- XRP fell 2.86% to $1.9279, breaking above $2, the psychological help that has supported value actions since December.

- In line with Glassnode knowledge, short-term holders have a decrease price foundation than their 6-12 month cohorts, a sample final seen earlier than XRP crashed 60% in 2022.

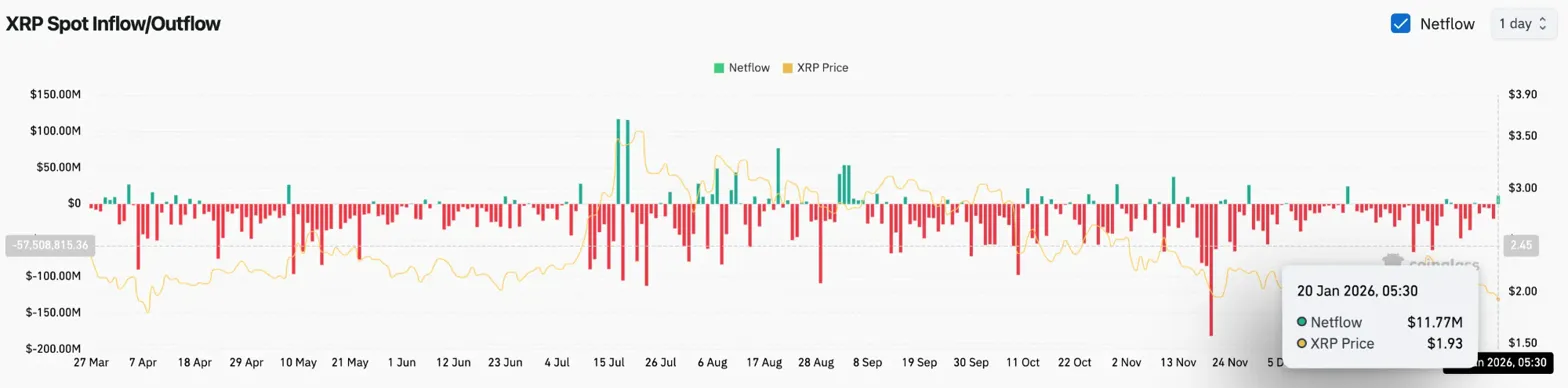

- The whale run continues at $20 million per day as holders who entered above $2 face growing promoting stress.

XRP value is buying and selling round $1.9279 right now after falling beneath the important thing psychological help of $2. This transfer is inflicting a structural shift, with on-chain analytics agency Glassnode warning that it’s just like the scenario earlier than XRP’s 60% collapse in early 2022.

Glassnode Flags 2022 Sample Repeat

The present market construction displays the bearish formation final seen about 4 years in the past. In line with Glassnode, the fee foundation for short-term holders is beneath the realized price foundation for the 6-12 month cohort.

This discrepancy is necessary. Traders working on a one-week to one-month time horizon are at the moment accumulating XRP at a value beneath that bought by intermediate-term holders. This places psychological stress on those that enter at the next degree, making them extra more likely to give up if their feelings worsen.

When this identical sample appeared in February 2022, XRP was buying and selling round $0.80. The broader market downturn that adopted noticed the inventory plummet 60% to lows round $0.30 as traders and whales exited their positions.

Whereas this parallel line doesn’t assure a recurrence, it does spotlight the dangers confronted by XRP holders who bought throughout the rally above $2.

$2 Break Set off Realized Loss

The psychological degree of $2 has served as a key help zone influencing holders’ conduct. In line with Glassnode knowledge, every time the value retested this degree, XRP holders incurred realized losses of $500 million to $1.2 billion every week.

Now that the value has damaged above this degree, there may be room for promoting stress to speed up additional. Holders who accumulate between $2 and $2.50 face the selection of promoting at a loss or ready for a restoration that will by no means come.

The 30-day transferring common of XRP Whale Move has remained adverse throughout the latest rally, indicating continued distribution from giant holders. Promoting stress has eased since its peak, however outflows are nonetheless averaging about $20 million a day.

Offering restricted help via spot inflows

Foreign money move knowledge reveals some consumers are coming in regardless of the decline. Coinglass recorded internet inflows of $11.77 million on January twentieth. This implies the cash are transferring from the change to your private pockets.

That accumulation has been modest in comparison with promoting stress from whales and intermediate-term holders. When on-chain indicators diverge from value actions, bigger flows normally win. On this case, the distribution of whales exceeds the buildup of spots.

This influx means that some merchants see the present value as a possibility. The validity of this bid towards continued promoting will decide whether or not XRP stabilizes or falls additional.

Value break beneath all 4 EMAs

On the every day chart, XRP is at the moment buying and selling beneath the 20-day, 50-day, 100-day, and 200-day EMAs for the primary time for the reason that October rally started. The EMA stack has fully turned bearish and all 4 averages are tilted to the draw back.

Present main degree:

- Speedy resistance: $2.04 (20 EMA)

- Secondary resistance: $2.06 (50 EMA)

- Key resistance ranges: $2.18 to $2.31 (100/200 EMA cluster)

- Supertrend resistance: $2.2386

- Present help: $1.80 demand zone

- Breakdown goal: $1.60 to $1.50

The supertrend indicator has turned bearishly at $2.2386 and is at the moment performing as an overhead resistance degree. The downtrend line from the October excessive continues to cap any upside, compressing the value in the direction of the $1.80 demand zone.

Intraday momentum approaches oversold

A shorter timeframe signifies the depth of the latest sell-off. On the 30-minute chart, the value crashed from $2.10 to a low of $1.85 earlier than rebounding to present ranges.

The RSI is approaching oversold territory at 33.05. The MACD stays bearish, however the histogram has began to shrink, suggesting that promoting momentum could also be working out. Such measurements typically precede a short-term pullback earlier than the development resumes.

Each aid rally faces resistance at $2.00. Returning to this degree with confidence would invalidate the breakdown and present consumers are defending the construction.

Outlook: Will XRP observe the 2022 playbook?

Cautious setup is required. On-chain metrics, whale flows, and technical constructions all level to rising draw back dangers. Though the 2022 parallel doesn’t assure a recurrence, the situations previous that crash nonetheless exist.

- Bullish case: Value rebounds from the $1.80 demand zone and regains $2.00. An in depth above $2.04 would sign a sell-out and goal a retest of $2.18.

- Bearish case: If the closing value for the day is beneath $1.80, the breakdown will likely be confirmed and the goal will likely be $1.60. If the 2022 sample repeats on an identical scale, XRP might check $1.00 to $1.20.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.