Broff is worried that bitcoin’s value stage holding above $30,000 will see a noticeable shift in market conduct, particularly for short-term holders.

Quick-term holders (STH), i.e. holders who’ve held Bitcoin for lower than 155 days, play an vital function in market evaluation. Their actions usually present perception into market sentiment and potential value actions.

They’re normally extra delicate to cost modifications and have a tendency to purchase and promote primarily based on latest market actions. This could result in elevated volatility as their buying and selling exercise may cause sharp value actions.

For instance, when short-term holders begin to maintain, sell-side strain available in the market will be eased, making the worth atmosphere extra steady.

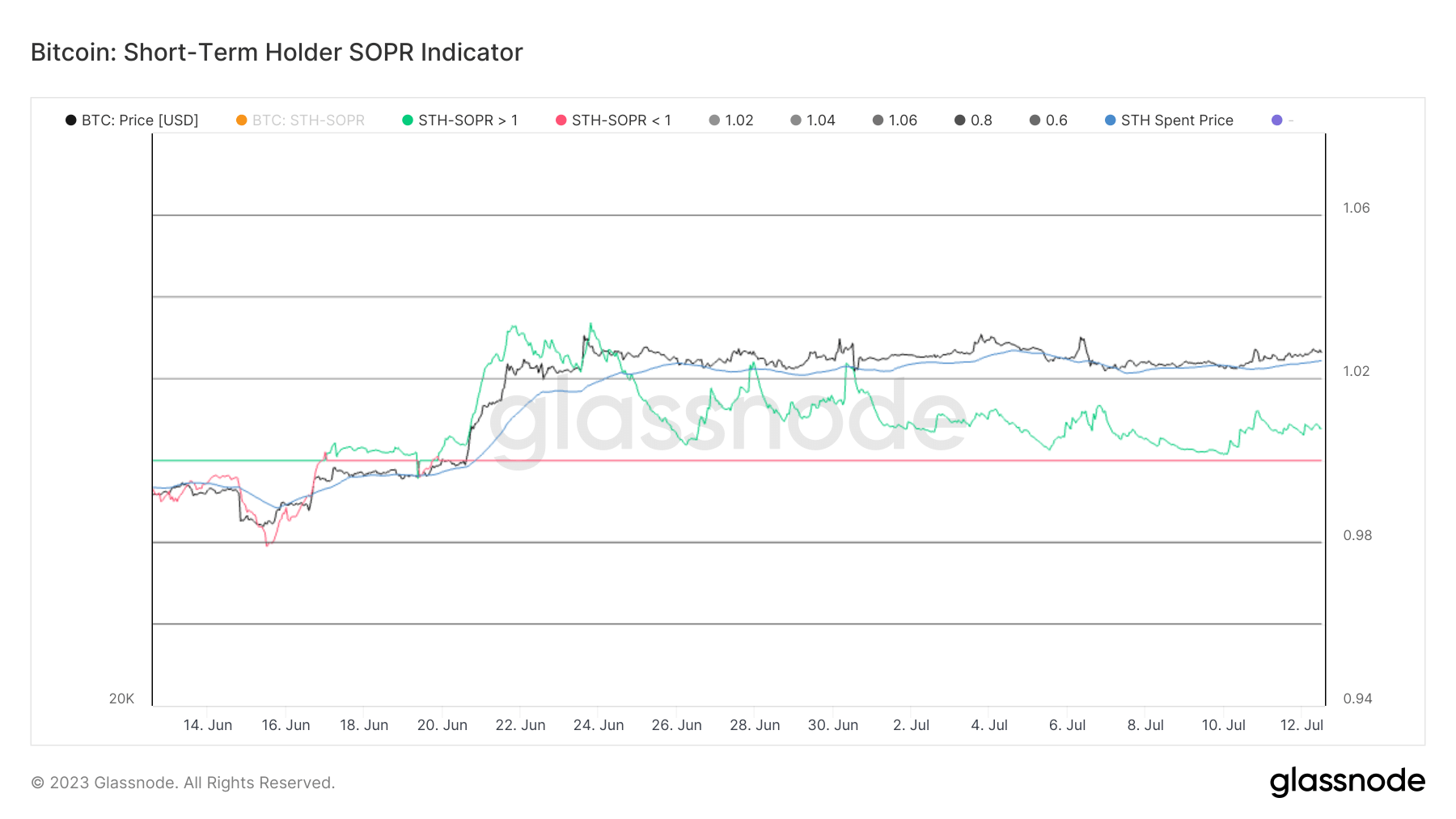

With the latest Bitcoin value leap from $26,000 to over $30,000, STH is generally worthwhile. That is evident from the short-term holders return on expenditure (STH-SOPR) indicator. SOPR is a metric that calculates revenue margins for cash moved on-chain, offering perception into whether or not holders are promoting at a revenue or at a loss. STH-SOPR has a transparent give attention to short-term holders.

