necessary level

- Ether has considerably underperformed Bitcoin for the reason that merge started in September

- That is regardless of the drop in Ethereum provide after the merger.

- Extra Ether Is Additionally Staking Since April’s Shapella Improve

- However relating to Bitcoin, demand is declining, outpacing provide decline

- Regulatory crackdown and rising institutional curiosity in Bitcoin seem to drive divergence, writes our head of analysis

One of many extra attention-grabbing traits to observe inside cryptocurrencies is the ETH/BTC chart. In different phrases, how his two largest cryptocurrencies on the planet carry out in opposition to one another. Ten months after the Ethereum merger, he feels it’s a good time to reanalyze the connection.

Merge utterly reworked Ethereum, switching the community to a proof-of-stake mechanism as an alternative of the earlier proof-of-work mechanism. Alternatively, Bitcoin is (and can all the time be) a proof-of-work blockchain.

Which means the underlying basis of the Ethereum community has been flipped. Maybe that is most noticeable when plotting the full circulating provide of ETH. Merge is because of go dwell in September 2022, however since that date the provision has been (barely) lowered, which may be very troubling.

Zooming in on the post-merger interval within the chart under exhibits the contraction. Provide is declining at a median price of 0.15% per 30 days. Earlier than the merger, provide elevated by 0.41% per 30 days.

