- Analysts suggested contributors to purchase the dip in Bitcoin and altcoins.

- BTC's dominance declined, hinting at a possible rally for altcoins.

- Bitcoin is prone to proceed buying and selling sideways as bulls and bears stay on the sidelines.

Cryptocurrency analyst Michael Van de Poppe posted {that a} main correction in altcoins might be a possibility to compound the decline. Van de Poppe mentioned in a publish on January twenty fourth.

He mentioned the present unfavourable sentiment available in the market shouldn’t be seen as an indication of a lack of confidence. The truth is, he opined that it could be the most effective time to save lots of up for the subsequent rally.

The identical analyst additionally talked about Bitcoin (BTC) in one other publish. Based on him, BTC is within the closing levels of a correction as volatility is lowering.

Nonetheless, he mentioned the coin worth might nonetheless fall to $36,000, however famous {that a} rally might happen earlier than the halving.

On January twenty fourth, Coin Version reported that one other analyst indicated that BTC could not attain $46,000 till after the halving.

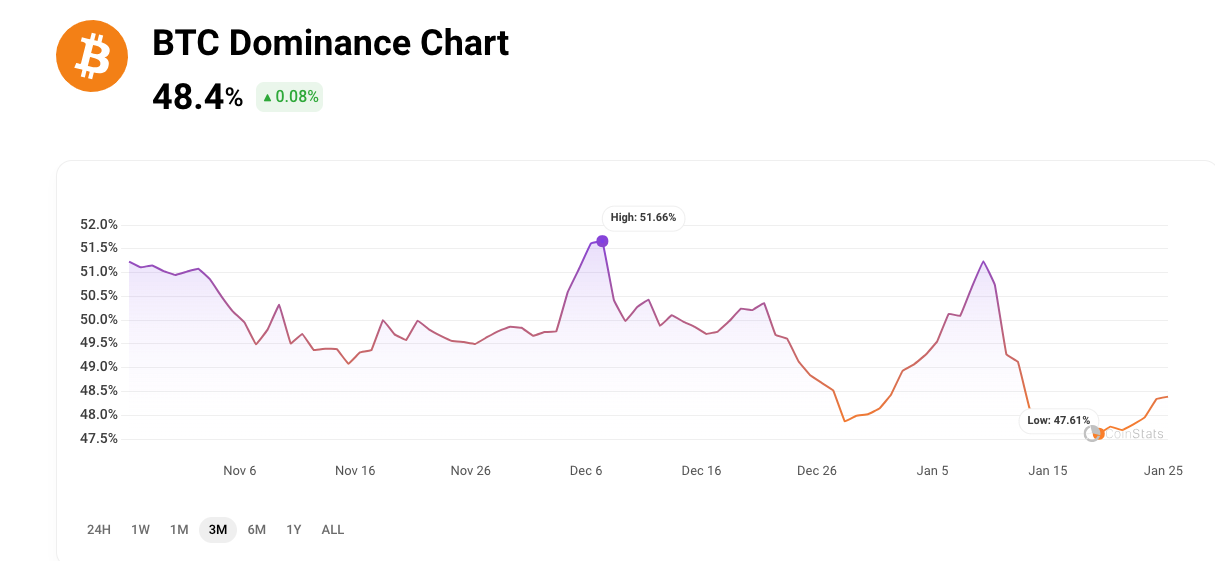

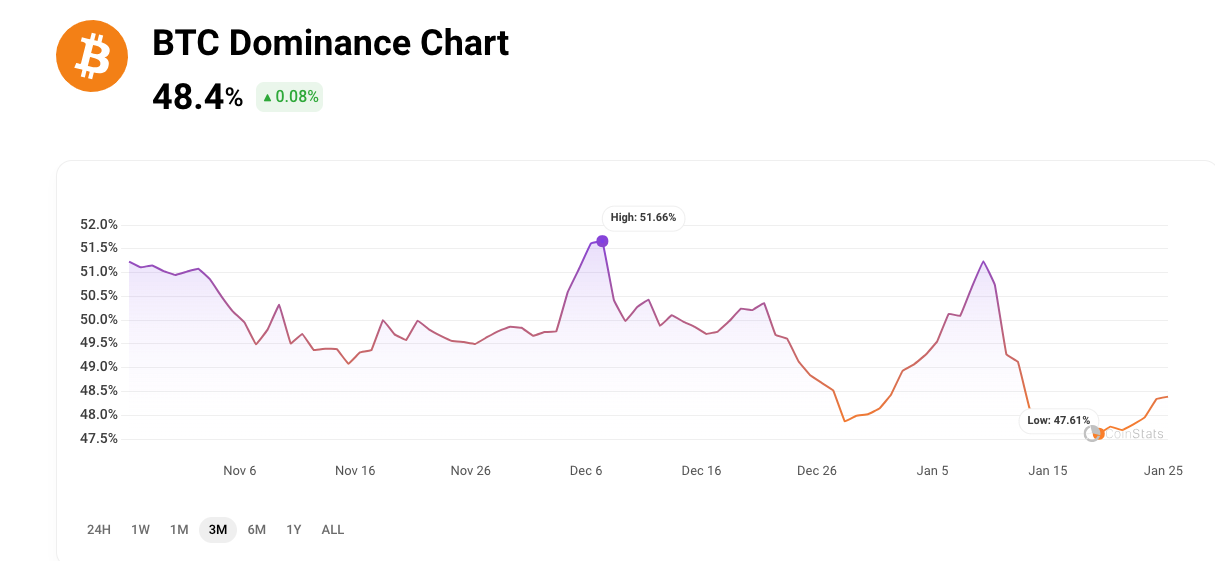

Lately, Bitcoin has carved out a good portion of its worth alongside many prime altcoins. On the time of writing, the value of BTC was $40,020. A have a look at Bitcoin's dominance chart confirmed it to be 48.4%, in response to CoinStats knowledge.

The Bitcoin dominance chart is a vital indicator of Bitcoin's power in comparison with different crypto markets. Bitcoin's excessive dominance signifies that Bitcoin outperforms different altcoins by way of market capitalization.

Nonetheless, the low dominance means that the altcoin has the potential to outperform its friends. This worth was one of many lowest BTC has seen prior to now three months.

If it rises additional, the value of BTC could rise. Nonetheless, additional decline might trigger liquidity to flow into into altcoins, pushing costs greater.

For now, BTC is prone to proceed hovering round $39,000 to $40,000. This was according to the symptoms proven on the 4-hour chart.

As of this writing, the Accumulation/Distribution (A/D) indicator has stopped. This case suggests that almost all market contributors are preserving the bulls and bears on the sidelines, hoping for higher timing to point out power.

Nonetheless, the RSI confirmed that bulls are prone to affect the value. As of this writing, the RSI is at 45.88, suggesting a reasonable shopping for momentum available in the market.

BTC might rise to $42,000 if extra patrons return. Nonetheless, an absence of bulls might permit altcoins to rise whereas inflicting costs to crash additional.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.