vital level

- Cryptocurrency costs are hovering, with Bitcoin up 20% within the final three weeks

- Many high-profile Bitcoin ETF filings spark optimism out there

- Whereas inside liquidity stays low and a few worrisome developments emerge,

- Regulatory points nonetheless exist, Coinbase and Binance face an unsure future

- The macro setting stays unsure, and the prospect of a delayed influence from financial tightening looms massive.

It isn’t the case that the cryptocurrency market is overly excited. Over the previous few weeks, optimistic vibes have returned to the business, led by the seminal filings for Bitcoin spot ETFs by the world’s largest asset managers, BlackRock and Constancy.

As well as, Constancy has joined the ranks of main trad-fi operators together with Schwab and Citadel to again EDX, a brand new change providing buying and selling in Bitcoin, Ether, Litecoin and Bitcoin Money.

Bitcoin rose 20% over the previous three weeks to interrupt by way of the $30,000 degree, whereas Ether surged 16% over the identical interval, approaching the $2,000 degree once more. at first sight, worry and greed The Index, an attention-grabbing metric that measures the general feeling of house, has a rating of 61 (0 representing excessive worry and 100 representing excessive greed), clearly belonging to the “grasping” class. .

Nonetheless, a glance beneath the hood raises some issues. First, if ETF filings are apparently the explanation for the latest inventory worth rally, is the 20% rise justified? It has notified Nasdaq and CBOE (which filed the paperwork on behalf of the asset supervisor) that there have been not sufficient particulars concerning the “surveillance sharing settlement.” The SEC has beforehand mentioned that bitcoin belief sponsors would want to enter into sizable regulated markets and oversight sharing agreements.

Nonetheless, a glance beneath the hood raises some issues. First, if ETF filings are apparently the explanation for the latest inventory worth rally, is the 20% rise justified? It has notified Nasdaq and CBOE (which filed the paperwork on behalf of the asset supervisor) that there have been not sufficient particulars concerning the “surveillance sharing settlement.” The SEC has beforehand mentioned that bitcoin belief sponsors would want to enter into sizable regulated markets and oversight sharing agreements.

Whereas the applying may be renewed or re-filed (CBOE has certainly re-filed since then, and the Nasdaq will doubtless comply with go well with quickly), this growth is much-needed. It hints at how troublesome it was to cross the road with spot ETFs. Regardless of the large corporations concerned, there is no such thing as a assure that these will likely be authorized, and the SEC has rejected Constancy’s functions prior to now, even rejecting them in January 2022.

Actually, it feels inevitable that bitcoin spot ETFs will sooner or later turn out to be freely traded, however given what else has occurred on this house and the present state of bitcoin, previous numbers A 20% enhance in simply weekly filings is a major enhance. We’ll delve deeper into the market.

Liquidity

Liquidity lags proceed and this issue can’t be overstated, however certainly the ultimate approval of spot ETFs ought to assist.

