Bitcoin’s illiquid provide has reached a brand new all-time excessive as holders spend lower than they accumulate.

The surge in illiquid provide proves the resolve of Bitcoin traders amid rising issues about fiat inflation and macroeconomics.

Historically, the “illiquid provide” refers back to the quantity of Bitcoin held by an organization that’s not available for buying and selling or sale.

Glassnode takes a extra nuanced strategy to figuring out illiquidity provide, utilizing statistical strategies to find out which entities are primarily sending/promoting or receiving/shopping for bitcoins and which entities are bitcoins. Distinguish the elapsed time since utilizing the coin. Bitcoin is taken into account illiquid whether it is held by an organization that has spent or offered solely a fraction of the Bitcoin it has obtained prior to now.

The illiquid provide has reached unprecedented heights, with 15.11 million bitcoins presently held by these entities. The determine is up considerably from final month’s file of 15,056,000, and accounts for about 78% of the circulating provide.

What are the causes of lowered liquidity?

The rise in Bitcoin’s illiquid provide will be attributed to a wide range of elements. Probably the most necessary is the conduct of short-term holders of bitcoin who’ve held it for lower than 6 months. This group now holds over 20% of the provision, and their holdings have seen a notable improve in current weeks. This development means that short-term holders (lots of whom purchased bitcoin in This autumn 2022 and Q1 2023) are shifting to long-term holders. As these people proceed to carry Bitcoin, the illiquid provide is predicted to extend additional.

The rising illiquid provide of Bitcoin comes amid rising fiat inflation world wide. As central banks print cash in response to financial strain, the worth of conventional currencies is diluted. Bitcoin, against this, is usually seen as a hedge towards inflation as a result of it has a capped provide and a hard and fast emission. Furthermore, the rise in illiquid provide means that extra people are recognizing Bitcoin’s potential as a retailer of worth and selecting to carry property quite than commerce or promote. improve.

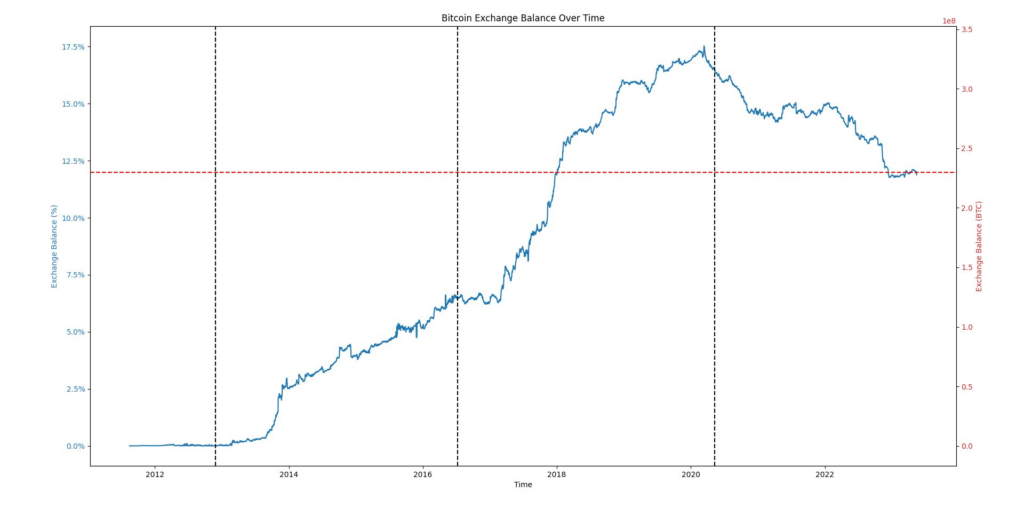

This speculation is supported to some extent by the correlation with the decline in Bitcoin holdings on exchanges because the illiquid provide will increase. In the beginning of 2020, the trade held 17.5% of the Bitcoin provide. The determine has since dropped to round 12%, indicating that extra people are selecting to maintain their bitcoins in non-public wallets.

The chapter of a serious cryptocurrency trade in 2022 additional accelerated Bitcoin’s departure from exchanges. Nonetheless, it might have had some influence on illiquid provide as liquidators nonetheless maintain billions of {dollars} value of cryptocurrencies at chapter hearings of failed exchanges.

The rising illiquid provide of Bitcoin is proof of Bitcoin’s rising recognition as a hedge towards inflation and as a retailer of worth. As extra people select to carry Bitcoin, the illiquid provide will increase. This development contrasts sharply with fiat economies, as lowered spending results in greater prices of residing quite than accumulation of wealth. It is necessary to notice that some international locations, such because the UK, are in a “value of residing disaster” and as folks reduce on non-essential buying, so too will spending on cryptocurrencies.

Put up-Bitcoin illiquidity provide has reached an all-time excessive as Hodler’s dedication first appeared on currencyjournals.

Comments are closed.