- If ETH breaksout above $3,250, the short-term construction turns into bullish because the EMA aligns to the upside.

- Open curiosity of over $40 billion will push up the upside, however volatility threat attributable to liquidations will improve.

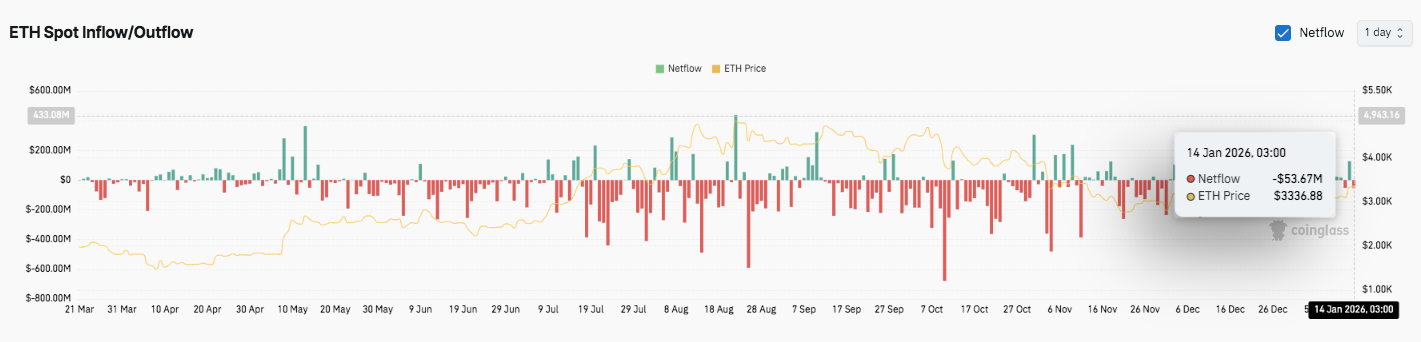

- Spot outflows ease close to $3,300, suggesting sellers flip bearish forward of attainable consolidation

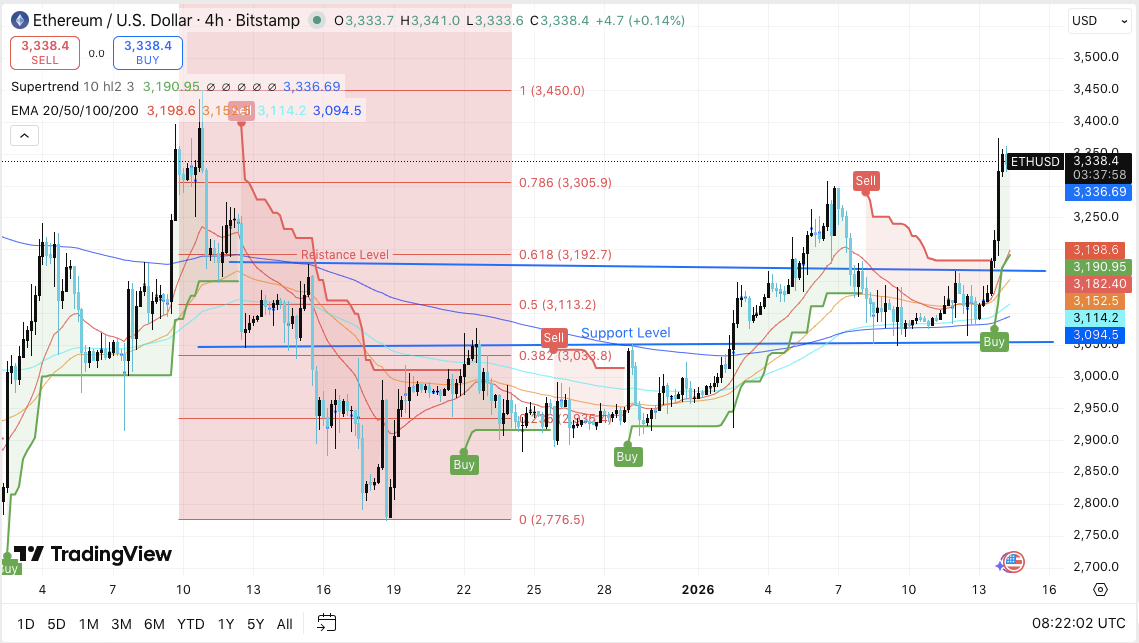

Ethereum prolonged its short-term restoration as the worth stabilized across the $3,335 degree throughout the newest four-hour session. Market information reveals that ETH is rising from a multi-week slide and sentiment is shifting in direction of a continued rally. The transfer follows a number of failed makes an attempt earlier this yr that capped worth actions beneath $3,250.

