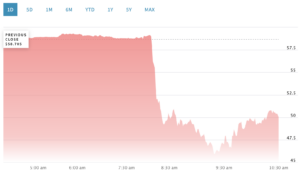

Shares of Coinbase plunged 22% after information emerged that the U.S. Securities and Trade Fee had sued the platform for allegedly violating securities legal guidelines.

Shares on the U.S. change fell to round $48 from $58.71 earlier than the market, in line with Nasdaq information. On the time of writing, it had barely recovered to $50.03, down 15% from the day.

In the meantime, the lawsuit additionally triggered a gradual drop within the worth of Bitcoin (BTC), dropping 0.51% towards the greenback on the hourly candlestick.In keeping with 25,493 folks as of 13:30 UTC of crypto slate information. Shares of a number of Bitcoin miners, together with Riot Blockchain, CleanSparks, Bitfarms, and Marathon Digital, have posted vital drops following the information.

coinbase lawsuit

In keeping with the SEC, Coinbase operated as an unregistered dealer, change and clearing home, providing unregistered securities by a staking program. The regulator additionally alleged that the change was providing unregistered safety tokens reminiscent of ADA and SOL to US traders by its platform.

The SEC stated:

“The Coinbase platform integrates the three features of a dealer, an change, and a clearing home which might be sometimes separate in conventional securities markets. We circumvent the disclosure regimes that Congress has established for our securities markets as a result of there isn’t a such factor.”

In the meantime, the lawsuit comes lower than a day after watchdogs filed comparable fees towards Binance, the most important cryptocurrency change by buying and selling quantity. The SEC stated Binance has made billions of {dollars} by soliciting U.S. traders to commerce on its unregistered platform.

Coinbase Constantly Highlighted U.S. Regulatory Vacuum

Up to now, the SEC and Coinbase have been embroiled in a prolonged authorized battle over an absence of regulatory readability within the cryptocurrency house. In a Could 15 courtroom submitting, the monetary regulator stated it had no obligation to offer the requested readability.

In testimony ready earlier than the Home Agriculture Committee on June 6, Coinbase Chief Authorized Officer Paul Grewal stated:

“Regulation establishes clear guidelines for the business and likewise gives vital legal responsibility measures for potential dangerous guys. I assure you.”

The change’s CEO, Brian Armstrong, stated on Could 30 that the U.S. crypto business faces a robust problem from China.

A 15% drop in COIN first appeared on currencyjournals after the SEC litigation, inflicting a drop in Coinbase inventory.

(Tag Translation) Bitcoin

Comments are closed.