- LUNC is buying and selling at $0.00012 after recovering considerably from its latest sell-off.

- A constructive divergence may push LUNC worth as much as $0.00014.

- Within the absence of consumers, LUNC might not dump again to the $0.00011 assist.

Terra Luna Traditional (LUNC) worth hit a low of $0.00011 on January third and lately reached $0.00013. This enhance represents a worth enhance of roughly 30%. Regardless of the run, LUNC was unable to carry the world.

Primarily based on information from CoinMarketCap, LUNC was buying and selling at $0.00012 on the time of writing. 10 days in the past, Coin Version reported how LUNC is attracting market consideration. In the meantime, the cryptocurrency confirmed indicators that it may break into the highest 50.

Nonetheless, press time information confirmed LUNC's market capitalization place at 89th place. When it comes to worth motion, the 4-hour chart confirmed {that a} descending channel sample is forming.

LUNC tries to breakout

From the chart beneath, the pattern line is beneath numerous assist ranges. On December twenty sixth, the bulls did not defend the assist at $0.00014. So the value went down. The assist then dropped to $0.00012 on January 4th. Costs fell once more.

However the subsequent drop to $0.00011 appeared just like the breakthrough LUNC wanted. Shopping for strain pushed the value as much as $0.00012. Furthermore, the sign from the sample urged that the value may rise quickly and as soon as once more he may attain $0.00014.

The RSI was additionally forming a constructive divergence by forming increased lows. If LUNC worth makes new lows, the bias is confirmed and will set off a breakout.

Nonetheless, RSI is simply one of many many indicators LUNC wants to realize its predictions. The Superior Oscillator (AO) indicator confirmed a detrimental studying.

This detrimental studying signifies that the 5-period MA will not be above the 34-period MA, suggesting bearish momentum. Nonetheless, the pattern may shortly reverse if shopping for momentum strengthens. If this occurs, LUNC may rise to $0.00014.

Then again, if there’s a lack of consumers, LUNC worth might proceed to hover round $0.00011.

Possible rise to $0.00014

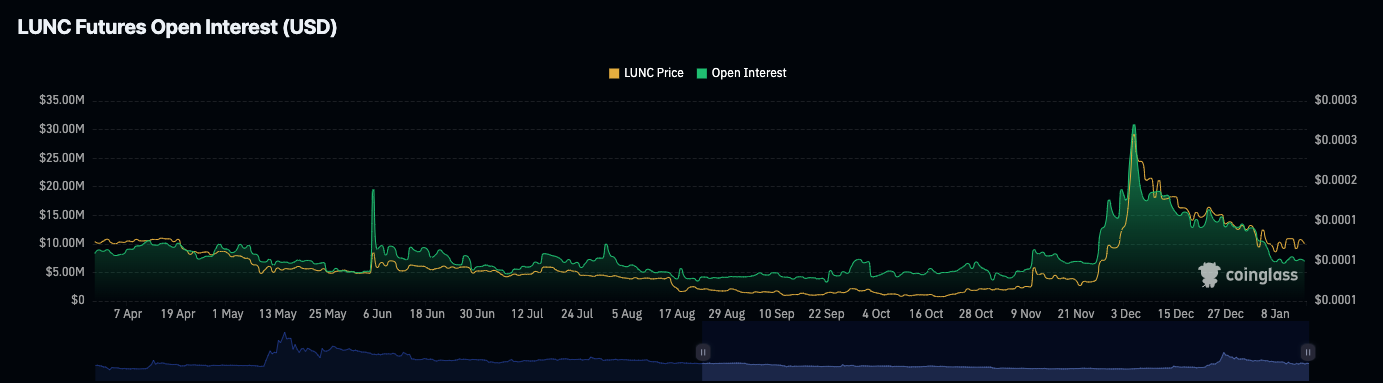

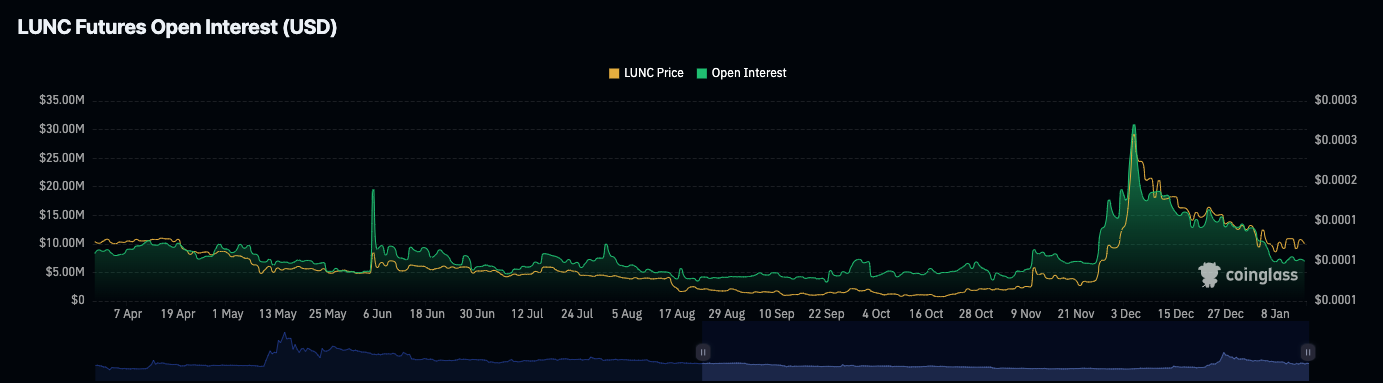

Coinglass information exhibits a major decline in open curiosity, and on the time of writing, LUNC's open curiosity had fallen to $6.9 million. By the tip of December 2023, it reached $20 million.

This decline means that market individuals are more and more closing out their web positions. Additionally, shorts with open positions have been extra aggressive than longs.

This discount in open curiosity may ship LUNC again to the $0.00014 resistance if shopping for strain will increase. Nonetheless, if the shopping for strain doesn’t strengthen, the value may break into the $0.00011 assist.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.