- AVAX has been dominated by bear claws for the previous seven days.

- AVAX is oscillating inside a widening descending wedge and will breakout quickly.

- There may be resistance forward of AVAX, but when it’s a conventional bullish wedge, AVAX may surge.

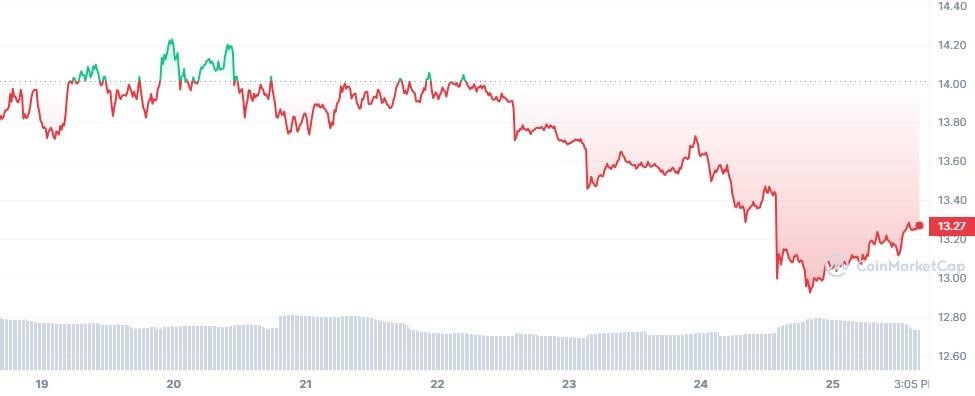

Final week, Avalanche was dominated by bears. For the primary 4 days of the week, AVAX was buying and selling within the pink zone just under the opening value of $14.108. There have been a number of short-term exits from the pink zone earlier than falling beneath the opening value. Nevertheless, over the previous week, AVAX has hit a brand new all-time excessive of $14.22.

AVAX/USD 7-day chart (Supply: CoinMarketCap)

The chart above exhibits AVAX making decrease highs halfway by means of the fourth day. It continued to make decrease highs till the start of the seventh day, reaching a low of $12.93. Nevertheless, after reaching a low, AVAX has began to rise once more and is now at $13.27 after gaining 1.08% in 24 hours.

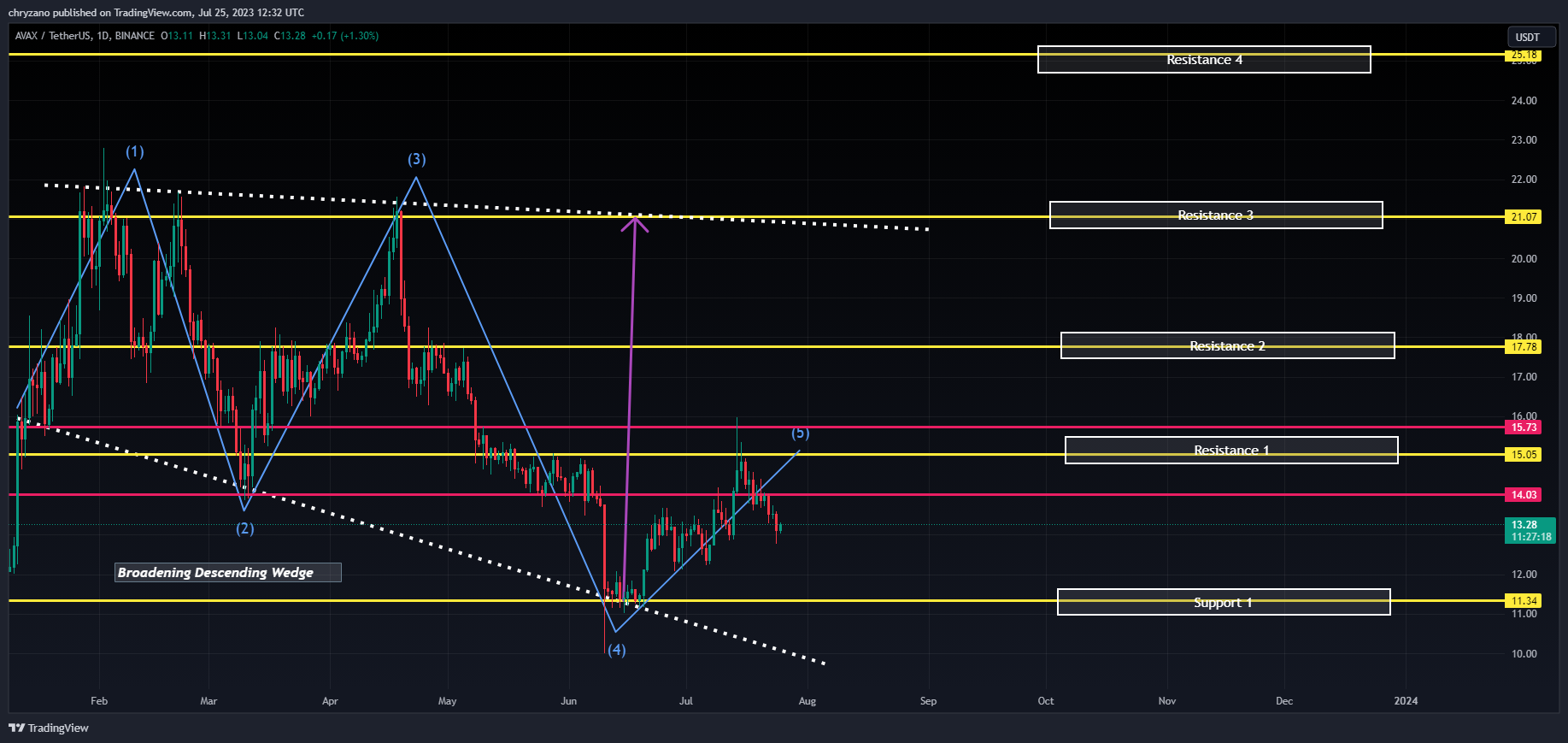

AVAX/USDT 1-day chart (Supply: Tradingview)

Wanting on the chart above, we will see that AVAX is oscillating inside an increasing descending wedge. The highest trendline exhibits a big divergence from the horizontal axis, whereas the underside trendline exhibits a big angle, with AVAX making decrease lows.

If it is a conventional widening descending wedge, we will count on AVAX to succeed in the higher trendline near resistance 3 at $21. Nonetheless, AVAX appears to be trending down just lately, so it’s more likely to attain help 1 at $11.3. Nevertheless, if AVAX breaks help 1, it is going to be pressured to depend on the decrease trendline to maintain this sample.

If AVAX surges, we would discover resistance first within the pink line the place part (2) meets the decrease trendline. Nevertheless, this could possibly be a superb entry for consumers. If AVAX breaks resistance 1 at $15, it may attain resistance 2 at $17. If the bull doesn’t retrieve, AVAX may see him attain resistance 3 at $21.

Disclaimer: As with all info shared on this value forecast, views and opinions are shared in good religion. Readers ought to do their analysis and due diligence. Readers are strictly liable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

Comments are closed.