- The Ethereum community has attracted 35 main world monetary establishments previously few months.

- The US, Europe, and Asia are main the way in which in Ethereum adoption, as MiCA and different rules assist progress.

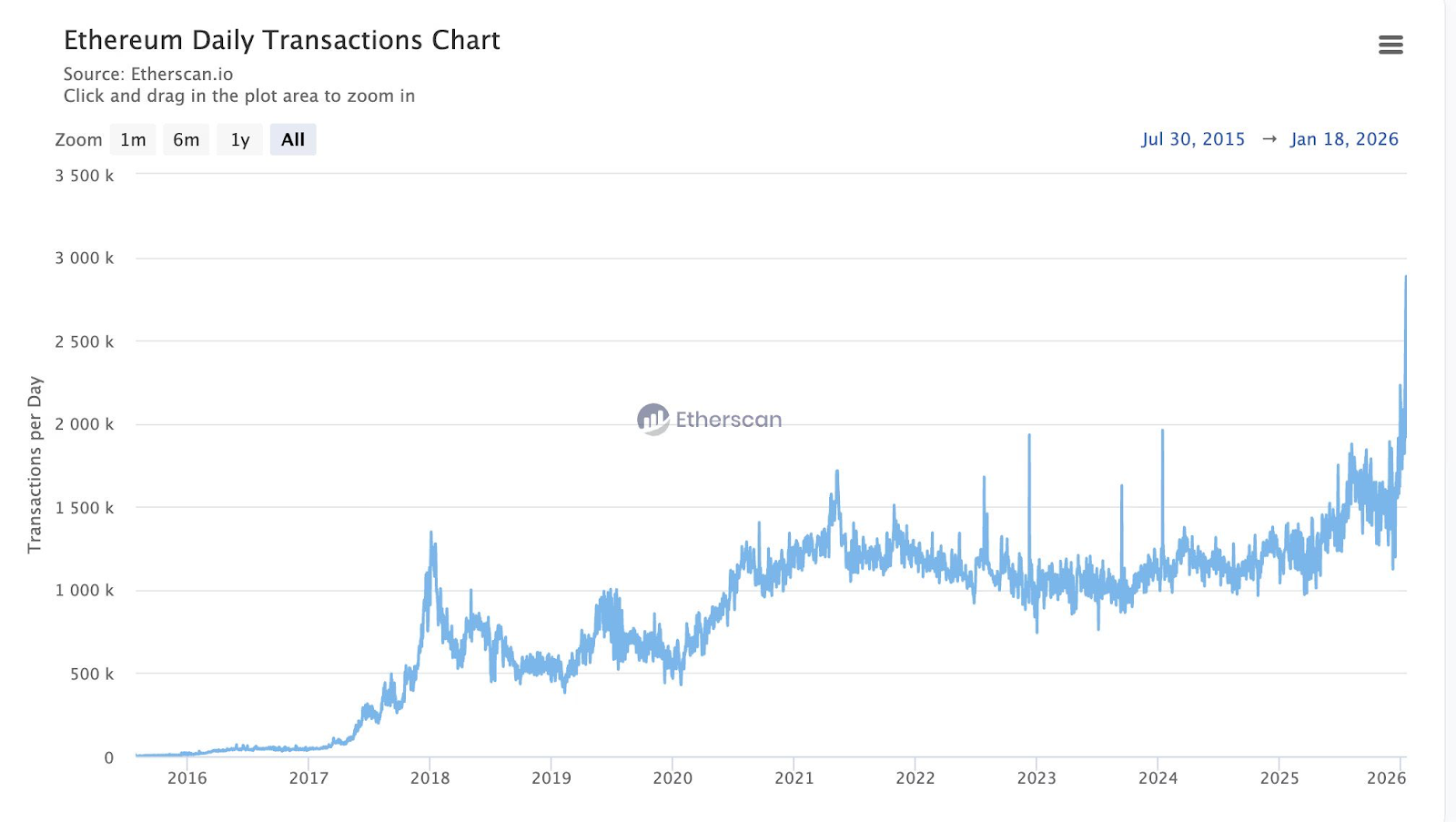

- On-chain knowledge exhibits that day by day transactions of ETH are surging to new ATHs.

Ethereum continues to steer institutional blockchain adoption, with 35 main world monetary establishments leveraging the community to drive progress by digital belongings and Web3 know-how.

Ethereum adopted by 35 main world establishments

Based on the announcement, the Ethereum community has seen a major improve in institutional use circumstances over the previous few months. The Ethereum community, which has maintained constant uptime since its inception, has turn out to be a powerhouse for onboarding institutional buyers.

Institutional buyers from all areas are leveraging Ethereum, with most of its adoption coming from US-based corporations. Distinguished US corporations which have adopted Ethereum in recent times embrace Google, Constancy, Stripe, Kraken, BNY Mellon, BlackRock, Morgan Stanley, SPDJ Indices, and the Commodity Futures Buying and selling Fee (CFTC).

In Europe, the Ethereum community has attracted many monetary establishments because of the continued implementation of the Marketplace for Cryptoassets (MiCA) regulation. European-based monetary establishments embrace Switzerland-based UBS, PostFinance, and Sygnum, in addition to France-based Amundi and WisdomTree.

In Asia, monetary establishments which have adopted the Ethereum community embrace ChinaAMC, Ant Group, JPYC, and Sony Financial institution. Within the Center East, UAE-based ADI Basis just lately adopted the Ethereum community.

In the meantime, in Africa, Kenya-based cell cash M-Pesa plans to enroll greater than 60 million prospects on-chain by the Ethereum community.

What’s the influence available on the market

The plain institutional-led introduction of the Ethereum community has had a serious influence available on the market outlook. Based on Etherscan’s on-chain knowledge evaluation, Ethereum’s day by day transaction depend just lately surged to an all-time excessive (ATH).

Elevated demand for Ethereum by monetary establishments will additional drive mainstream adoption by retail buyers. Based on Tom Lee, who led BitMine and amassed greater than $11 billion in ETH, the exceptional adoption of Ethereum by monetary establishments over the previous few months highlights its significance in the way forward for finance.

As such, ETH value is well-positioned to rise sharply within the coming months. US lawmakers are anticipated to go the CLARITY Act quickly, and demand for ETH is poised to surge in 2026.

Associated: CLARITY Act stalls as analyst Poppe stays bullish on cryptocurrencies

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.