PayPal's entry into the stablecoin market on August 7, 2023 was welcomed by many within the business, with Circle CEO Jeremy Allaire calling the competitors from PayPal “an important factor.”

Information of this launch led to a modest 4% enhance in Bitcoin costs, and inside days, exchanges started providing low-fee promotional alternatives to merchants who wished to reap the benefits of PayPal's PYUSD. By the top of August, Coinbase, Kraken, and HTX had listed their stablecoins and added help for Venmo only a month later.

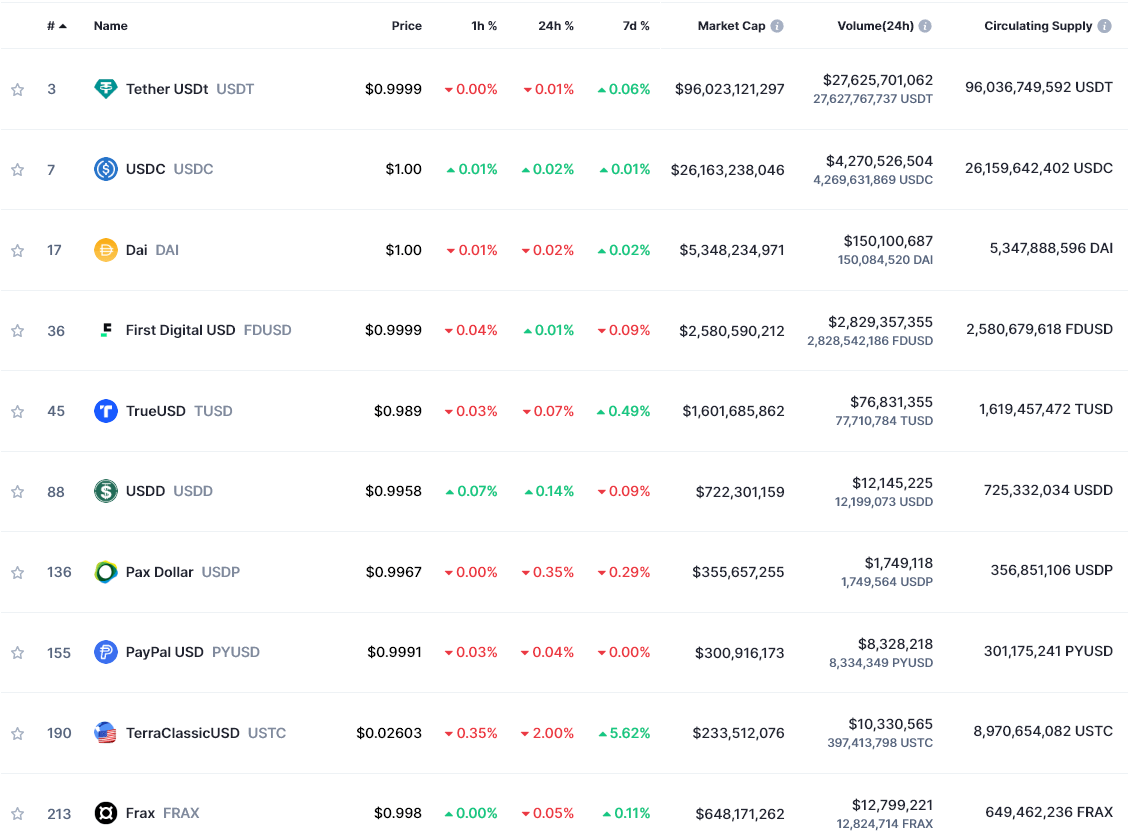

5 months after its launch, PYUSD presently holds the eighth place within the international stablecoin chart by market capitalization, reaching the $300 million mark round January twenty second. Nonetheless, when ordered by quantity, PYUSD falls to eleventh total with simply $10 million. With 24 hour buying and selling quantity. That is 98% off its initially deliberate $1 peg and solely barely above the UST Traditional, which has traded simply $500,000 under prior to now day.

