Bitcoin (BTC) miners bought a considerable quantity of the bitcoins they mined in June to fund their operations, based on Glassnode knowledge analyzed by . crypto slate.

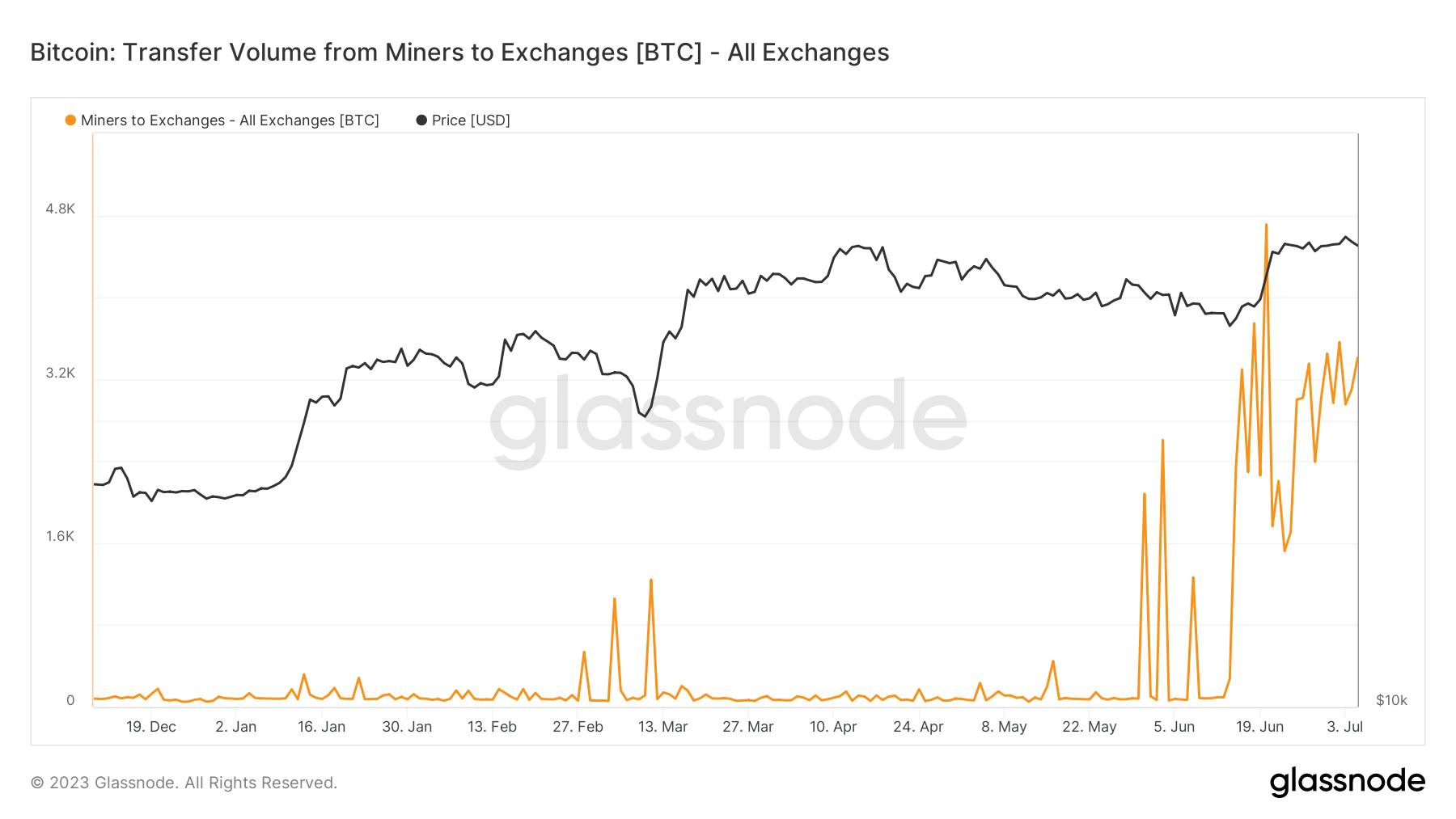

In keeping with the chart under, miner change flows peaked at 4,710 BTC on June twentieth, the best fee in 5 years. Different days of the month additionally noticed vital spikes, with buying and selling volumes to exchanges averaging over 2000 BTC.

