Binance’s regulatory troubles in numerous jurisdictions in June seem to have resulted in a big drop in customers’ crypto belongings.

Binance customers withdraw belongings.

Customers’ bitcoin deposits fell 3.5% to 592,450 BTC from the 614.800 BTC recorded on June 1, in keeping with the alternate’s newest proof preparation snapshot taken on July 1. Which means that platform customers withdrew round 22,000 BTC from the platform throughout this era.

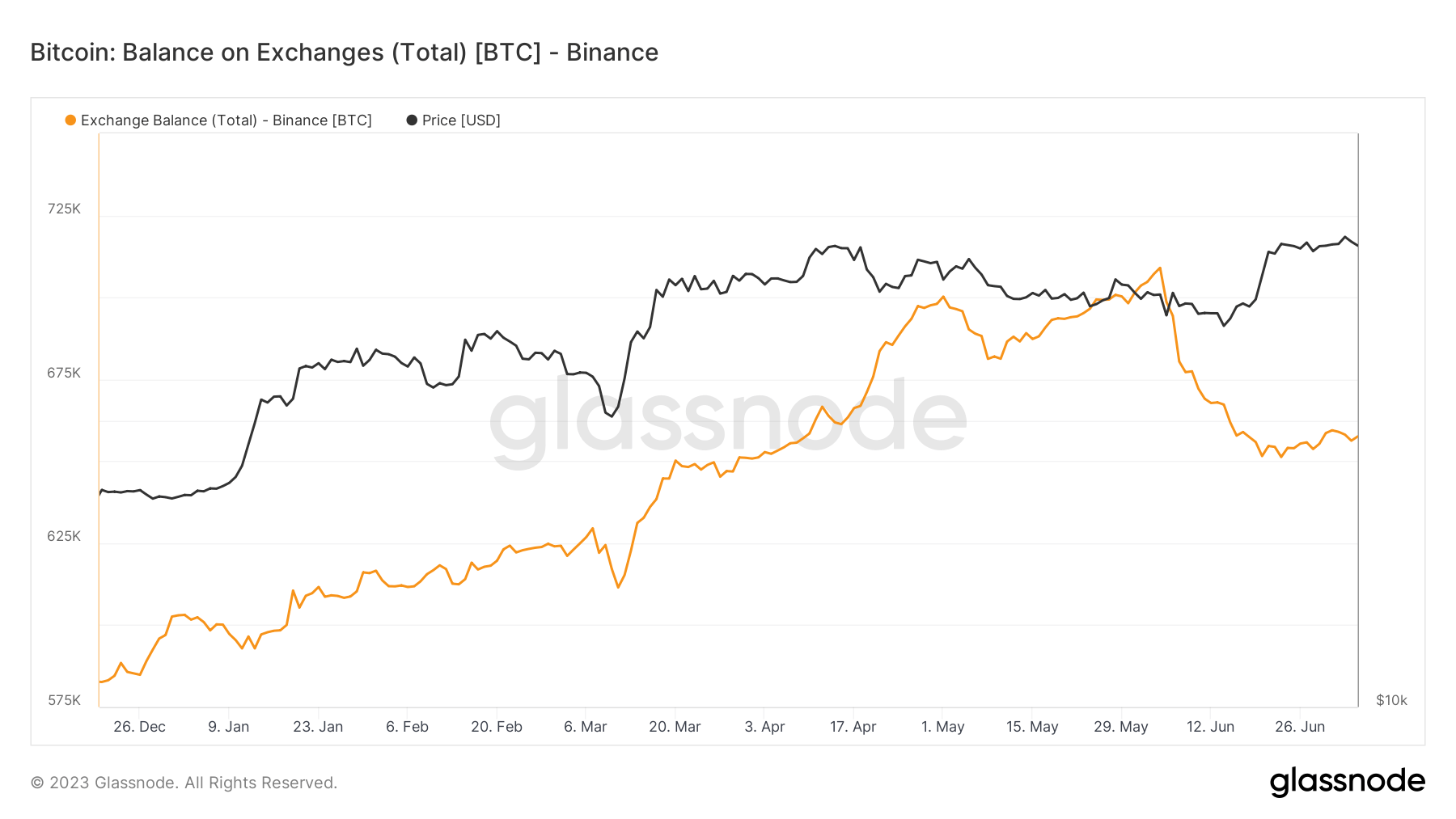

Glassnode knowledge confirms that BTC exchanges on Binance have dropped considerably. In keeping with the info aggregator, Binance’s BTC alternate stability fell from a peak of 709,001 BTC on June 4th to 651,275 BTC on June twenty third, earlier than standing at 657,536 BTC as of July sixth. rose to

