Greater than 650,000 staked Ethereum models value roughly $1.6 billion had been redeemed final week, the biggest redemption quantity for the reason that Shanghai Improve was accomplished final 12 months.

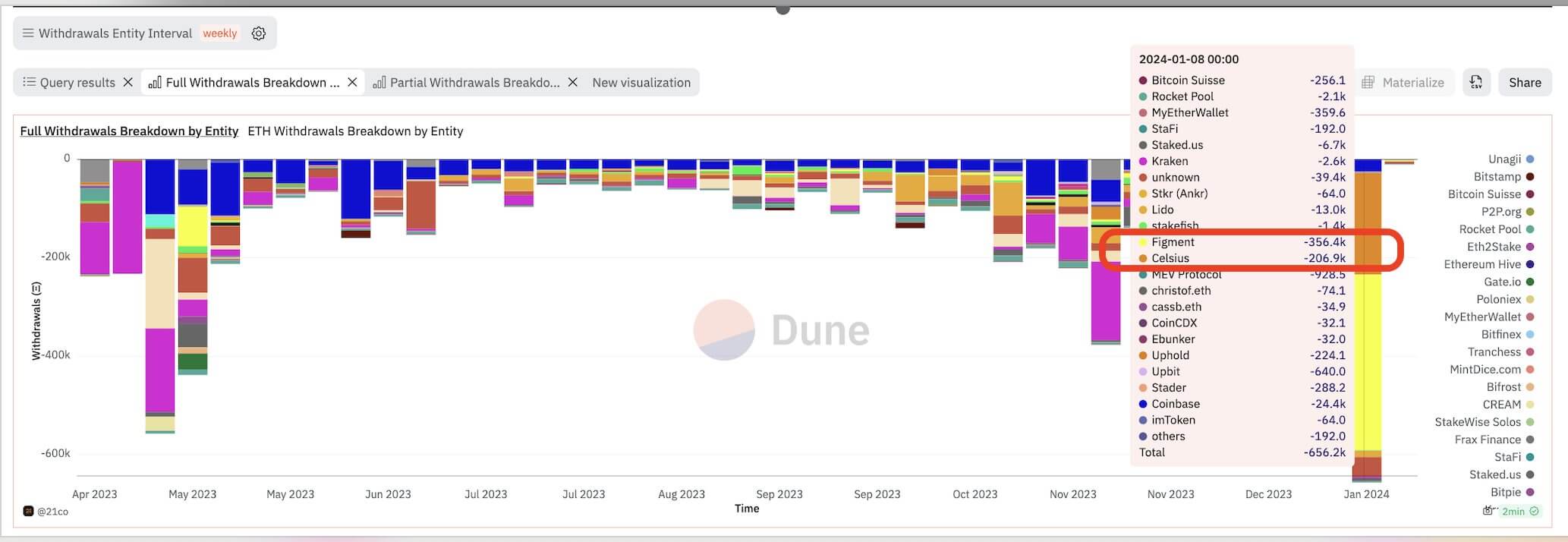

A Dune Analytics dashboard shared by 21 Shares analyst Tom Wan exhibits that bankrupt crypto financier Celsior and staking service supplier Figment are the principle contributors to this important redemption spike. I did. They coordinated withdrawals of a complete of 563,300 staked ETH, accounting for his 85% of the overall redemption quantity through the reporting interval.

crypto slate highlighted the function of those firms in driving Ethereum's validator exit to an all-time excessive of over 16,000 validators on January fifth. On the time, the 2 firms had been planning to take away greater than 550,000 validators, which accounted for about 75% of the overall withdrawals within the queue. I staked Ethereum.

Celsius beforehand revealed plans to de-stake 206,300 ETH, value roughly $470 million, as a part of its chapter proceedings. The failed financier stated the withdrawals could be used to facilitate the distribution of belongings to collectors.

In the meantime, Figment additionally made massive withdrawals of over 350,000 staked ETH on behalf of its clients.

Following these massive withdrawals, the overall quantity of Ethereum staked now stands at 28.9 million, in accordance with Nansen’s Ethereum Shanghai (Shappera) Improve Dashboard.

ETH value is just not affected

Staked Ethereum withdrawal exercise has been buoyed by ETH's value efficiency over the previous week, as the worth of the digital asset rose by round 12% to a peak of $2,700, its highest since Could 2022. It had no destructive results.

Strategies that the U.S. Securities and Alternate Fee could approve a spot Ethereum exchange-traded fund (ETF), following the same approval given to a Bitcoin ETF, contributed to this value improve.

Larry Fink, CEO of asset administration agency BlackRock, added to his optimism by saying in an interview with CNBC that “there may be worth in having an Ethereum ETF.”

In response to Polymarket knowledge, round 55% of bets on the platform anticipate approval of the Ethereum ETF by the top of Could.