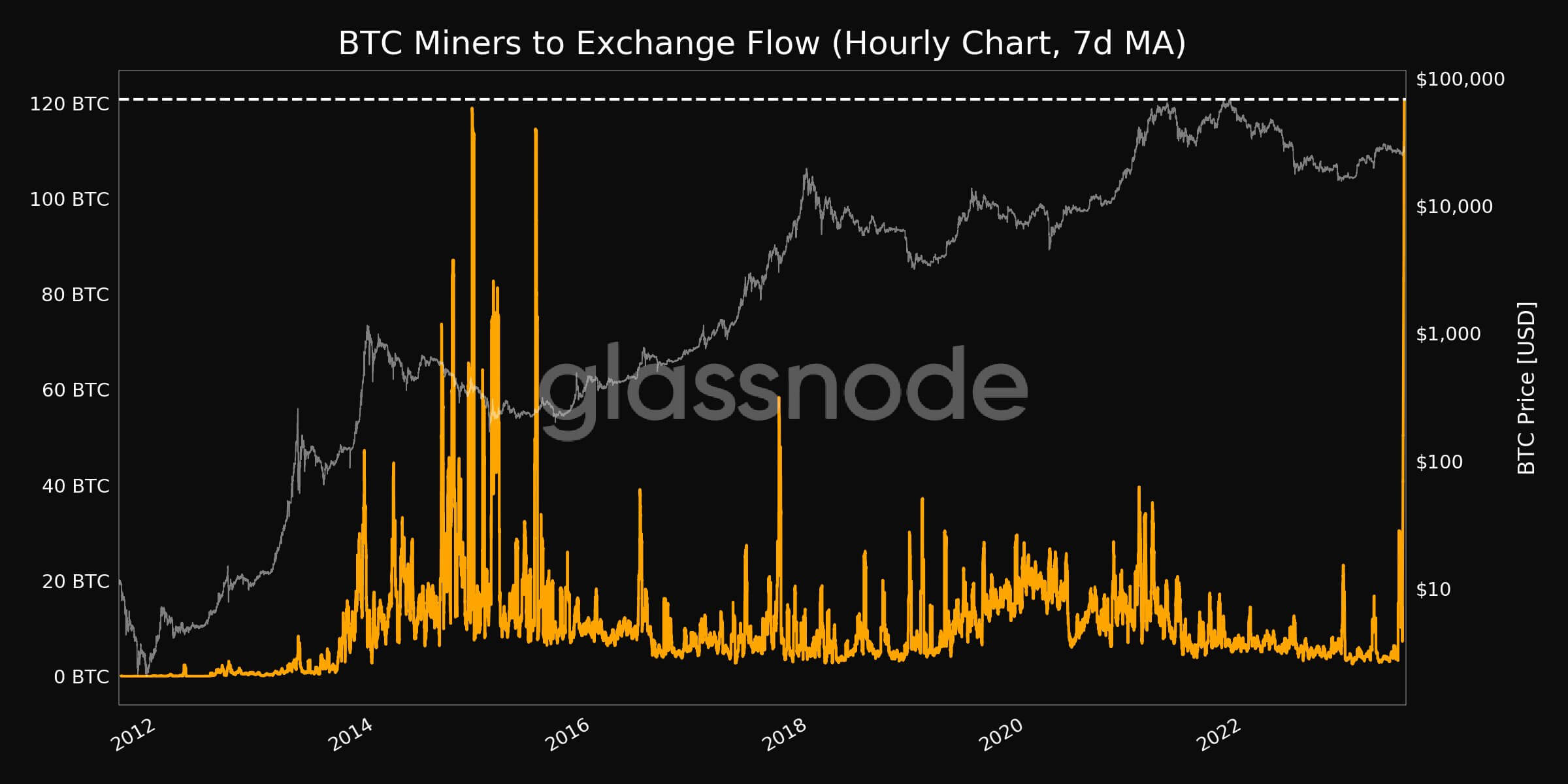

glass node mentioned 7-day shifting common hourly circulation from m tointerior To echange reached 120.77 BTC, one of many highest ranges since 2015.