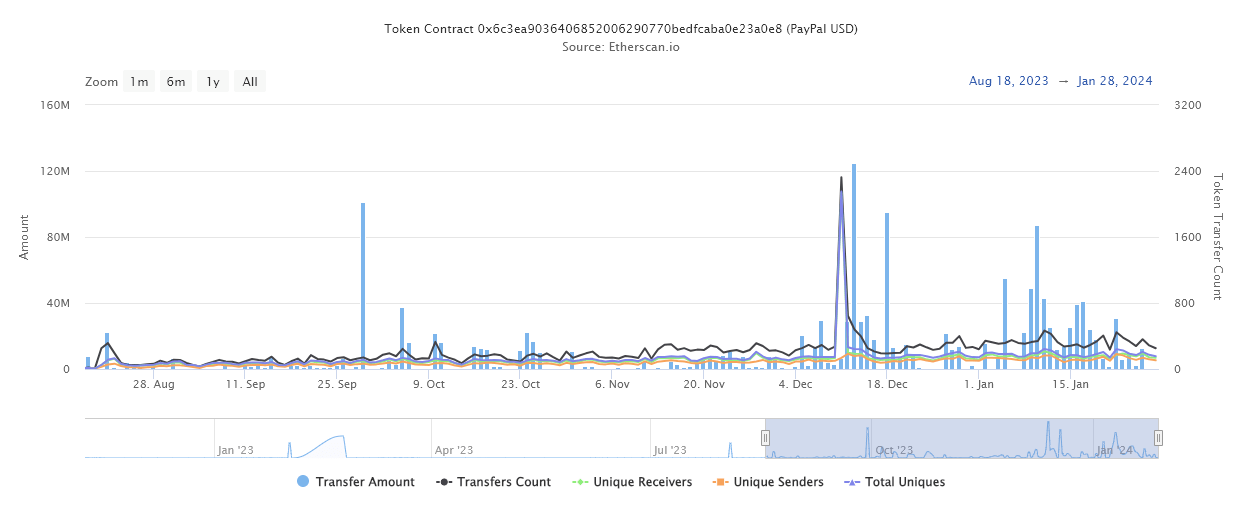

Nonetheless, it's spectacular that PayPal's PYUSD rose to $300 million in locked worth in 5 months. Along with rising market capitalization, the token additionally has regular on-chain exercise, with 200-400 transactions per day.