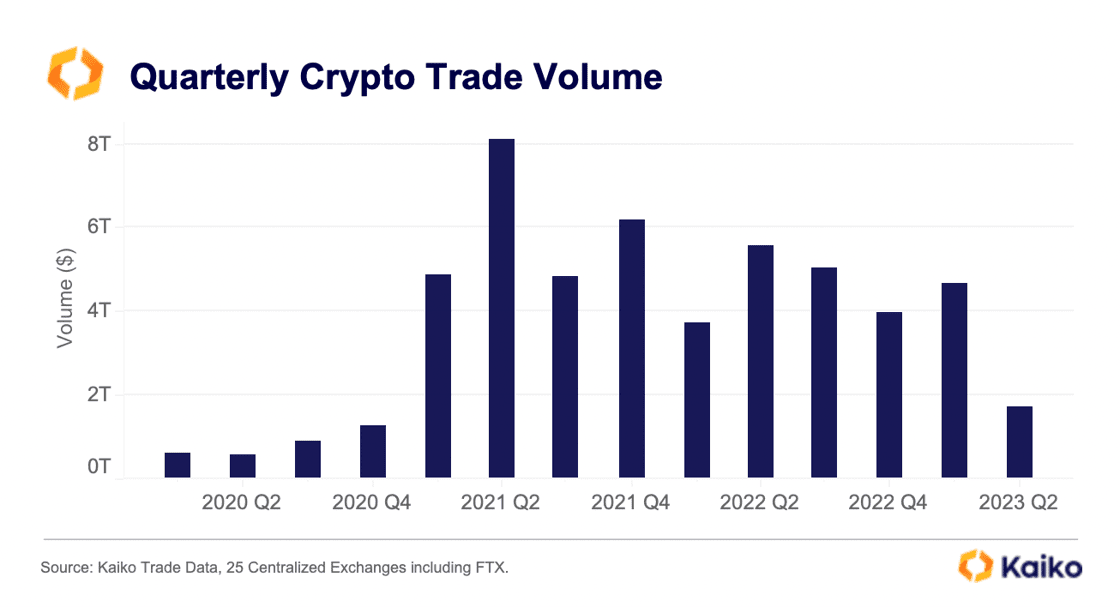

As we wrap up the second quarter of 2023, a have a look at centralized exchanges per Kaiko’s knowledge exhibits that buying and selling volumes have fallen once more over the previous three months, and 2020 earlier than bitcoin and cryptocurrencies launched into a relentless worth rally. It was the bottom quantity because the 12 months. A whirlwind takes place within the monetary world.

Nevertheless, a drop in liquidity worsens the transfer to each the upside and the draw back. This most likely contributed to Bitcoin’s surge over the previous few weeks and because the starting of the 12 months, which is now up 83%.

Nevertheless, market contributors ought to be involved that liquidity and buying and selling volumes are so low. From a buying and selling standpoint, lots of the forays made in the course of the pandemic, at the very least from a liquidity standpoint, have slowed, if not reversed, with regards to Bitcoin’s place as second solely to the actual asset class.

As additional proof of this, the chart beneath exhibits the overall steadiness of stablecoins throughout exchanges, which has seen a staggering 60% decline over the previous six months, with $26 billion outflow.