Since June twentieth, STH-SOPR has been trending above 1, indicating that short-term holders are on common shifting their cash to make income. This indicator he peaked at 1.033 on June twenty first after which trended downward, reaching 1.006 on July eleventh. This implies that STH remains to be worthwhile, however margins are declining.

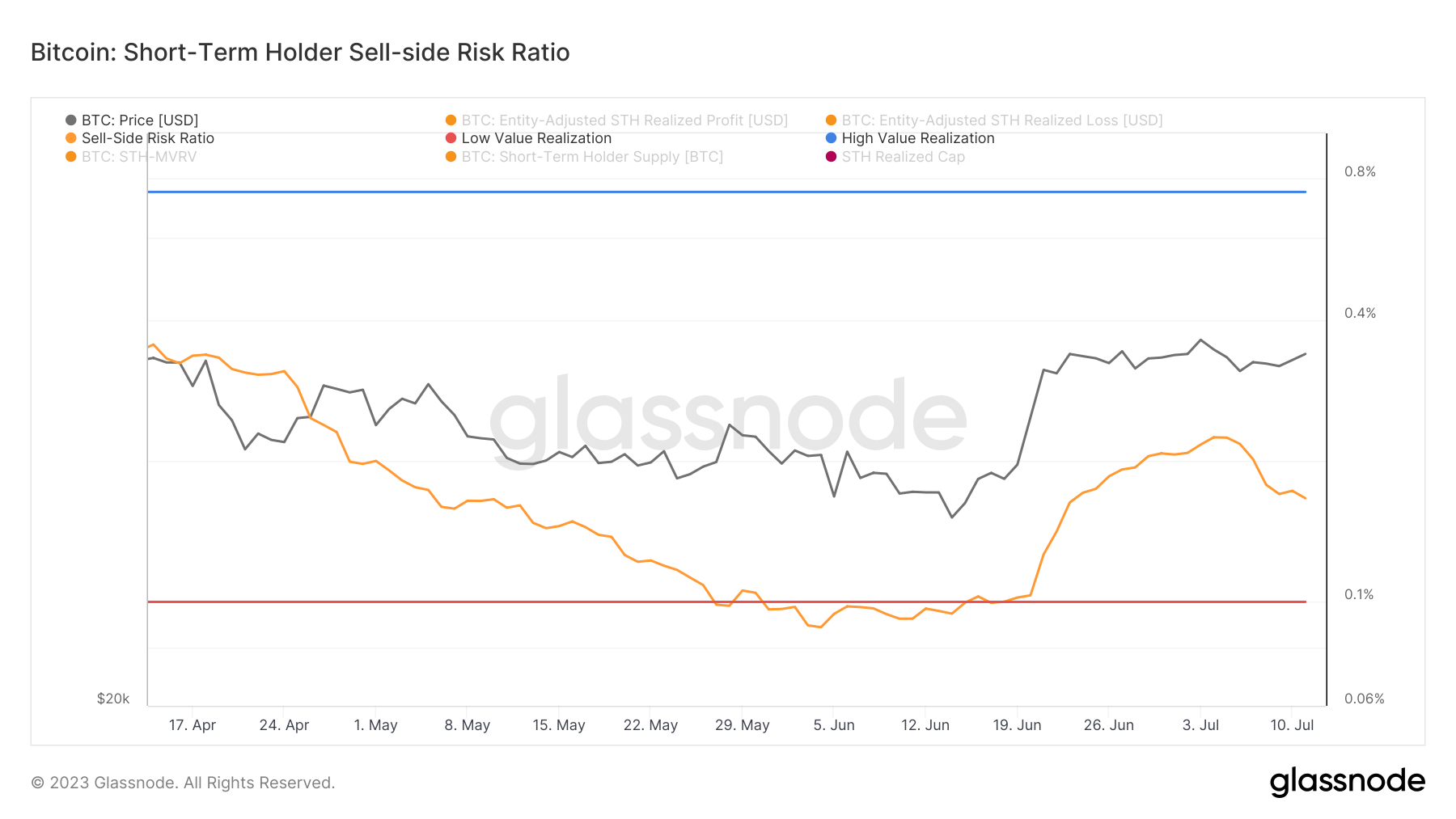

In the meantime, information from on-chain market analytics platform Glassnode reveals that the sell-side danger ratio for short-term holders is declining. The sell-side danger ratio quantifies the mixture sell-side danger available in the market by evaluating the full USD spent by buyers every day to the full realized capital of short-term holders. Larger values sometimes point out aggressive revenue taking, whereas decrease values coincide with a market consolidation section or bear market.

The ratio began rising on June twenty first and peaked on July fifth. Since then, the ratio has fallen sharply, indicating a decline in sell-side strain from short-term holders.

Combining these two metrics paints an attention-grabbing image. Whereas revenue margins for short-term holders are falling, so too are sell-side pressures. This might recommend that short-term holders are selecting to carry on to bitcoin regardless that income are dwindling.

This motion might stabilize the market and lay a stable basis for future value will increase.

The put up Why short-term holders are holding with out taking income? First appeared on currencyjournals.

Comments are closed.