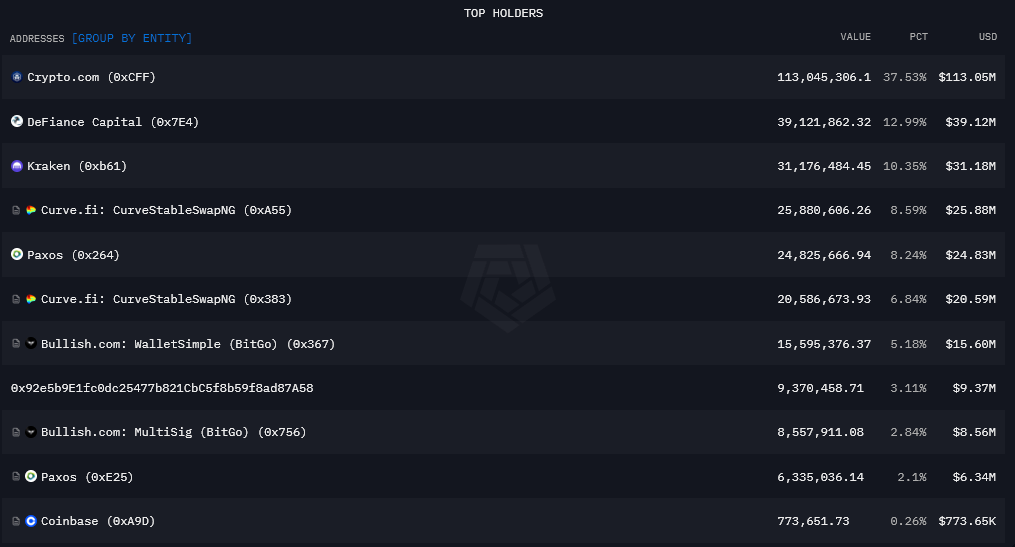

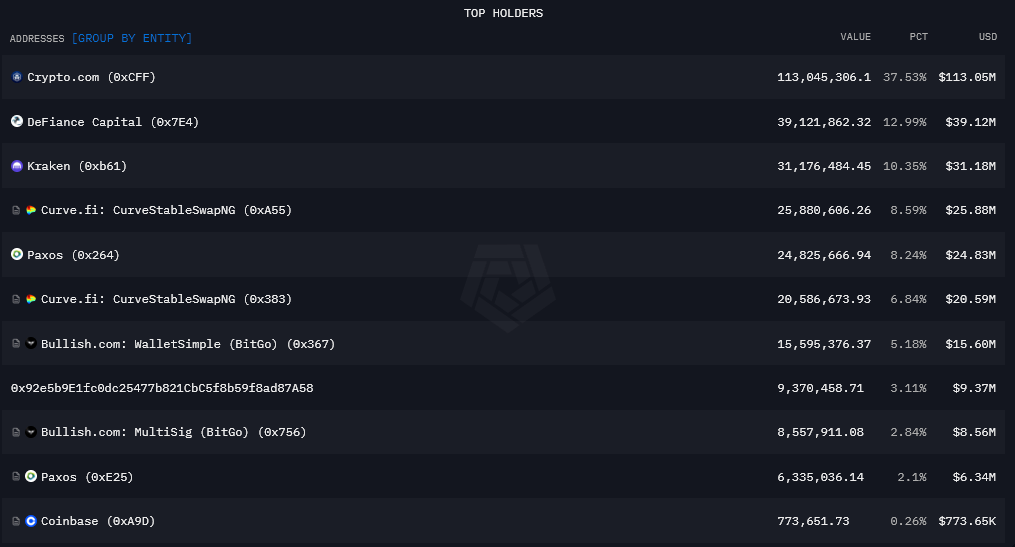

Nonetheless, because the desk and chart under spotlight, PYUSD has but to meaningfully enter the DeFi surroundings. The vast majority of PYUSD's liquidity is on centralized exchanges, with Crypto.com being the token's largest single holder at $113 million, simply over a 3rd of its market capitalization.