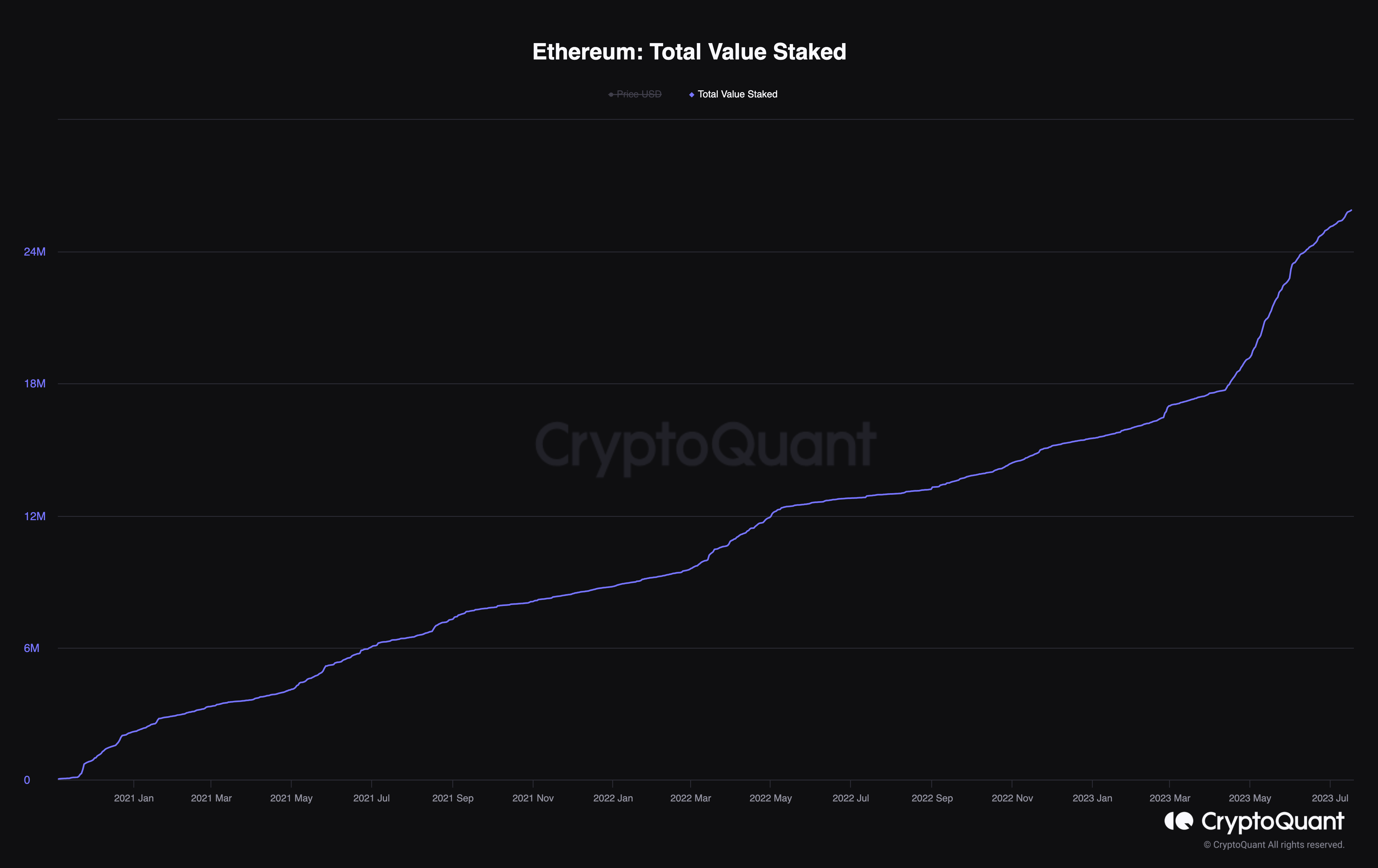

Moreover, the liquid ether provide is shrinking even additional than the graph above suggests. Wanting on the whole quantity of Ether staked, the sample has been comparatively secure for the reason that staking contract launched in November 2020. This pattern continued kind of after the merge was launched in his September 2022. Nonetheless, as will be seen within the following graph, the quantity of Ether staked has skyrocketed particularly since he launched the Shapella improve in April of this yr.

Also called Shanghai, this improve to Chapela lastly noticed staked Ether on the market, with some early stakers locking up their tokens for the reason that fourth quarter of 2020. Regardless of fears that this might flood the market with enormous quantities of Ether and result in a dent out there, the other is occurring in worth. With the indefinite lockup restrict not an element, Ether stakes skyrocketed considerably, and the pattern has surged additional within the three months since.

However how has this structural failure on the provision aspect affected Ether’s efficiency relative to Bitcoin? Much less provide means larger costs, proper? No, probably not. As plotted within the chart under, ETH has fallen relative to Bitcoin nearly 10 cents for the reason that merge started (the black line marks his September merge).

The explanation, after all, is that costs are pushed by provide and demand, not simply provide. And whereas provide has shrunk, the demand aspect has been unsustainable, not less than in comparison with Bitcoin.

Ether underperforms Bitcoin

Two months after the merger, FTX collapsed, throwing the whole cryptocurrency sector into chaos. As is usually the case when costs fall, Bitcoin’s losses had been smaller than the remainder of the market. Subsequently, it’s not stunning that Ether will fall in opposition to Bitcoin within the aftermath of the crash.

Thus far in 2023, nonetheless, the cryptocurrency market has been in a frenzy, with token costs accelerating throughout the board amid a softening macro surroundings amid declining inflation. The Nasdaq is up 32% within the first six months of the yr, its greatest half-year return since 1983. Nonetheless, regardless that the cryptocurrency market is using this wave, Ether has fallen additional in opposition to Bitcoin, seemingly bucking the pattern.

