- Bitcoin stays under key EMA resistance, short-term momentum stays tilted in the direction of sellers

- Help close to $88,000 stays essential and shedding that zone might begin a deeper draw back transfer.

- Falling open curiosity and unstable spot flows counsel continued de-risking after rally

Bitcoin has returned to a short-term downtrend on the 4-hour chart after failing to defend its earlier breakout space. BTC peaked close to $97,971 earlier than reversing sharply and dropping under the EMA cluster, which frequently signifies weakening momentum.

Because of this, merchants are actually centered on whether or not the most recent rally could be sustained or if it stays a short-term corrective transfer. Bitcoin has not too long ago been buying and selling round $89,464, and the value stays under some robust resistance zones that might restrict any upside makes an attempt.

BTC Value Development Reveals Sellers Nonetheless Management Momentum

Bitcoin faces its first rebound ceiling close to $90,758, which is the near-term pivot. Moreover, the $91,629 to $91,816 vary stands out as a earlier structural zone of EMA stress. A stronger resistance band lies between $92,445 and $92,874, which sellers could defend aggressively.

Subsequently, BTC wants to interrupt out of this space cleanly for sentiment to enhance. The bulls will seemingly have to get better $95,480 to reset the short-term pattern of their favor.

On the draw back, Bitcoin is testing rapid help close to $89,606, which coincides with a significant Fibonacci degree. Nonetheless, the $88,000 to $87,777 demand zone stays the important thing space that holds the chart collectively.

If BTC loses that area, promoting stress might speed up in the direction of $87,630. Moreover, a deeper decline might expose $84,436 as the following main swing help.

Leverage cools as open curiosity recedes

Bitcoin’s open curiosity expanded considerably via 2025 as leverage elevated together with value energy. Importantly, the rally in late 2025 pushed open curiosity towards cycle highs above the $80 billion area. That build-up did not final lengthy.

Associated: Cardano Value Prediction: ADA faces new stress as outflows decline, however…

As BTC retreated from its peak, open curiosity decreased, indicating merchants lowered threat and closed positions. By January 21, 2026, open curiosity remained close to $60.44 billion and BTC was buying and selling at round $88,348, indicating consolidation after the shakeout.

Tom Lee warns of dangers in 2026, spot flows stay unstable

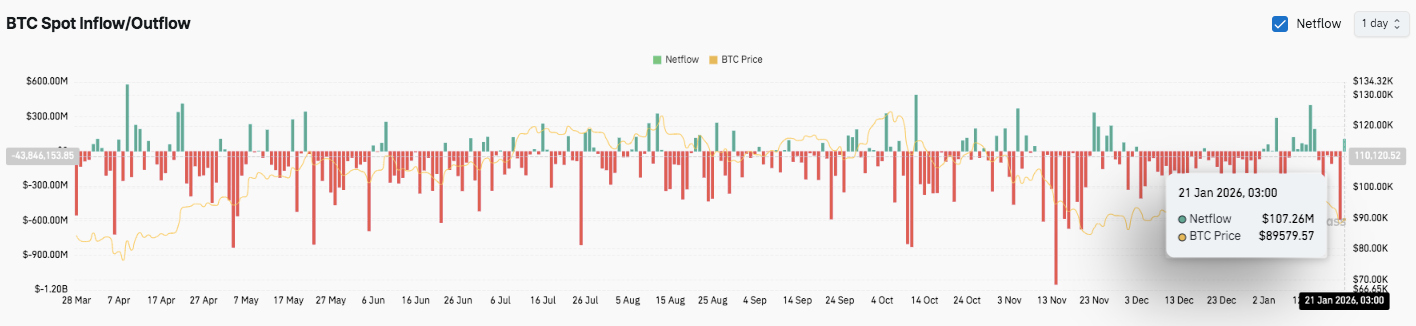

The spot circulation was negatively sloped over a protracted time period, with a secure distribution of repeating outflow bars. Along with that, a brief influx spike appeared throughout stronger pushes, but it surely did not final lengthy.

Outflows spiked considerably from mid-November to late November, coinciding with a pointy drop. After this flush, capital flows remained blended, however the newest readings confirmed web inflows reaching practically $107 million.

Tom Lee, head of analysis at Fundstrat, additionally warned that 2026 might see a painful decline in crypto markets and the broader market as an entire. Moreover, he stated Bitcoin might nonetheless attain new highs this 12 months if the market absolutely recovers. Mr Lee additionally warned that coverage shifts might decide which sectors outperform, resulting in a 15% to twenty% inventory market correction.

Bitcoin (BTC) technical outlook

The important thing ranges stay well-defined as Bitcoin trades via a unstable reset section.

Upside ranges embrace the primary rebound hurdle at $90,758, adopted by convergence of earlier construction and EMA resistance at $91,629-$91,816. A stronger breakout might pave the way in which to $92,445-$92,874, the important thing resistance ceiling that must be reversed to regain near-term bullish momentum. Above that, $95,480 turns into the extent that resets the broader pattern bias.

On the draw back, $89,606 serves as rapid help. Under that, the $88,000 to $87,777 demand zone stays essential. Failure to maintain this space dangers additional decline in the direction of $87,630 and even $84,436. Technical situations counsel that BTC is strong after a pointy deleveraging transfer, with momentum nonetheless favoring sellers under the EMA band.

Will Bitcoin be secure or will it fall?

BTC’s near-term route will rely upon whether or not patrons can defend $87,777 lengthy sufficient to problem the $91,600-$92,800 resistance cluster. A mixture of compression, cooling open curiosity, and spot flows suggests larger volatility forward. If the resistance could be regained cleanly, there’s a chance that the upward momentum can be restored, but when there’s a breakdown, there’s a threat that the correction can be extended.

Associated: Solana Value Prediction: ETF inflows resume as SOL rebounds inside descending wedge

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.