In a July 10 letter, cryptocurrency supervisor Grayscale questioned the US Securities and Alternate Fee’s resolution to approve a leveraged Bitcoin (BTC) exchange-traded fund (ETF).

The corporate’s Bitcoin Belief (GBTC) has additionally shrunk to its lowest since Could 2022, in keeping with ycharts knowledge.

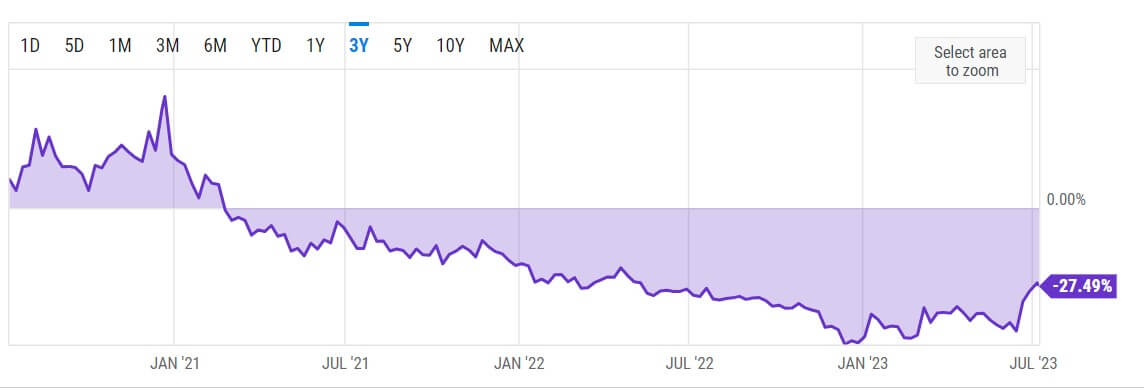

GBTC low cost narrows

GBTC’s low cost to web asset worth (NAV) has shrunk to 27.49%, and the inventory is buying and selling close to $20, in keeping with ycharts knowledge.

Over the previous few weeks, GBTC’s low cost charge has shrunk and its share worth has outperformed Bitcoin’s worth. For context, GBTC inventory has risen practically 43% over the previous month, whereas BTC’s worth has risen solely 17% over the identical interval. of crypto slate knowledge.

Market gamers attributed GBTC’s improved efficiency to BlackRock’s submitting of a Bitcoin spot ETF. Because the asset supervisor utilized for a spot BTC ETF on June 15, different conventional monetary establishments, together with Constancy, have additionally utilized for comparable ETFs.

SEC Doubts Over BTC Leveraged ETFs In Grayscale

tenth july, grayscale criticized The SEC’s actions within the US monetary regulator’s resolution to approve leveraged BTC ETFs (funding funds that search to extend income via the usage of monetary derivatives and debt) show that the SEC is appearing arbitrarily. claimed to be.

The corporate wrote:

“The 2x Leveraged Bitcoin Futures ETF employs leverage with the objective of doubling the efficiency of the S&P CME Bitcoin Futures Day by day Roll Index day-after-day. You may be uncovered to an funding product that’s even riskier than the product.”

Grayscale mentioned the joy generated by this leveraged BTC ETF wasWhat buyers are anticipating BTC Keep away from dangers with ETF wrapper safety. ”

The agency added that there isn’t any legitimate cause for the SEC to approve leveraged futures merchandise whereas denying approval of spot merchandise.

Final yr, the SEC rejected Grayscale’s plan to transform Bitcoin Belief into an ETF, and the corporate filed a lawsuit towards the SEC, arguing {that a} spot ETF could be no totally different than a futures ETF beforehand accepted by the SEC. pressured to get up.

Submit-Grayscale, which disputes the SEC’s resolution on a leveraged Bitcoin ETF, made its first look on currencyjournals as GBTC’s low cost unfold narrows.

(tag translation) bitcoin