- When DOGE falls beneath $0.135, sellers regain management and short-term construction turns bearish

- Weak momentum continues as DOGE trades beneath Ichimoku Kinko Hyo with destructive capital flows

- Derivatives and spot knowledge present warning, leverage restrained, distribution continues

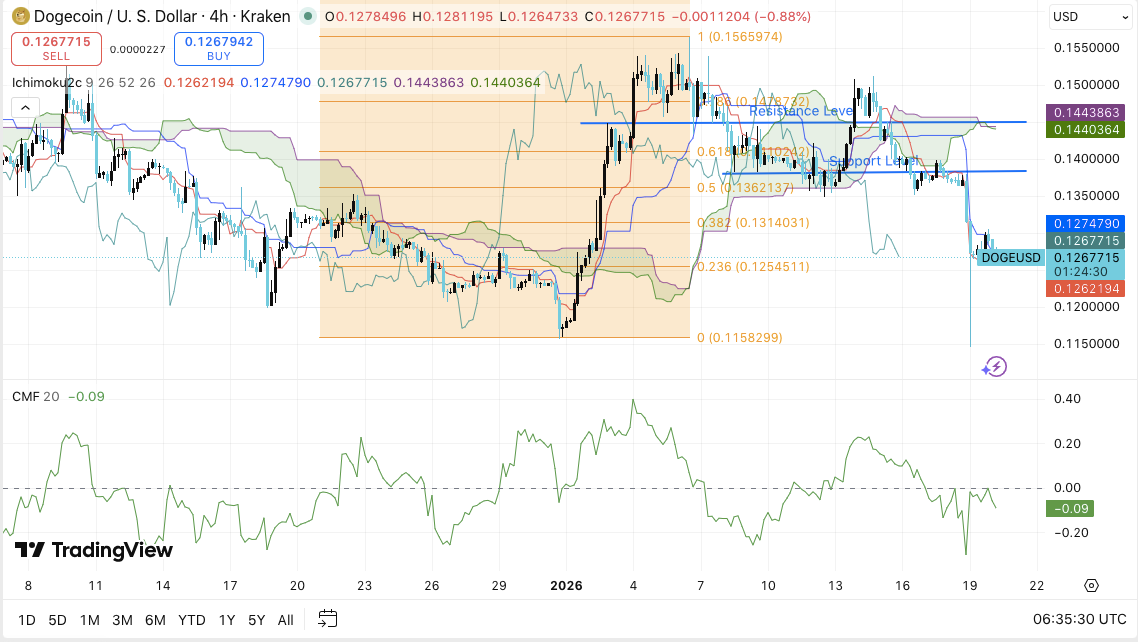

Dogecoin (DOGE) is flashing new draw back dangers on the 4-hour chart after breaking out of its earlier vary. Market individuals stated the meme coin misplaced management of a key help stage, which precipitated a speedy decline and adjusted the short-term construction in favor of sellers.

DOGE breaks by means of key help and slides into new vary

DOGE spent a number of periods shifting sideways between the $0.140-$0.145 resistance zone and the $0.135 help space. However the flooring lastly gave method, and this collapse opened the door to an excellent deeper fall. Because of this, DOGE has slipped into the $0.126-$0.127 area and patrons at the moment are making an attempt to guard the subsequent short-term base.

Momentum indicators additionally mirror growing weak point. DOGE is buying and selling beneath the important thing Ichimoku equilibrium stage, which regularly signifies restricted bullish management. Moreover, the Chaikin Cash Movement measure stays barely destructive at round 0.09. This implies that capital continues to circulate out relatively than flowing in once more.

At present, the $0.126-$0.127 zone is appearing as instant help after a pointy decline. If sellers push DOGE beneath that stage, analysts count on the subsequent draw back take a look at to be round $0.1254, which coincides with the 0.236 Fibonacci stage.

As well as, $0.1200 is positioned beneath as psychological help to draw market patrons. If strain stays aggressive, DOGE may revisit $0.1168, which matches the latest wick low.

On the upside, DOGE faces resistance at $0.1314, which coincides with the 0.382 Fibonacci stage. Subsequently, patrons want a clear restoration past that space to scale back the instant draw back danger.

