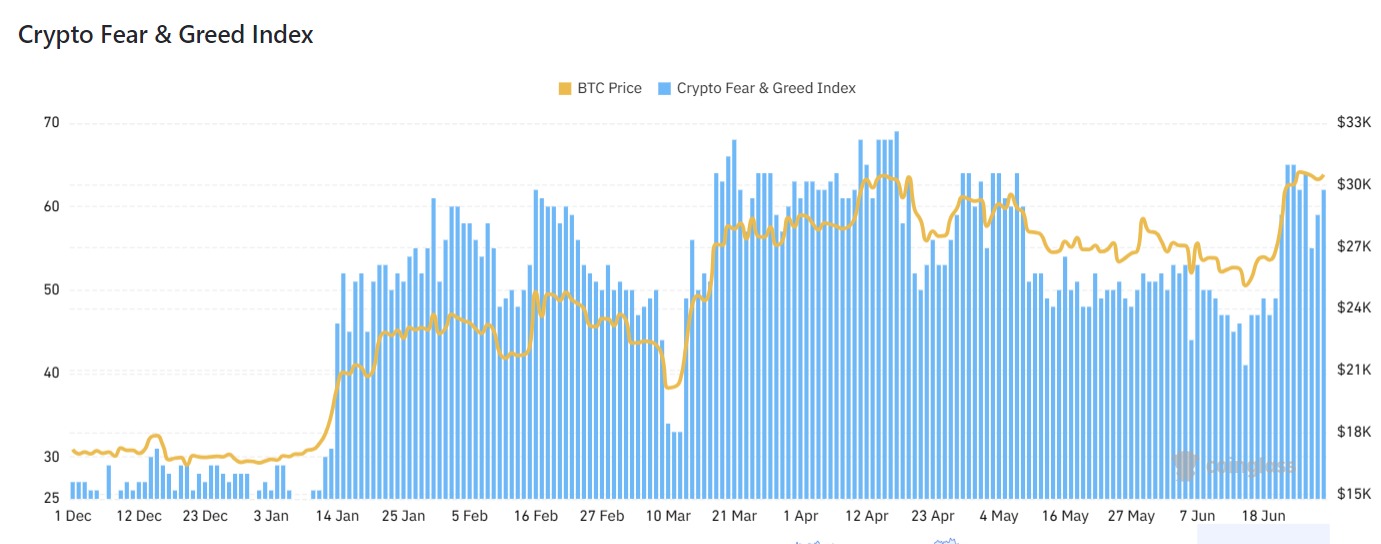

Forward of Bitcoin choices expiry, the cryptocurrency worry and greed index moved into greed territory. Bitcoin The value on Wednesday was buying and selling at $30,392 and has remained at that degree for the previous few days. That worth is just a few factors under the year-to-date excessive of $31,478. At its peak, the coin rose greater than 104% from its 2022 lows.

Worry and greed indicators level to greed

The crypto worry and greed index has rebounded strongly over the previous few weeks. Moved from 41 within the Worry Zone to 62 within the Greed Zone. Which means that the current influence of his ETF information has made traders reasonably grasping. The most recent bitcoin information got here on Tuesday when Constancy introduced it had submitted an ETF proposal to the SEC.

Buyers imagine spot ETFs will result in elevated demand for Bitcoin from institutional traders. Nonetheless, this view ought to be taken with a grain of salt because the ProShares Bitcoin Technique ETF (BITO) has loved modest progress over the previous few years. It presently has roughly $1 billion in property. BITO tracks Bitcoin futures, however has an in depth correlation with Bitcoin itself.

The worry and greed index reveals extra upside potential for Bitcoin as traders have a tendency to purchase Bitcoin when there’s greed out there. Presumably, these good points will come earlier than or after the Bitcoin choices expiration scheduled for this Friday.

Information present that almost all of those choices are calls with strike costs round $30,000. This explains why bitcoin has barely moved this week.

Bitcoin worth prediction

An excellent technical evaluation can assist you expect the following worth transfer for cryptocurrencies and different property. Trying on the each day chart, we will see that Bitcoin is fluctuating on the 50% Fibonacci retracement degree. This is a crucial degree for merchants to concentrate to.

On the similar time, April 14th was the best, so this is a crucial worth. Most significantly, the coin is forming what seems like a bullish pennant sample. Due to this fact, with consumers concentrating on the following crucial degree of $35,000, the worth might make a bullish breakout quickly. This worth is about 15% increased than present ranges. A break above this degree will lead to a soar to the following resistance level of $40,000.

(Tag Translation) Evaluation

Comments are closed.