- One other debate erupted over ETH’s standing as a safety, led by the previous Twitter CEO.

- The Bulls defended ETH at $1800, resulting in additional appreciation.

- The CMF indicator identified that ETH might quickly turn out to be overbought.

The previous CEO and co-founder of Twitter has affirmed his place that Ethereum (ETH) is a safety. Dorsey shared his views on the SEC’s transfer to label some cryptocurrencies as unregistered securities, however initially talked about three belongings that might stand up to censorship.

Jack is at odds with Gary

As anticipated, his listing included Bitcoin (BTC). Nevertheless, Dorsey excluded the second largest cryptocurrency by market worth. When requested if he by accident forgot Ethereum, Dorsey replied, “No, I did not.”

The assertion sparked vital debate inside the cryptocurrency neighborhood and raised questions on Ethereum’s regulatory classification. The problem was controversial, however bitcoin extremists weren’t enthused. The truth is, he sarcastically responded to a different person who referred to as him a “clown” to his earlier opinion: Please inform me the magician. ”

Previous to the latest debacle, there was debate as as to whether ETH was a safety. Nevertheless, on April 28, Yahoo Finance reported that SEC Chairman Gary Gensler didn’t contemplate the security of altcoins. On the time, Mr. Gensler stated, “It’s decentralized sufficient now that folks would suppose it’s not a safety.”

Combating compliance

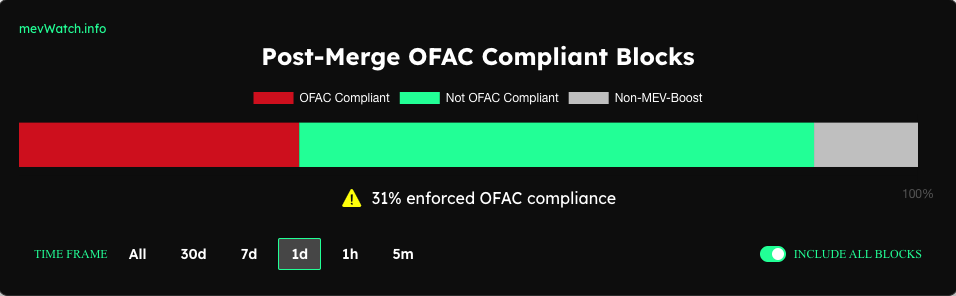

Within the midst of the ups and downs, MEV Watch revealed that solely 31% of ETH’s post-merge blocks are OFAC compliant.

OFAC stands for Workplace of Overseas Belongings Management, an company of the US Treasury Division accountable for commerce and financial sanctions. Moreover, the Ministry of Finance started monitoring blockchain after it switched to Proof of Stake (PoS).

For Ethereum to be OFAC compliant, some MEV enhance relays might want to censor some transactions on the community.

This improve subsequently means that almost all of Ethereum blocks are usually not interacting with sanctioned functions. Nevertheless, the present state of affairs nonetheless raises eyebrows about blockchain decentralization.

ETH: Battle to repel bears

After the downtrend interval on June 5, ETH established a bullish swing and climbed to $1,874. This equates to a 3.86% improve for him within the final 24 hours. The rise could also be associated to the restoration of the cryptocurrency market as an entire.

Nevertheless, after the worth rejected on the $1,905 resistance degree, the bearish construction began to wipe out good points. Regardless of a collection of bearish candlesticks, the bulls ultimately defended the $1,808 assist. This pushed the worth again to $1,885 on the every day chart.

Nevertheless, the bulls did not assist the present worth degree of $1,876. If this example continues, a bearish benefit will emerge and ETH worth could drop.

In the meantime, Chaikin Cash Movement (CMF) was trending upward. This implies that ETH has had constructive liquidity flows. Nevertheless, if the indicator is 0.19, the cryptocurrency could attain oversold territory.

Lastly, ETH may have elevated demand to maintain up with bullish strikes. On the identical time, the worth dangers a reversal if the CMF ultimately reaches 0.20.

Disclaimer: The views, opinions and data shared on this worth forecast are revealed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly accountable for their very own actions. Coin Version and its associates are usually not accountable for any direct or oblique damages or losses.

Comments are closed.