- The Federal Reserve Financial institution of Chicago has launched a letter on cryptocurrency buying and selling in 2022.

- The financial institution’s letter particulars the main cryptocurrency platforms that may go bankrupt in 2022.

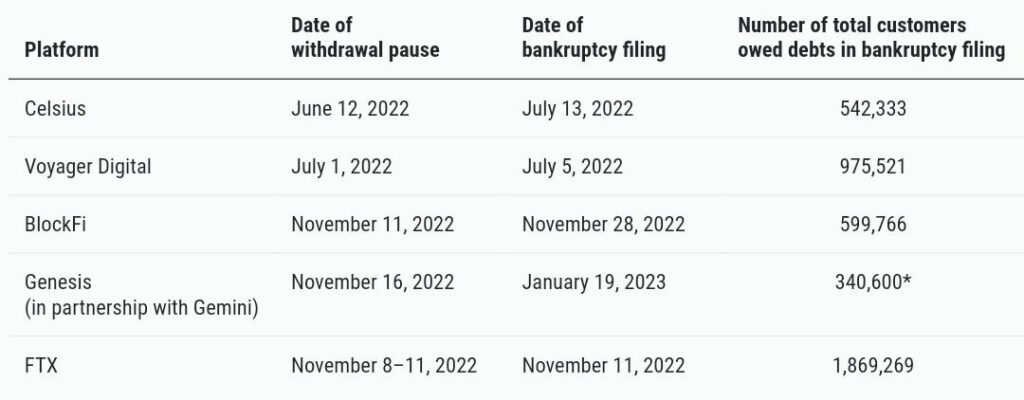

- Firms that failed included Celsior, Voyager Digital, BlockFi, Genesis, FTX and others.

The Federal Reserve Financial institution of Chicago (the Federal Reserve Financial institution of Chicago) has launched a letter summarizing the huge cryptocurrency runs that occurred in 2022. The financial institution pointed to attention-grabbing background, information and when these firms filed for chapter. The letter directs customers to Celius, Voyager Digital, BlockFi, Genesis and FTX.

The Federal Reserve Financial institution of Chicago stated a number of cryptocurrency platforms have suffered vital declines in 2022 attributable to giant person withdrawals and funding losses. These platforms supplied a variety of cryptocurrency-related services, together with custody, buying and selling, and high-yield investments. .

However the Chicago Fed says their enterprise mannequin is in danger, because the platform makes use of its funds for speculative and dangerous investments, whereas clients can withdraw their funds every time they need. stated. A serious incident occurred on his FTX platform the place a buyer withdrew his quarter of his funds in at some point.

We promise high-yield funding merchandise

Prospects of those platforms had been significantly interested in high-yield funding merchandise. The promise of assured rates of interest greater than conventional funding choices has attracted purchasers looking for favorable returns.

The primary funding choices included stablecoin and non-stablecoin crypto belongings, with rates of interest starting from 7.4% to 9%. Some platforms had been providing even greater than typical rates of interest on among the lesser-known crypto belongings they promote.

what went mistaken?

An investigation into the chapter submitting revealed details about withdrawals of buyer funds from different platforms. The main causes of the cryptocurrency crash embody the collapse of Three Arrows Capital (3AC) and the collapse of the stablecoin TerraUSD.

The client withdrew the cash instantly to forestall loss. The platform’s publicity to 3AC, which lent billions of {dollars} to hedge funds, grew to become a major supply of an infection. A large buyer outflow following FTX’s chapter in November 2022 exacerbated the liquidity issues of those platforms.

Information from the Chicago Fed exhibits that from Could 9 to June 12, 2022, Celsius withdrew $1.4 billion and $580 million. The very best withdrawal was confirmed on FTX from November 6-11, 2022, exceeding $7.81 billion.

Regulatory motion is urgently wanted, as evidenced by the momentous occasion of the collapse of a crypto asset platform in 2022.

On regulatory oversight, the Chicago Fed stated:

“The platform’s providing of high-yield investments has been round since at the least 2021, when Coinbase introduced that it had acquired a warning from the U.S. Securities and Change Fee (SEC) that its future-proof investments may turn into securities. are below regulatory scrutiny.”

The dearth of deposit insurance coverage and the lure of high-yield investments created an environment of instability, weak to financial institution runs and monetary crises. Coverage makers want to deal with these points with a purpose to shield buyers and preserve stability within the cryptocurrency market.

(Translate tags) Market information

Comments are closed.