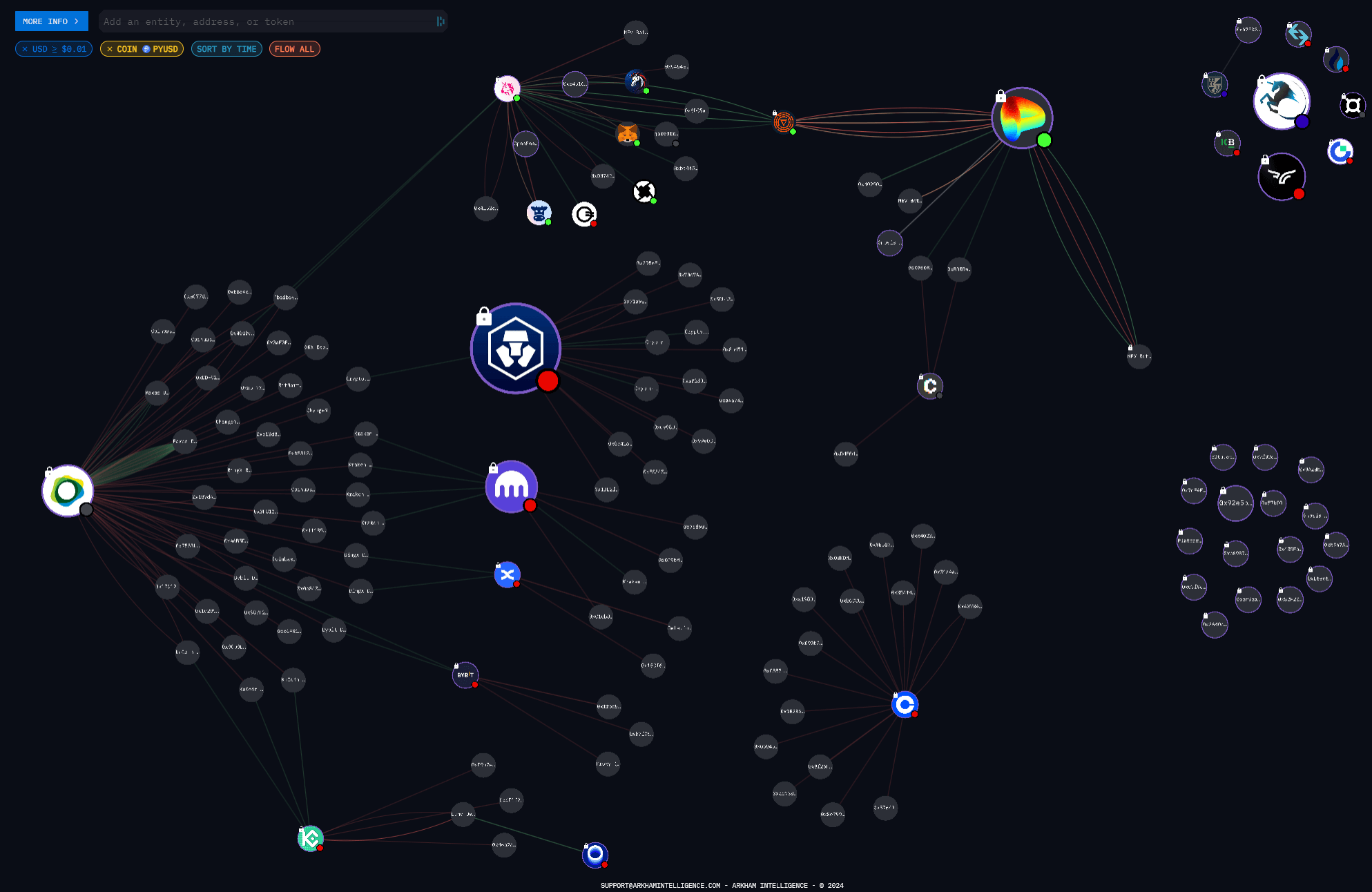

The visualization under reveals the transactions between the primary entities devoted to PYUSD. Corporations with bigger quantities of PYUSD will seem bigger than these with smaller quantities. The entity on the far proper with no emblem is an unknown pockets holding greater than $30,000. The emblem on the prime proper signifies a token of an entity, presumably within the possession of the Treasury Division.

Apparently, there are some connections between PYUSD issuers Paxos, Uniswap, and Curve. Nonetheless, these entities will not be linked to main exchanges, suggesting that PYUSD's DeFi and CEX ecosystems are fully separate.

PayPal was served with a subpoena by the SEC when PYUSD was half its present market cap, however it reportedly complied with the request and little has been heard concerning the matter since then. The submitting announcement additionally marked an area low for PayPal's inventory value, which has risen 24% since November.

Moreover, PayPal Ventures not too long ago started utilizing the PYUSD stablecoin as a strategic funding mechanism, utilizing it as an fairness stake in institutional crypto platform Mesh. Amman Bhasin, Accomplice at PayPal Ventures, commented:

“Because the world of monetary companies undergoes speedy transformation, we imagine that consumer possession and asset portability will turn out to be crucial elements of product innovation, and that cryptocurrencies will function the primary beachhead to allow this. Masu.”

So, whereas PYUSD nonetheless has an extended strategy to go to meet up with giants like Circle and Tether, the debut Web2 disruptor is definitely solidifying its place within the business.

(Tag translation) Ethereum

Comments are closed.