrelated to tariffs, and the court docket remained silent. The shortage of a call despatched shares focused by the tariffs decrease, highlighting how carefully markets are monitoring the case. In customary apply, the court docket points its opinion with out advance discover of what choices are prepared when the justices take the bench at 10 a.m. Washington time.

Authorized oversight over emergency tariff powers

On the middle of the controversy is President Trump’s April 2nd “Emancipation Day” tariffs, which impose tariffs starting from 10% to 50% on most imports. Further taxes have been utilized to items from Canada, Mexico, and China, which the administration justified underneath a 1977 legislation that provides the president expanded powers throughout nationwide emergencies.

Oral arguments on Nov. 5, through which a number of justices questioned whether or not the legislation supplied a ample authorized foundation for tariffs, set off a collection of inquiries that formed market expectations.

A ruling on the tariffs would straight undermine the foundations of President Trump’s financial coverage and signify the largest authorized setback since he returned to workplace. Till the court docket guidelines, traders will proceed to watch alerts from each judicial and market-based indicators.

Associated: Crypto markets face risky week as tariff dividends, shutdown ends, Fed liquidity collide

Prediction markets reevaluate outcomes

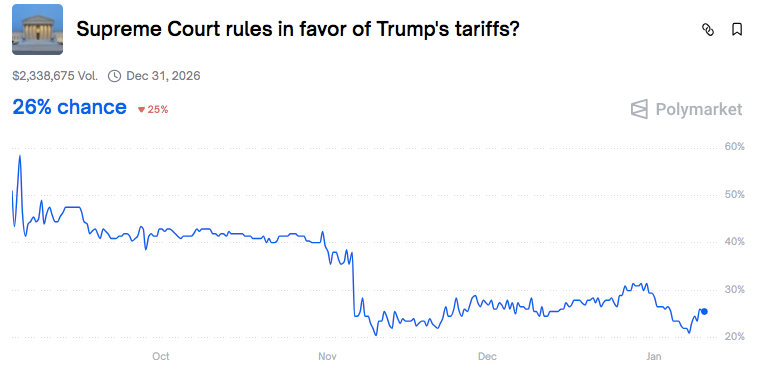

In polymarkets, merchants lowered the implied likelihood of a ruling in favor of tariffs. The contract presently displays a likelihood of 26%, down from the excessive ranges earlier within the buying and selling interval. The overall quantity will attain roughly $2.34 million.

Supply: Polymarket

The value curve exhibits preliminary volatility after which declines from October to November. An adjustment in early November raised odds from the mid-30s to 25%, after which pricing stabilized between 22% and 30%.

The digital forex market stays sturdy

In opposition to this backdrop, the broader crypto market confirmed indicators of consolidation moderately than stress. Market capitalization decreased by 0.2% to $3.09 trillion. The CMC20 index tracked by CoinMarketCap fell 0.22% to $192.44, reflecting diminished intraday exercise.

Bitcoin fell 0.07% up to now 24 hours to commerce at $90,538.48. Market capitalization remained at $1.8 trillion, however buying and selling quantity decreased by 10.6% to $33.73 billion.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.