The subsequent retrieval level is round $0.1362, close to the 0.5 Fibonacci mark. Importantly, the $0.140-$0.145 band was beforehand held as help and stays a significant barrier.

By-product positioning sign Warning

Open curiosity knowledge provides context to cost weak point. Traditionally, DOGE open curiosity has gone by means of boom-bust cycles with speedy will increase. Leverage rose quickly in the course of the sturdy rally, however was deleveraged when the value reversed. Because of this, speculative curiosity proved unstable.

As of January 20, 2026, open curiosity stands at practically $1.48 billion. This stage displays cautious positioning relatively than aggressive risk-taking. Furthermore, the failure of the latest rally in open curiosity means that merchants stay on the defensive. Subsequently, leverage at the moment supplies restricted help for a sustained bull market.

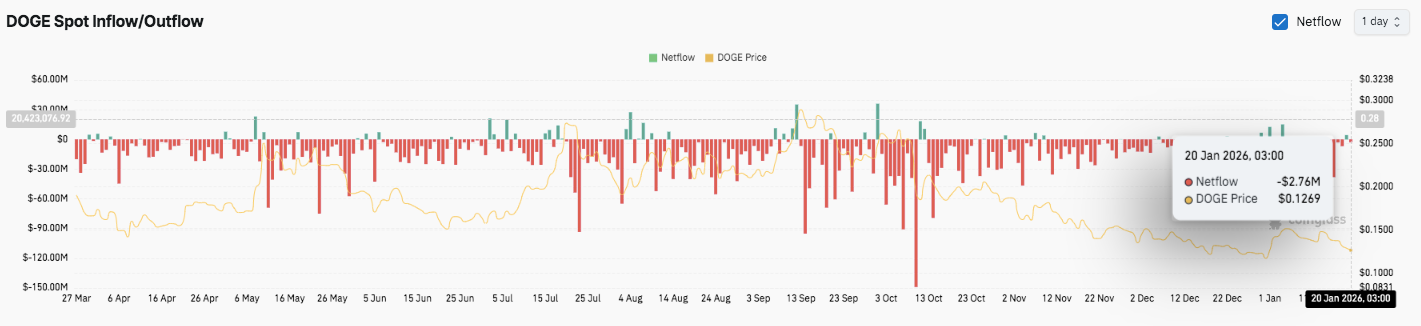

Spot flows mirror ongoing deliveries

Spot market knowledge additional strengthens the bearish outlook. Web flows stay destructive over time, and distributions stay steady. Along with a brief surge in inflows, sellers have dominated buying and selling since mid-year. Outflows intensified in late summer season and early fall, coinciding with a pointy decline in costs.

The outflow of funds continued from November to January, suggesting that overseas change deposits and profit-taking promoting continued. The most recent web outflow of practically $2.76 million is in line with falling costs and weak demand. Because of this, DOGE will face headwinds until patrons return with confidence and quantity.

Technical outlook for Dogecoin worth

DOGE’s key ranges stay well-defined as worth motion weakens on the 4H chart.

On the upside, $0.1314 would be the first hurdle, adopted by $0.1362 as a key mid-range restoration stage. A powerful breakout above $0.140-$0.145 may sign a pattern reversal and open room for a bigger restoration. Nevertheless, DOGE continues to be buying and selling beneath the vital Ichimoku equilibrium stage, and there may be restricted scope for upside at this level.

On the draw back, the $0.126-$0.127 zone stays the instant help space that maintains the present base. A break beneath this vary dangers a decline in direction of $0.1254 after which the psychological stage of $0.120. If the bearish strain stays lively, the subsequent draw back worth goal might be close to the latest lows at $0.1168.

Will Dogecoin go up?

Dogecoin’s near-term worth outlook is dependent upon whether or not patrons can defend the $0.126-$0.127 vary and push again above $0.131-0.136. If quantity improves and momentum stabilizes, DOGE may try a restoration in direction of the earlier vary highs.

Nevertheless, the bias stays bearish as the value continues to say no beneath $0.1314. For now, DOGE stays within the crucial zone and any decisive transfer may result in additional volatility.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.