The interval main as much as the launch of the ETF was characterised by an increase in Bitcoin costs. And the launch of the primary U.S. spot ETF did not create the huge bull market that many had hoped for. It confirmed how essential regional markets are in driving international costs.

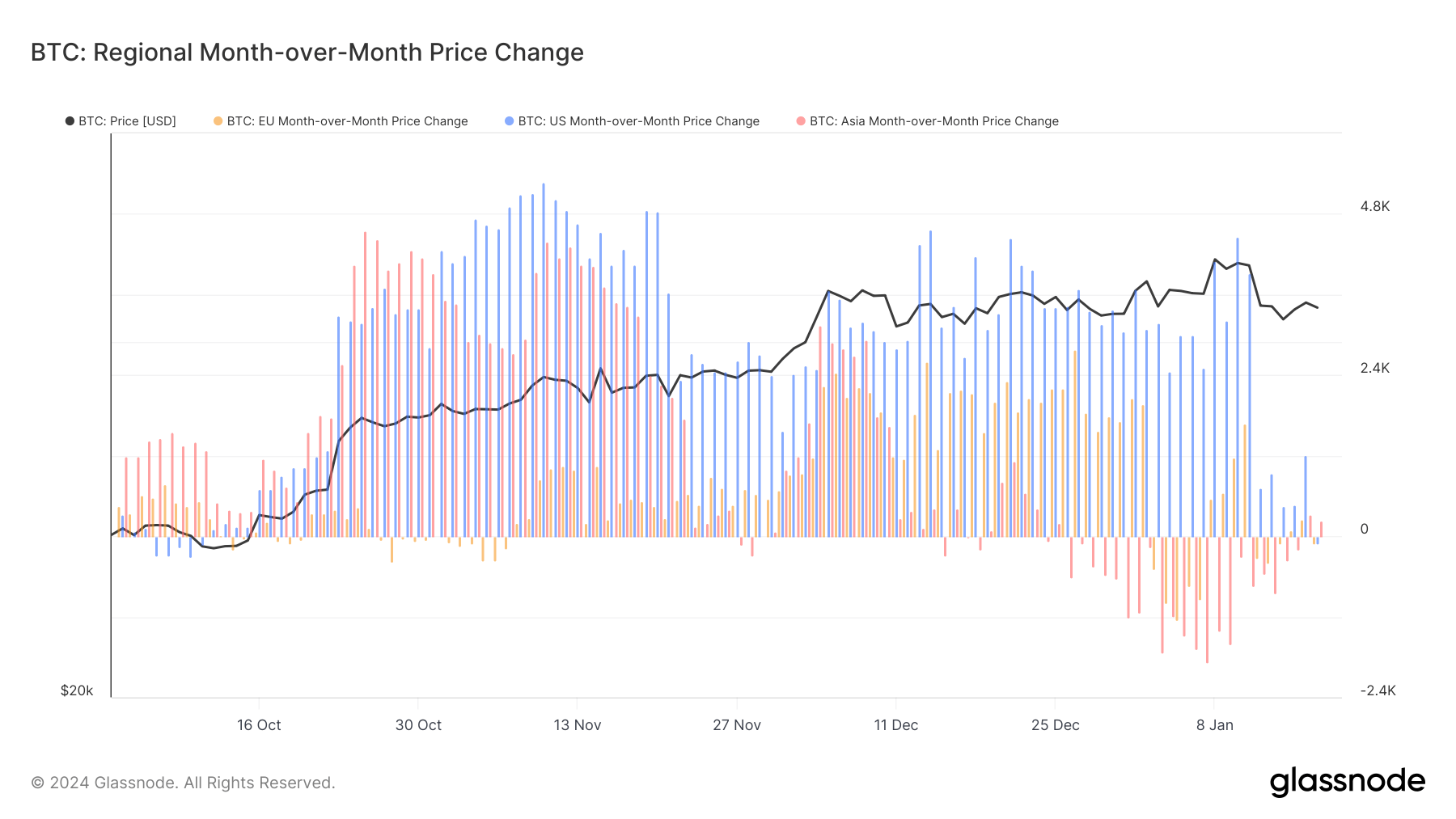

Particularly, Glassnode's information on regional month-over-month value modifications reveals that the US market skilled the very best charge of value development in comparison with Asia and the EU. This means that curiosity in Bitcoin is rising amongst US buyers, maybe because of expectations for ETFs. ' introduction.

This elevated regional focus is essential because it highlights how localized elements corresponding to regulatory modifications or the launch of recent monetary merchandise can have a big impression available on the market. .

The US market performs an essential function within the international monetary system and subsequently has a big impression on international Bitcoin costs. Dwelling to many influential buyers and a serious hub for technological and monetary innovation, developments in the US typically form international market sentiment. Moreover, the US greenback's standing because the world's major reserve forex implies that US monetary developments, together with the crypto sector, have broader international implications.

Traditionally, the launch of recent funding automobiles like ETFs has generated bullish sentiment, particularly within the area the place the ETF was launched, as they provide a extra regulated and probably safer method to put money into cryptocurrencies. could also be produced.

