Bitcoin worth has been caught in a decent buying and selling vary over the previous week, regardless of a latest rally to try to retake the 200-Week Shifting Common (WMA).

The announcement of BlackRock’s integration of Bitcoin into its ETF portfolio and Bitwise’s refiling of its Bitcoin Spot ETF are important items of reports that would transfer the value of Bitcoin. Moreover, whispers of an “earthquake” transfer by Constancy in cryptocurrencies are elevating expectations.

Nevertheless, evaluation of varied on-chain indicators, together with Bitcoin exercise, suggests the market lacks volatility.

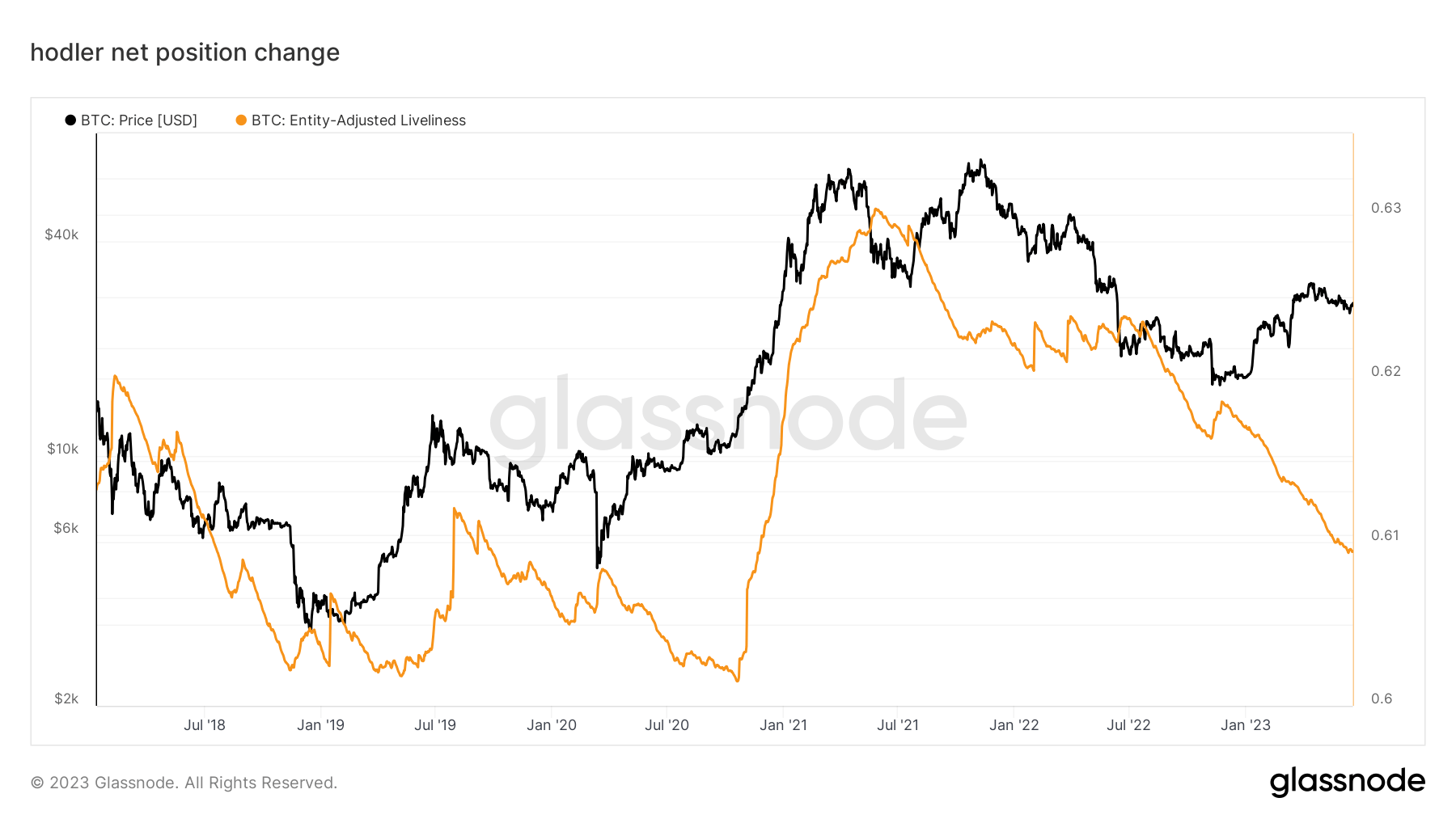

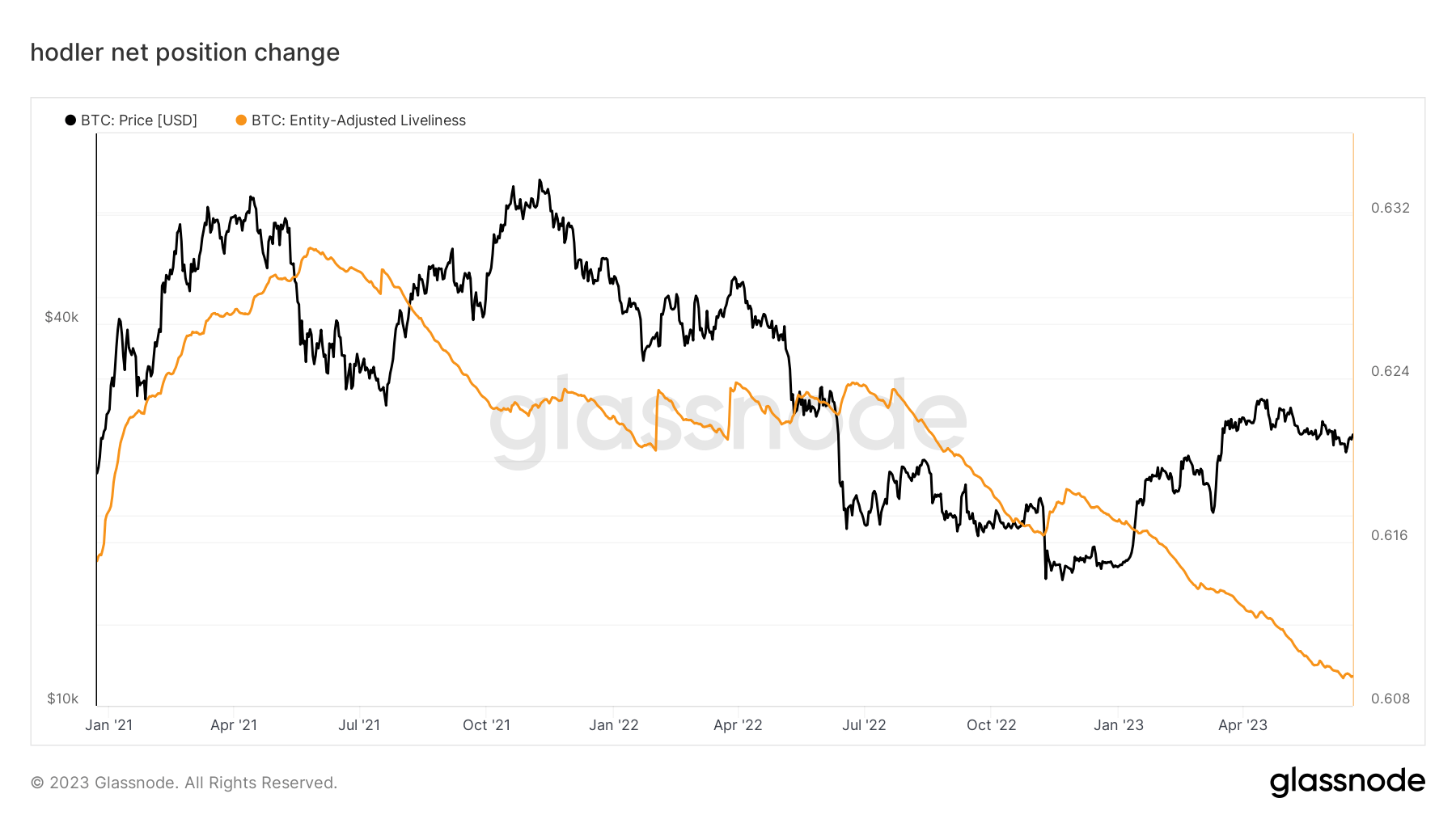

Exercise is a time-weighted measure of Bitcoin UTXO (Unspent Transaction Output), indicating the share of Bitcoin that has been dormant for a time period. As such, it serves as a beneficial barometer of market exercise and offers perception into Bitcoin hodler habits.

The exercise metric makes use of “coin days”, which suggests the variety of days since every coin was final moved. Greater liveliness scores and an upward pattern counsel that the hodler is energetic and shifting cash. Conversely, if the exercise rating is low and trending downward, it signifies that the hodler is missing in exercise and the coin is dormant.

Since peaking in Might 2021, Bitcoin’s growth has been on a downward trajectory, which correlates with the start of an ongoing bear market.

The pattern of declining vigor usually signifies that Hodler is shifting bitcoin into chilly storage and out of circulation. This motion has led to a rise within the illiquid provide of Bitcoin, which contributes to the present market stability we’re witnessing.

This historic downward pattern means that extra hodlers are shifting their cash into chilly storage and could also be poised for long-term funding methods.

The post-Bitcoin exuberance reveals the “hodler” habits throughout a protracted interval of worth stability that first appeared on currencyjournals.

Comments are closed.