This time, consumers returned with better conviction. Buying and selling exercise elevated as Ethereum regained main technical ranges, indicating a short-term structural change. Because of this, analysts monitoring intraday developments see the market as constructive so long as current good points maintain.

Breakout Construction Reinforces Bullish Bias

Ethereum’s current rally has pushed the worth decisively above the $3,200-$3,250 congestion zone. Along with clearing horizontal resistance, ETH additionally regained all main exponential transferring averages on the 4-hour chart. These embrace the 20, 50, 100, and 200 EMAs. This match displays renewed power within the development and continued shopping for curiosity.

Importantly, this breakout occurred after an extended interval of compression, usually accompanied by elevated volatility. Due to this fact, merchants are actually monitoring the follow-through worth motion quite than following the preliminary impulse.

Fast resistance lies between $3,350 and $3,380, the place sellers beforehand intervened. A strong break above this vary would give us extra confidence to proceed. Moreover, the following upside criterion is close to $3,450, matching the earlier swing excessive. If momentum accelerates additional, the psychological degree at $3,500 may come into focus.

On the draw back, Ethereum maintains short-term assist between $3,305 and $3,310. This space coincides with a serious Fibonacci retracement degree. Furthermore, the $3,190 to $3,200 zone stays vital.

Associated: Solana Value Prediction: $5.54 million spot inflows assist uptrend line as open curiosity…

This vary combines Supertrend assist and EMA clusters. A sustained break beneath this can weaken the bullish construction. Because of this, consideration will shift from the earlier breakout base of $3,110 to the $3,115 space.

Derivatives and spot stream alerts

Spinoff information additional complicates the outlook. Ethereum’s open curiosity has expanded quickly attributable to current worth will increase, reaching over $40 billion. This development displays a rise in leveraged participation quite than pure spot accumulation.

Nevertheless, the sharp decline earlier this yr prompted a brief open curiosity flush. Specifically, positions are instantly rebuilt each time they’re reset. This habits suggests continued speculative involvement and elevated sensitivity to volatility from liquidations.

Spot stream information tells a extra considerate story. Ethereum skilled a rise in web outflows and exhibited distribution strain throughout a pullback. Nevertheless, just lately the outflow quantity has shrunk to round $3,300.

Associated: Pepe Value Prediction: PEPE Eyes Restoration on Assist Maintain and Market Exercise…

As well as, intermittent influx spikes occurred across the native low strain system. This variation means that promoting strain could also be easing. If new demand emerges, ETH may consolidate earlier than trying to maneuver greater.

Technical outlook for Ethereum (ETH/USD)

Key ranges stay effectively outlined as Ethereum trades in a vital technical zone for the upcoming session.

On the upside, $3,350 to $3,380 is the quick resistance zone. A confirmed breakout above this space may pave the way in which to $3,450, which may observe the psychological $3,500 degree if momentum accelerates. These zones coincide with earlier swing highs and Fibonacci extensions, making them vital upside targets.

On the draw back, the primary assist is situated at $3,305-$3,310, the place short-term consumers had been beforehand intervening. The $3,190 to $3,200 space beneath reveals a robust demand zone strengthened by a supertrend indicator and a clustered EMA base. A deeper pullback may expose $3,110-$3,115, which represents the earlier breakout base and the vital Fibonacci midpoint.

From a structural perspective, ETH continues to carry out effectively even after retrieving all main transferring averages. Value developments recommend continued power quite than depletion.

Nevertheless, derivatives information reveals rising open curiosity, indicating that leverage-driven momentum may amplify volatility. In the meantime, spot flows proceed to point out subdued accumulation, and bull markets stay delicate to modifications in sentiment.

Will Ethereum rise additional?

Ethereum’s near-term outlook depends upon whether or not consumers can proceed to defend the $3,200 space. A maintain above this degree would hold the bullish bias intact and assist a possible push in direction of $3,450.

Nevertheless, failure to maintain $3,190 dangers weakening the construction and a broader decline in direction of $3,110. For now, ETH is buying and selling in a decisive zone, with affirmation from quantity and sustained inflows seemingly figuring out the following huge transfer.

Associated: Sprint Value Predictions for 2026: Evolving Good Contracts and the Battle of Privateness Proliferation July 2027 EU Ban

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.