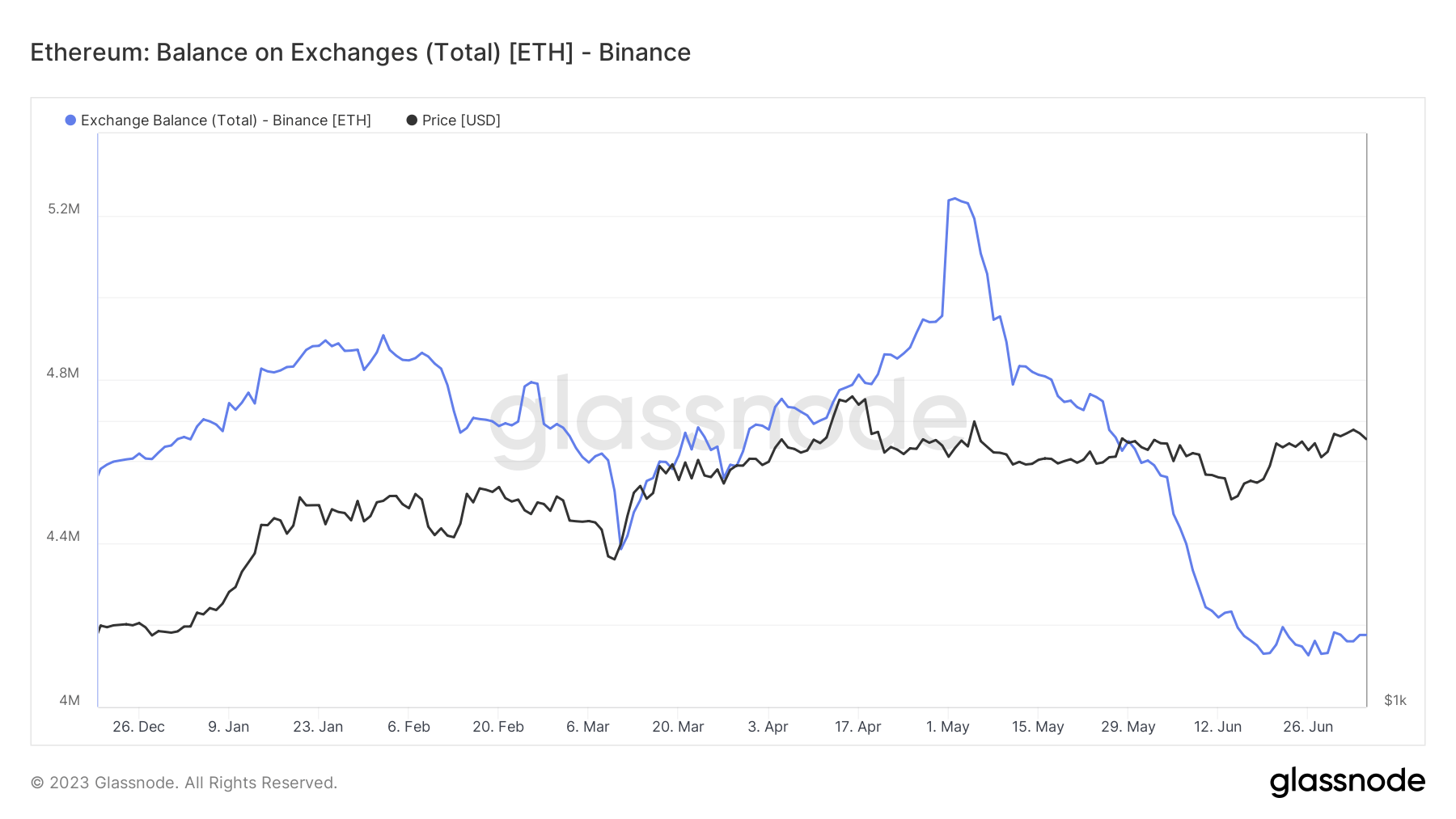

Ethereum deposits of alternate customers decreased by 4.4% from 4.35 million ETH held by customers on June 1 to 4.16 million ETH as of July 1. Which means that alternate customers have withdrawn about 200,000 ETH from the platform in 30 days.

In the meantime, Glassnode knowledge reveals that ETH balances on Binance have been trending downward since early Might, coinciding with a time when whole ETH holdings throughout all exchanges fell to their lowest stage in 5 years.

One other main crypto asset that noticed deposits decline over the previous month is Tether’s USDT. Binance’s stablecoin stability fell by 1.61 billion to fifteen.47 billion, a lower of 9.45%.

In the meantime, Binance’s BNB stability bucked the declining development in deposits, rising 6.6% to 29.7 million BNB as of July 1. Different belongings which have recorded deposit progress embody Ripple’s XRP, USD Coin (USDC) and others.

Binance Regulatory Points

In June, Binance confronted vital regulatory hurdles in a number of jurisdictions. America, European international locations and Nigeria have stepped up surveillance of alternate exercise.

The U.S. Securities and Alternate Fee (SEC) has accused Binance of violating federal securities legal guidelines in its operations, including that the alternate was providing cryptocurrency tokens to Individuals.

Binance has pledged to contest these allegations, however CEO Changpeng ‘CZ’ Zhao has characterised the lawsuit as greater than only a company authorized battle, stating that the broader cryptocurrency trade has been criticized. I see it as an assault.

The alternate has misplaced its euro clearing companions in Europe and pulled out of a number of regional markets, together with Austria, the Netherlands, Cyprus and Germany. Throughout these departures, French authorities raided alternate places of work in France, and a suspension order was issued towards alternate places of work in Belgium.

Regardless of these points, a Binance spokesperson stated: crypto slate The corporate stated its focus was on guaranteeing compliance with Europe’s upcoming Crypto Asset Market (MiCA) laws.

Comments are closed.