Almost $130 million of positions held within the cryptocurrency market have been liquidated after Bitcoin (BTC) briefly crossed $28,000 early in right now’s buying and selling hours.

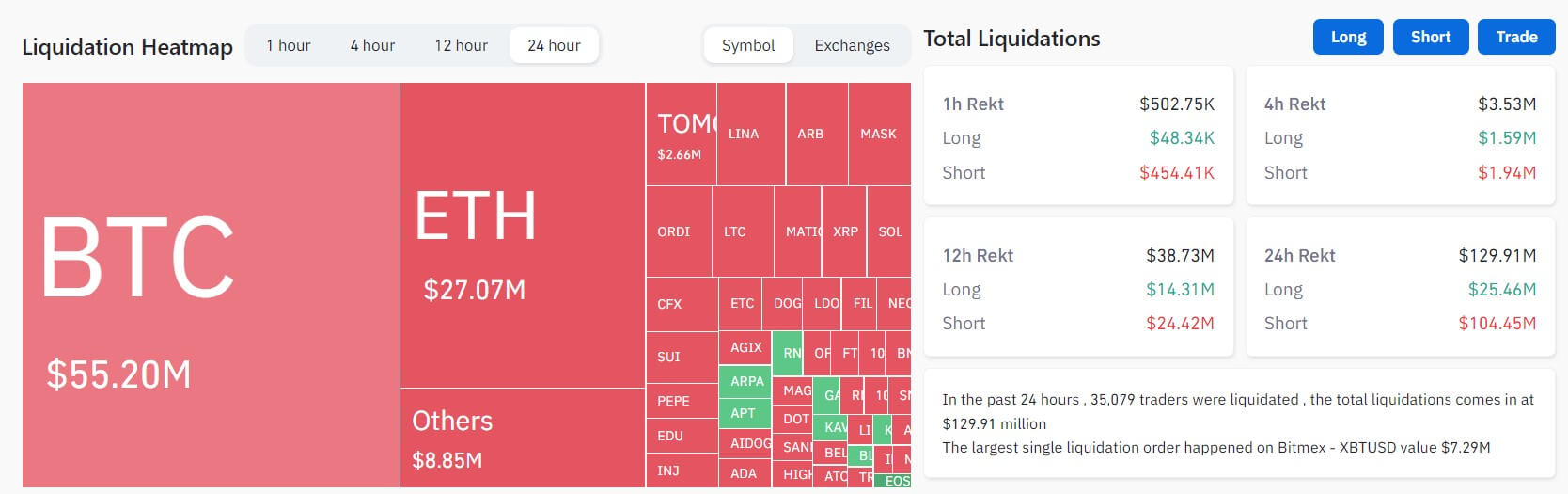

In keeping with information from Coinglass, the flagship digital asset recorded $55 million in liquidations for merchants who held positions within the final 24 hours.

liquidated roughly $130 million

During the last 24 hours, the cryptocurrency market has liquidated $129.91 million and greater than 35,000 merchants.

In keeping with Coinglass information, quick merchants misplaced $104.45 million, of which greater than $68 million was in Bitcoin and Ethereum.

In the meantime, lengthy merchants skilled $25.46 million liquidations. His prime two digital belongings account for greater than 50% of those losses.

Different belongings similar to Dogecoin, BNB, Chainlink, XRP, Litecoin, and Solana every liquidated lower than $2 million.

Throughout exchanges, many of the liquidations occurred on OKX, Binance and ByBit. These three exchanges accounted for over 70% of his complete liquidations, with 99% being quick positions. Different exchanges similar to Huobi, Deribit and Bitmex additionally recorded important quantities of complete liquidation.

Essentially the most important liquidation was on Bitmex – XBTUSD, valued at $7.29 million.

Bitcoin briefly surpasses $28,000

Up to now 24 hours, BTC has damaged by means of the $28,000 stage barrier and hit a brand new excessive of $28,432, in line with the report. of crypto slate information.

Nevertheless, on the time of writing, it has returned to $27,960.

Ethereum (ETH) is up 3% whereas BNB is up 2%. XRP, Cardano (ADA), Dogecoin (DOGE), and so forth. have additionally made substantial positive aspects throughout the reporting interval.

The rise was fueled by information that the US authorities had reached a deal on a debt ceiling. On Might 28, President Joe Biden stated, defined It described the settlement as a “compromise” and “an essential step ahead in lowering spending whereas defending vital applications for working individuals and rising the financial system for all.”

In a memo shared with currencyjournals, Markus Thielen, principal investigator at Matrixport, stated the debt ceiling deal means market skeptics want new causes to keep up their bearish outlook. he added:

“Whereas many traders have been involved in regards to the debt ceiling and the potential for a default by the U.S. authorities, such an occasion is extraordinarily unlikely. They’re going to want to search out another bearish information.”

Comments are closed.