- The 200-EMA golden cross on the SHIB every day timeframe may set off an uptrend in the long run.

- Because of the OBV stagnation, the token lacked liquidity.

- Merchants will not be thrilled by the short-term outlook.

IntoTheBlock knowledge reveals that the Shiba Inu (SHIB) has fallen 90.16% from its all-time excessive (ATH), with 81% of homeowners struggling losses. This case explains why the token didn’t meet up with different cryptocurrencies in the course of the short-term bull market.

In accordance with the Crypto Market Insights platform, this efficiency has resulted in a 0.86 correlation between SHIB and Bitcoin (BTC). Whereas this correlation could possibly be thought of near-perfect, the meme means that he hasn’t adopted his BTC strikes 100% of the time just lately.

Nevertheless, falling rates of interest and lack of liquidity will not be the one cause why SHIB is unable to offer advantages to long-term holders.

SHIB’s bearish character stays

As an alternative, the emergence of Pepecoin (PEPE) additionally contributed. Regardless of the token’s declining worth, the broader cryptocurrency group nonetheless appears to have its eye on the token.

It’s because LunarCrush demonstrated social engagement. considerably elevated over the past week. For these unfamiliar, a surge in social engagement means extra searches and discussions about property. However how shortly will SHIB get out of this underwhelming efficiency?

Based mostly on the every day chart above, SHIB has not been in a position to maintain any vital resistance. As of April 19, the psychological resistance of 0.00001549 had dropped sharply. Subsequent makes an attempt had been additionally in useless.

Moreover, the 20-day exponential shifting common (EMA) has crossed the 50-day EMA (in orange). The state of those indicators signifies that sellers are in management. Subsequently, it might be troublesome for SHIB to get well within the quick time period.

Nevertheless, on March 9, there was an upward crossover or golden cross of the 200-day EMA (purple) above the 200-day EMA and the 50-EMA. This case reveals that SHIB could set up a brand new uptrend within the medium to long run.

However, on-balance buying and selling quantity (OBV), which measures buying and selling strain, has remained nearly flat. On the time of writing, OBV has proven that the intentions of market members are swinging from shopping for and promoting tokens.

An period when quick pants dominate the market

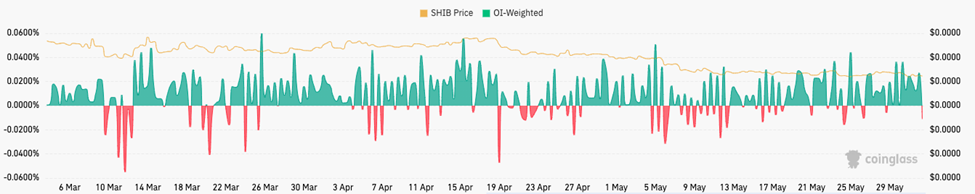

By way of funding charges, Coinglass revealed that SHIB has turned detrimental. Which means merchants holding quick positions are keen to pay lengthy place holders’ funding charges to maintain their futures contracts open.

Conversely, a optimistic funding fee signifies that the dealer’s place is bullish. Subsequently, merchants with lengthy positions will likely be keen to pay quick.

On condition that SHIB is among the high tokens held by whales, it tends to make a comeback in the long term. Nevertheless, short-term expectations could stay sluggish in a bear zone.

Disclaimer: The views, opinions and knowledge shared on this worth forecast are revealed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly chargeable for their very own actions. Coin Version and its associates will not be chargeable for any direct or oblique damages or losses.

(Tag Translation) Altcoin Information

Comments are closed.