- The cryptocurrency market has been underperforming the dear metals business in latest days.

- The primary issue is ongoing geopolitical tensions between the US and NATO members.

- As reserves transfer, gold overtakes the greenback, setting the stage for a BTC rotation.

The disconnect between the cryptocurrency market and the dear metals business is quickly widening. Over the previous two days, the whole cryptocurrency market has fallen by greater than 2% and is hovering round $3.9 trillion on the time of writing.

In the meantime, over the previous few days, gold and silver costs have led to a bullish outlook for the whole treasured metals business. Gold costs rose greater than 1% on Tuesday, reaching a brand new ATH of over $4,700 per ounce.

Silver costs have risen almost 6% previously 24 hours, buying and selling above $95 an oz.

Most important explanation why gold and silver outperform cryptocurrencies

Geopolitical tensions and tariff considerations

Rising world geopolitical tensions are the principle cause why gold and silver costs have outperformed the broader crypto market over the previous few days. Notably, the US and different NATO nations are at odds over Greenland.

In the meantime, as diplomatic relations between European nations and the US change into strained, Russia is escalating its assaults on Ukraine.

Consequently, merchants are shifting their focus to the broader treasured metals business, fearing a renewed tariff warfare. Moreover, President Donald Trump introduced new 10% tariffs on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland beginning February 1st.

Moreover, President Trump plans to extend tariffs to 25% indefinitely beginning June 1, 2026, till a deal is reached on Greenland.

technical breakout

Another excuse why the dear metals business has outperformed the cryptocurrency business is because of its technological breakout. For the previous 9 consecutive months, gold and silver costs have hit all-time highs.