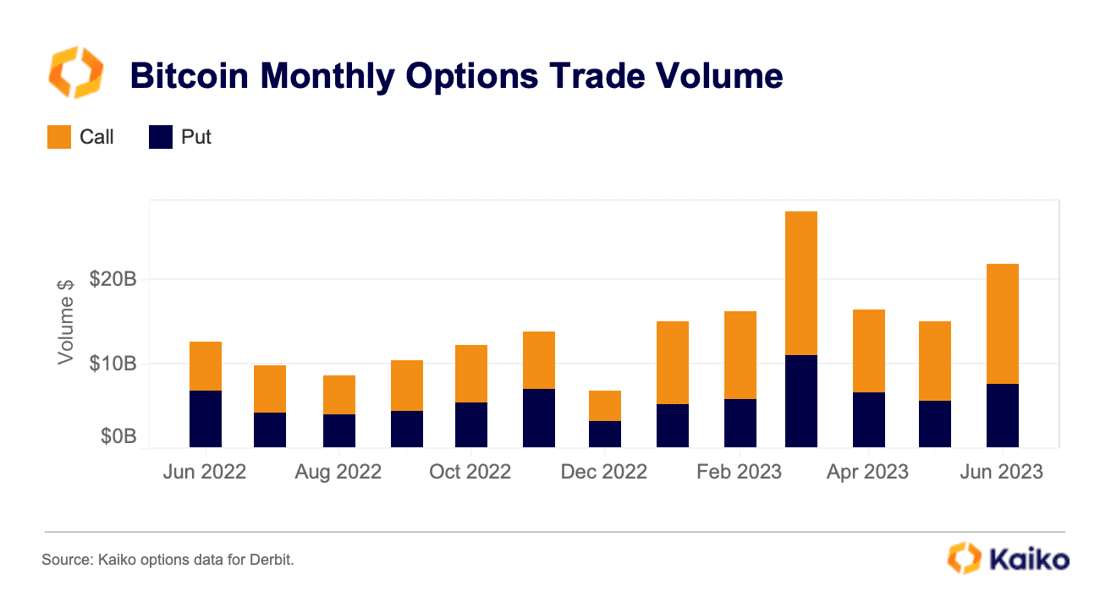

That mentioned, there’s some optimism that implies a brighter future if these spot ETFs are authorized. When you have a look at the derivatives market quantity, it is fairly steady. Actually, it’s going to rise considerably within the second half of 2022. Maybe because of this the spot market has been extra affected by regulatory crackdowns. Both approach, it is not as dire as what we’re seeing within the spot market.

regulation

For the time being, all of it comes right down to regulation with regards to cryptocurrency-specific dangers. Whereas we mentioned ETF filings, June additionally noticed two key moments: formal lawsuits in opposition to Coinbase and Binance.

The 2 instances are very completely different. Simply in case.Binance lawsuit not stunning, exchanges are all the time circumventing pointers and legal guidelines. The costs signify an enormous record of varied offenses, together with buying and selling in opposition to prospects, manipulating buying and selling volumes, encouraging customers to avoid geo-restrictions and securities violations.

However it’s the latter accusation that’s central to the lawsuit in opposition to Coinbase, and is crucial level. That is additionally the explanation for the Coinbase lawsuit. rather more attention-grabbing. Bear in mind, this allegation comes from the SEC, the identical company that presided over Coinbase’s April 2021 IPO. Why would the SEC record an unregistered inventory change on a US inventory change?

However let’s get again to what this implies for the cryptocurrency market. Whereas Bitcoin seems to have a novel standing within the eyes of the legislation, quite a few different tokens have been designated as securities by the SEC. Nonetheless, the inventory has skyrocketed since information of the Bitcoin ETF got here out. Does this make sense?

Conclusion

In any case, cryptocurrencies will likely be cryptocurrencies. Costs fluctuate, and making an attempt to find out why is commonly silly. However final month, regardless of some unhealthy information on the regulatory entrance, it seems like we have seen some very optimistic worth good points.

Furthermore, regardless of the pause on the final Fed assembly, the macro image has not modified a lot. Fed Chairman Jerome Powell’s feedback made it clear that this was a moratorium, not a shift in coverage.

“Trying ahead, virtually all committee members imagine that additional price hikes are more likely to be acceptable later within the 12 months,” Powell mentioned in saying the moratorium.

The market believes him. I’ve undone the chances from the Fed futures on the next chart. This means that there’s presently an 86% likelihood of a 25bps price hike on the subsequent Fed assembly in three weeks, and solely a 14% likelihood of holding charges once more. I put this side-by-side with the identical odds that the market reported simply over a month in the past (Bitcoin has risen 20% since then) to indicate that weak forecasts can not clarify the worth spike. (The percentages of not going up are literally lowering).

As I mentioned earlier, digital foreign money will migrate to digital foreign money. However because the sector is notoriously unstable, it could be sensible to pause and contemplate whether or not a sudden wave of growth is justified. Given the liquidity state of affairs and regulatory points, there are many causes to be hesitant.

Then after I overlay the macro photograph, the photograph is blurry once more. We neglect that we’re within the midst of the quickest price hike cycle in fashionable historical past, with rates of interest rising all the best way from zero to over 5%, with additional price hikes anticipated later this month. shouldn’t be

Financial coverage lags and the dimensions of its tightening is big. Feelings might really feel like they’ve modified dramatically, however there’s nonetheless an extended approach to go.

(Tag Translation) Evaluation

Comments are closed.