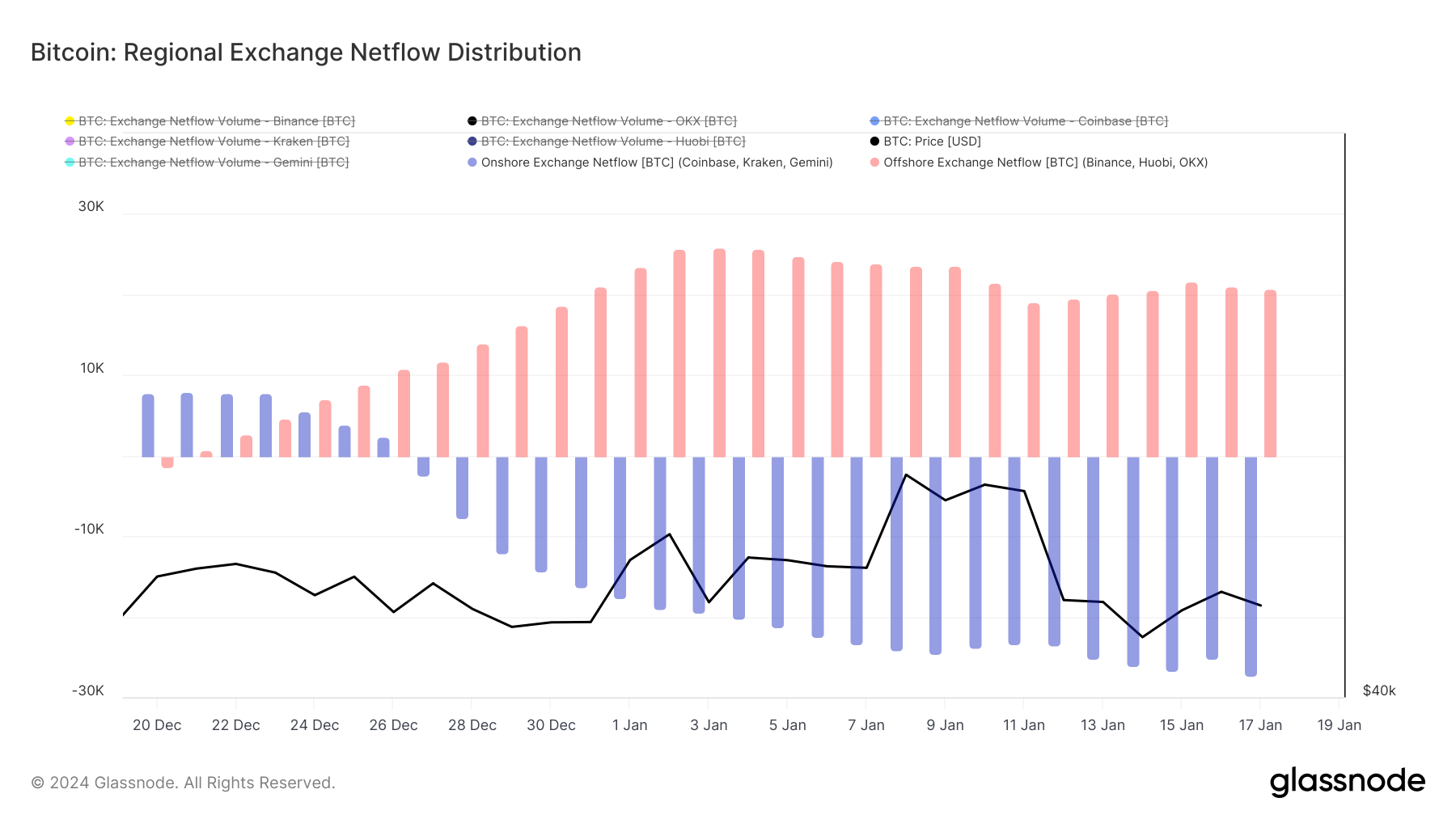

Additional help for this speculation is an evaluation of the change's web move distribution. It’s a measure of the quantity of Bitcoin getting into and exiting exchanges, and reveals a constant sample of Bitcoin outflows from US-based exchanges corresponding to Coinbase, Kraken, and Gemini. These outflows elevated from late December 2023 and reached their peak on January 17, 2024.

This transfer, with Bitcoin transferring away from exchanges and into particular person wallets and certain long-term holdings, indicators a strategic shift by U.S. buyers towards holding Bitcoin in anticipation of the launch of an ETF. Suggests. Such modifications will naturally cut back the availability of liquidity on exchanges and create upward stress on costs.

The worth drop from $46,944 to $42,730 after the ETF launch reveals the market's response to the belief of the long-awaited occasion. Reflecting the adage “purchase the rumor, promote the information,” any such value correction shouldn’t be unusual in monetary markets following a rise in main occasions.

Glassnode information demonstrated the numerous impression of the US market on Bitcoin value development within the months main as much as the launch of the US Spot Bitcoin ETF. Given these findings, it will likely be attention-grabbing to look at how the American market continues to form international crypto tendencies sooner or later. This additional confirms that constructive sentiment in native markets can have spillover results in international markets, influenced by favorable regulatory information and broader monetary market tendencies.

The put up How Rising US Curiosity Formed Bitcoin Costs Forward of ETFs appeared first on currencyjournals.