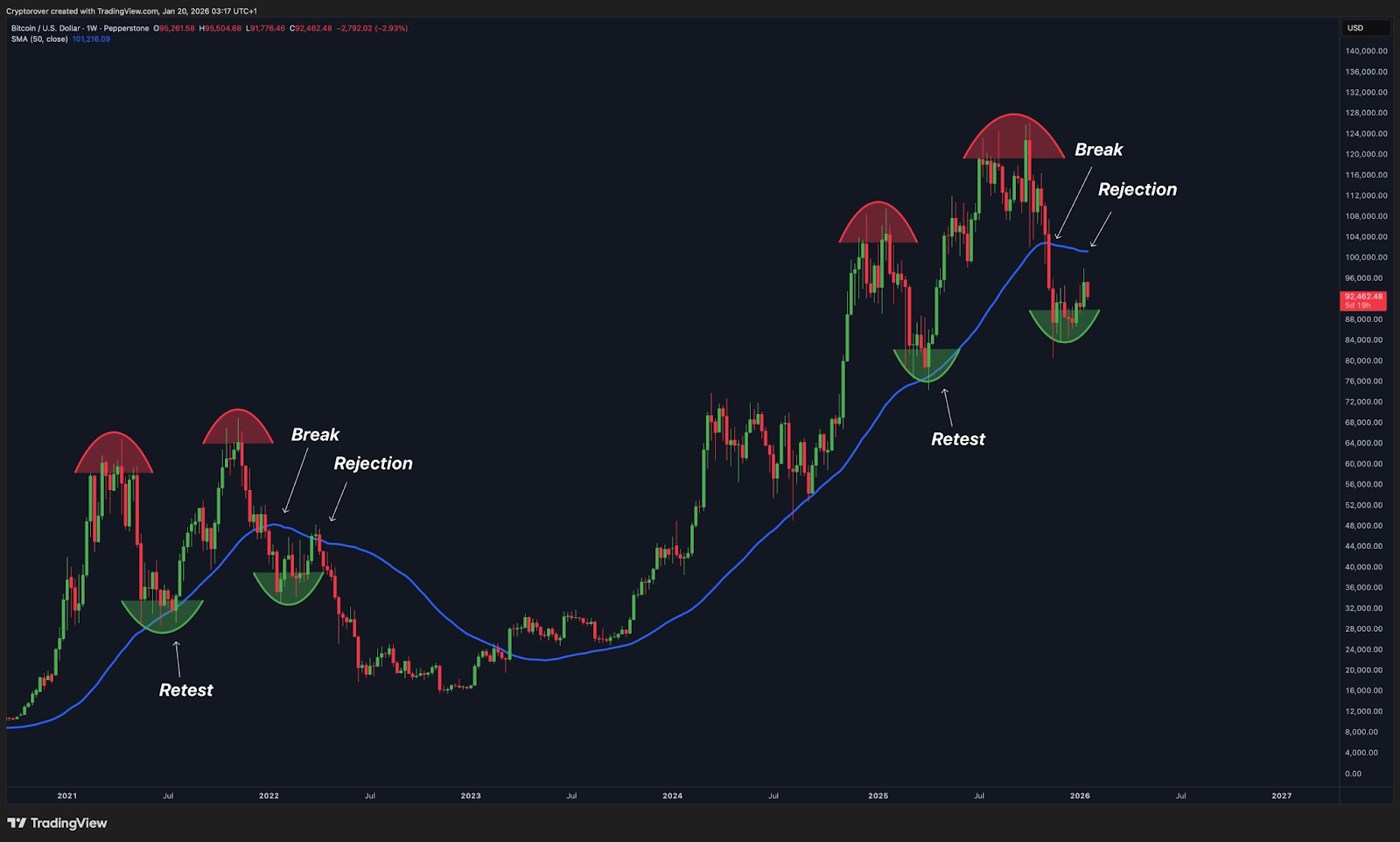

In the meantime, Bitcoin worth is main the broader cryptocurrency business in a risky consolidation. From a technical evaluation perspective, merchants are involved about additional crypto corrections within the quick time period.

Moreover, crypto merchants unanimously agreed that the four-year crypto cycle is over and a possible bull market in 2026 can be fueled by new capital inflows.

What’s subsequent?

Up to now, merchants have perfected the TACO (Trump At all times Rooster Out) commerce. At present, rising geopolitical tensions and impending tariffs introduced by President Trump recommend that the mixing of the crypto market could change into unstable.

As such, elevated demand for gold and silver as a hedge in opposition to macroeconomic uncertainty might drive costs greater. Moreover, many nations, led by China, are dumping US securities and accumulating extra gold.

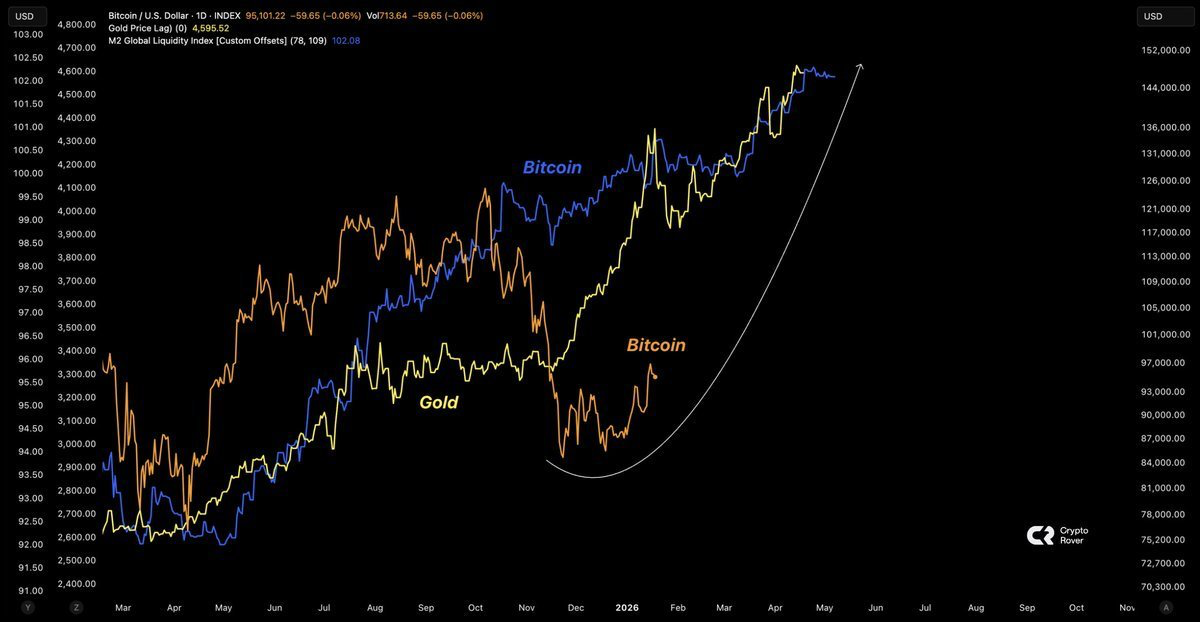

Consequently, gold has already overtaken the US greenback as the key world reserve forex. With the rise in world cash provide, the crypto market led by BTC will profit from the upcoming capital rotation away from gold and silver.

In response to crypto analyst @CryptoCapo at X, if the present help stage round $90,000 holds, Bitcoin worth is more likely to rebound in direction of $100,000.

Associated: Why are cryptocurrencies collapsing at this time? Bitcoin falls to $92,000, gold hits new all-time excessive

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.