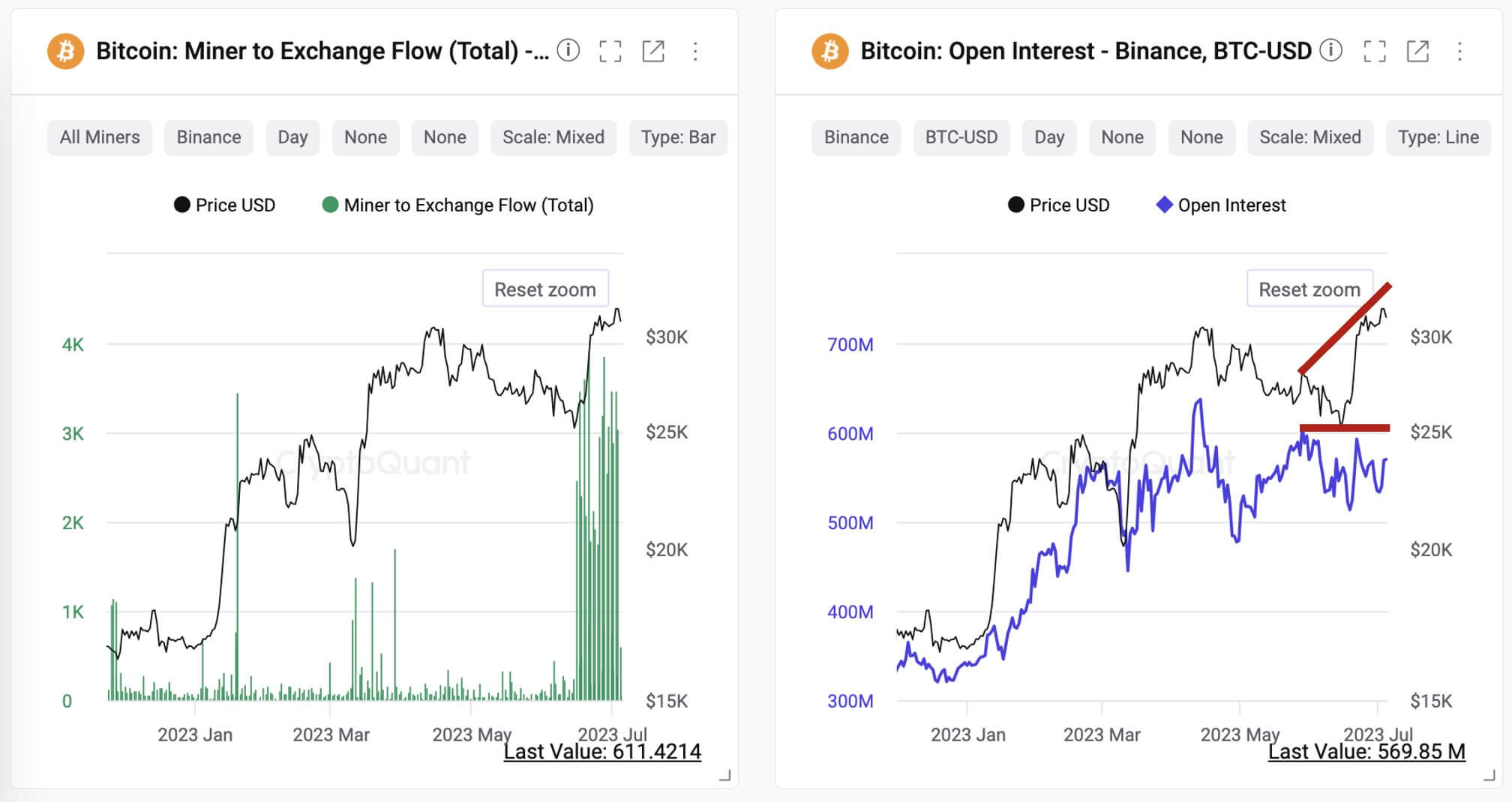

July 4, CryptoQuant CEO Ki Younger Ju Mentioned Over the previous three weeks, miners have transferred over 54,000 BTC to Binance. “BTC-USD open curiosity has not modified considerably, suggesting that it’s unlikely to fill collateral to punt new lengthy positions,” mentioned Ju.

Mr Ju added:

“There appears to be a excessive risk of spot promoting.”

In a not too long ago launched operational replace, bitcoin miners Marathon Digital, Cleanspark and Hut8 confirmed these transactions.

Marathon Digital introduced in a press assertion on July 6 that it had bought 700 BTC, or 71.5% of the 979 BTC mined in June, for an undisclosed quantity. Rival Hut8 bought 217 BTC, 100% of its manufacturing in Might, and 70 BTC in June for $7.9 million.

In the meantime, Cleanspark bought 84% of the 491 BTC it mined in June for $11.2 million, based on a July 3 assertion.

These buying and selling actions recommend that miners wished to capitalize on BTC’s current worth surge to safe earnings. In June, BTC principally traded above $25,000 and peaked at $31,268 after a number of conventional monetary establishments, together with BlackRock, filed for Bitcoin ETFs.

Submit-Bitcoin miners profited from the June worth surge, promoting hundreds of BTC and first showing on currencyjournals.

Comments are closed.