The Bitcoin (BTC) and Ethereum (ETH) derivatives markets skilled vital volatility following the January 9 incident by which the U.S. Securities and Change Fee's (SEC) Twitter account was compromised. This false announcement of Spot Bitcoin ETF approval triggered a collection of market reactions that worn out over $50 billion in Bitcoin market capitalization.

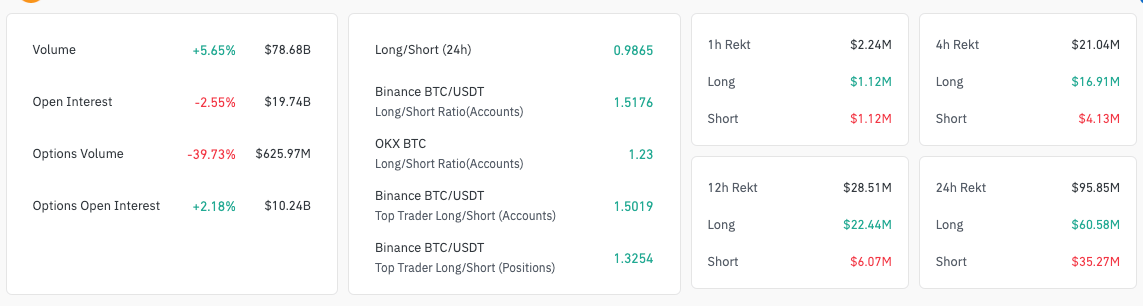

Derivatives markets have skilled unprecedented volatility. crypto slate Evaluation of CoinGlass knowledge confirmed that total buying and selling quantity elevated by 8.52% to $79.02 billion. This enhance in buying and selling exercise could replicate the market's fast response to pretend information, as merchants sought to reap the benefits of volatility or cut back danger.

Nonetheless, in distinction, open curiosity decreased by 2.78% to $19.69 billion. The decline in open curiosity, which represents the overall variety of excellent derivatives contracts, means that many merchants are selecting to shut positions amid uncertainty and cut back their publicity reasonably than take part in a extremely risky market. doing.

Bitcoin choices quantity decreased considerably by 39.73% to $625.97 million, however choice open curiosity elevated barely by 2.18% to $10.24 billion. This means that many merchants maintained their positions although choices contract buying and selling decreased. This can be on account of a technique of ready for market fluctuations or a perception in long-term tendencies which can be unaffected by short-term volatility.

The market noticed $95.41 million liquidated, with lengthy positions value $59.39 million and brief positions value $36.02 million. The continuing liquidation of lengthy positions suggests a bearish market response, with merchants who had wager on costs rising being caught off guard by the drop in costs after the ETF information unraveled.

Trying on the two largest exchanges based mostly on open curiosity, Binance and Bybit, each platforms have seen a rise in buying and selling volumes, indicating elevated exercise. The decline in open curiosity on these platforms additional confirms the tendency for merchants to decide on to shut positions in risky environments.

| image | value | Worth (24 hours%) | Quantity (24 hours) | Quantity (24h%) | Market capitalization | Open curiosity | Open curiosity (24h%) | Clearing (24 hours) |

|---|---|---|---|---|---|---|---|---|

| BTC | $44911.2 | -4.01% | $77.6 billion | +5.23% | $88.497 billion | $19.6 billion | -3.59% | $94.36 million |

| Ethereum | $2375.65 | +4.47% | $41.18 billion | +77.57% | $28.582 billion | $7.78 billion | +10.67% | $49.3 million |

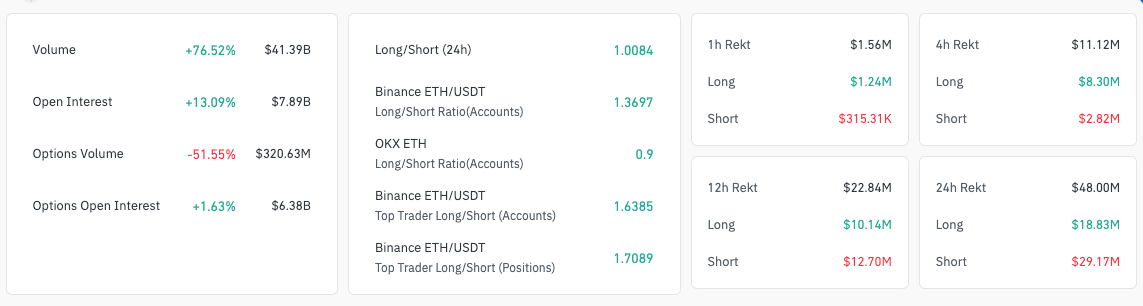

Once we take a look at the Ethereum derivatives market, the image is completely different. The whole buying and selling quantity of Ethereum derivatives elevated considerably by 79.85% to $41.3 billion. This huge enhance in buying and selling quantity is because of merchants pivoting to Ethereum amid the Bitcoin turmoil, or perceiving Ethereum as a safer or extra advantageous choice throughout this era of heightened market sensitivity. It’s thought of a factor.

Curiously, regardless of this spike in total buying and selling quantity, choices buying and selling quantity for Ethereum derivatives decreased considerably by 51.55% to $320.63 million. This distinction means that whereas buying and selling exercise has elevated total, there was a pullback within the choices market.

Merchants view futures contracts as a extra direct option to reap the benefits of or hedge market volatility than cope with the complexities of buying and selling choices in such unsure circumstances. , could have been extra inclined to work on futures contracts.

Ethereum's open curiosity additionally elevated by 11.52% to $7.81 billion, in distinction to the sample noticed for Bitcoin. This means new positions are being opened and, when mixed with elevated buying and selling quantity, suggests extra bullish sentiment within the Ethereum market, or no less than Ethereum turning into a extra steady asset within the face of market shocks. This implies that there’s.

The publish Ethereum Leads Bitcoin in Derivatives Buying and selling Quantity appeared first on currencyjournals.