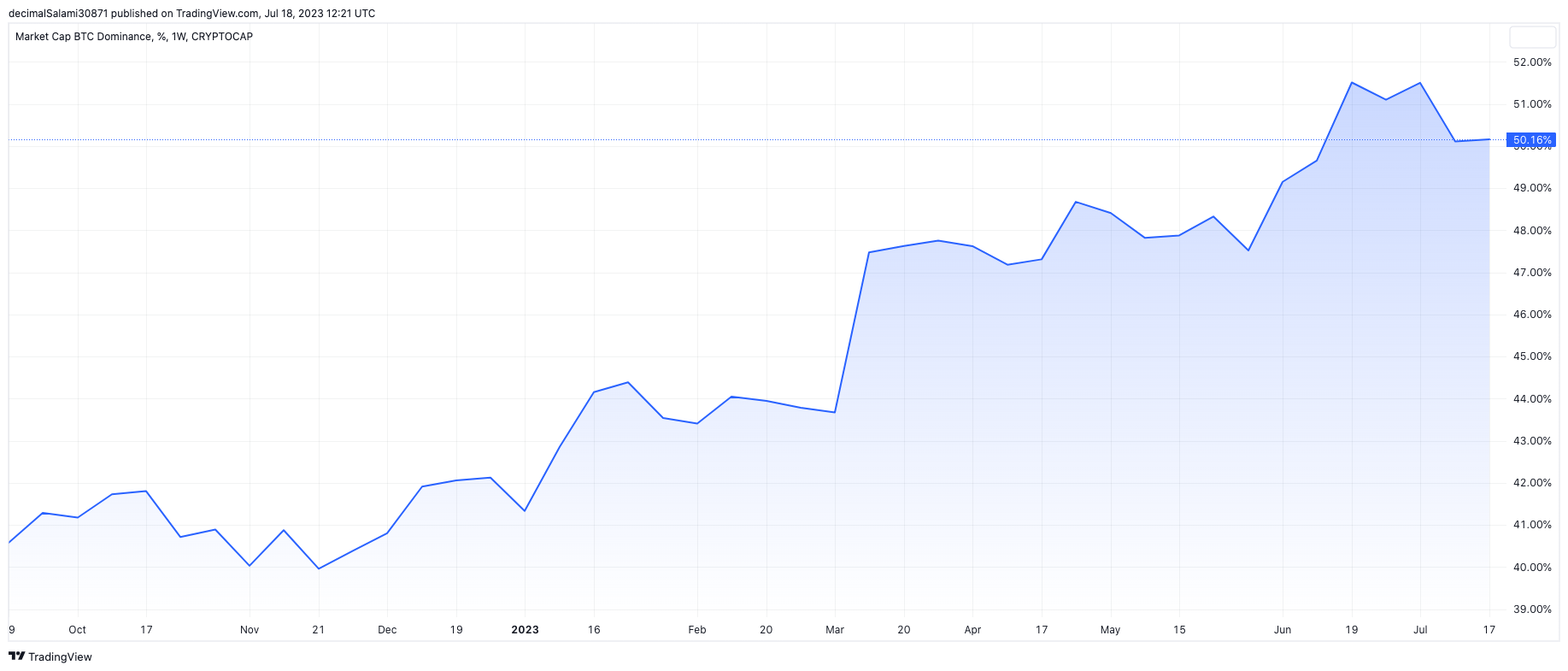

The reason being most likely regulation. A large regulatory crackdown within the US has been brutal in opposition to cryptocurrencies, however bitcoin has not obtained as a lot head-on consideration as many markets. This raised Bitcoin’s dominance to the very best degree. Highest degree in 2 years, which presently accounts for greater than 50% of the full cryptocurrency market capitalization. Initially of the yr, it was 42% (it was additionally round this degree on the time of the Ethereum merger in September).

This was carried out within the sentiment that Bitcoin might carve out its personal area of interest within the house. This can be a view that many within the area have lengthy held (and a vowed perception of Bitcoin maximalists), however the distinction now could be that the legislation appears to be shifting in direction of the identical view. Let Coinbase CEO Brian Armstong put it extra succinctly than I do.

“Return to 2021. We wished to be a public firm, so we defined all the pieces about our enterprise, the belongings we listed on our platform, how we staked. allowed to turn into

“[From about a year ago]a very totally different tone began to occur.” Mr. Armstrong continued. “Now we have obtained info from the SEC that, in truth, something apart from Bitcoin is a safety.”

Ether was not included within the record of tokens that make up the securities launched by the SEC, though that record additionally included different widespread cryptocurrencies reminiscent of MATIC, SOL and ATOM. It wasn’t unaffected. Although kind of thought of a grey space, Ether continues to endure from regulatory blows and is in hassle. Final week’s XRP ruling was optimistic for the sector, and whereas there will likely be extra twists and turns to come back, it nonetheless seems like Bitcoin has lower itself off from the group.

Various Bitcoin ETFs submitted for approval by the world’s largest asset managers, together with BlackRock, have additional strengthened this view. Repeatedly denied, the presence of massive firms backing Bitcoin on this stifling US authorized surroundings is one other boon for Orangecoin. And when you can (accurately) hypothesize that Bitcoin ETFs will make Ether ETFs extra probably, there is not any denying that Bitcoin has much more of an edge within the competitors.

This places Bitcoin forward of Ether in 2023, which appears stunning provided that the latter has tended to outperform the previous throughout earlier worth expansions. improve. Nonetheless, it’s all the time necessary to recollect how quick the transaction historical past of Ether and Bitcoin is. Ether simply launched in his 2015 and it took a couple of extra years earlier than it traded with actual liquidity. So counting on previous efficiency ought to all the time be carried out with a pinch of salt. As well as, the cryptocurrency market has by no means skilled macro surroundings.

Lastly, expectations that the merge would speed up Ether into the stratosphere could have missed how a lot cash was priced into the improve. It has been in improvement for a very long time and has been postponed many occasions earlier than lastly being realized after which deprecated.

All in all, this places Ether behind Bitcoin, giving the latter an edge over not solely Ether however the cryptocurrency market as a complete. Issues are altering quick within the cryptocurrency trade, and Bitcoin has weathered the tough waters higher than altcoins in current months, thanks largely to the authorized surroundings.

Once more, Ether traders cannot be too pissed off when worth developments. Ether remains to be up 57% up to now this yr regardless of successful the second medal. Even if you happen to endorse the fallacious horse, it may be worse.

(Tag Translation) Analysis

Comments are closed.