- BONK (BONK) faces an 8% decline in 24 hours and assessments the help at $0.00001103 amid rising promoting stress.

- BONK's market capitalization and buying and selling quantity decreased by 7.34% and 14.55%, indicating a decline in investor confidence.

- Technical indicators comparable to MACD, RSI, and Aroon point out a bearish development for BONK/USD within the quick time period.

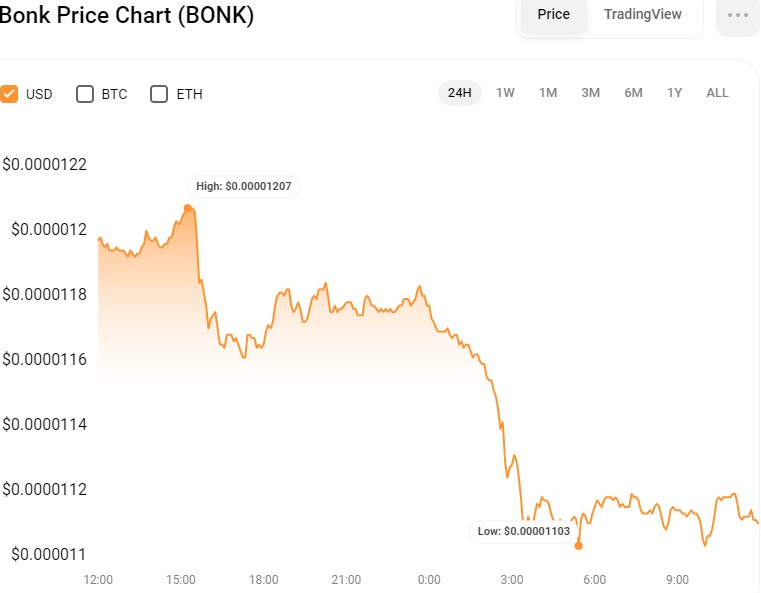

BONK (BONK) continued its bearish rally over the previous 24 hours, falling from an intraday excessive of $0.00001207 to a help low of $0.00001103. This worth decline may be attributed to elevated promoting stress and profit-taking by merchants.

Regardless of the unfavourable development, the help degree signifies that there should be some shopping for exercise at this worth vary, contemplating BONK's 0.83% rise within the earlier week. On the time of writing, BONK was buying and selling at $0.00001109, down 8.23% from its 24-hour excessive.

If this bearish development continues, it may take a look at the subsequent help degree at $0.00001050. Nevertheless, if the shopping for stress will increase and the help degree holds, BONK might have an opportunity to recuperate and retest the earlier highs.

Throughout the recession, BONK's market capitalization and 24-hour buying and selling quantity decreased by 7.34% and 14.55% to $701,864,960 and $79,045,175, respectively. This decline in market capitalization and buying and selling quantity signifies a decline in investor confidence and BONK market exercise.

BONK/USD Technical Evaluation

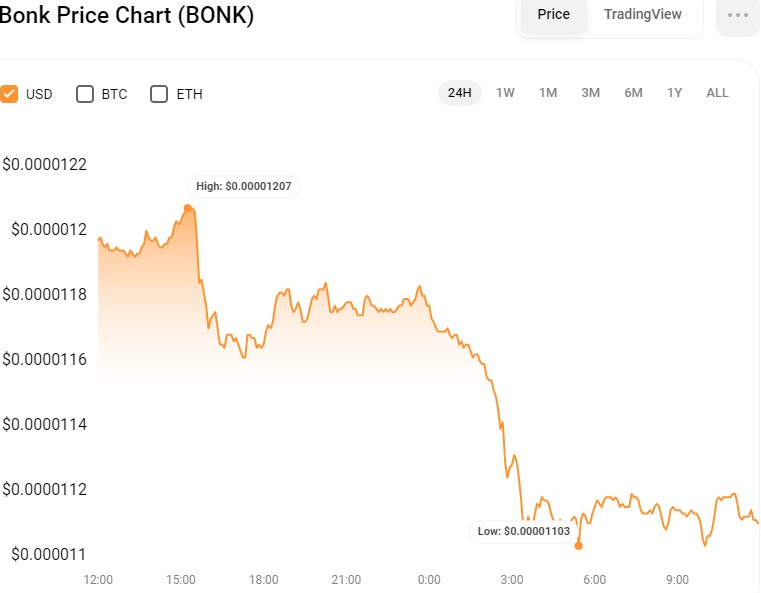

On BONKUSD 4-hour worth chart, the Shifting Common Convergence Divergence (MACD) has fallen under the sign line with score -0.000000087. This MACD development signifies a unfavourable sample for BONKUSD within the quick time period. Moreover, the histogram has turned unfavourable, confirming the bearish temper and indicating the potential for additional draw back for BONKUSD.

The Relative Energy Index (RSI), which helps the bear market rally, is under the sign line at 37.41. This RSI studying means that BONKUSD is approaching oversold territory, indicating that the worth is prone to fall. If the RSI falls under 30, a unfavourable development is confirmed and will result in additional promoting stress.

Moreover, Aroon Up (orange) is transferring decrease than Aroon Down (blue), with the previous and latter touching at 50% and 100%, respectively. This means that the momentum has shifted from bullish to bearish, with the Aroon rising line representing rising costs and the Aroon falling line representing falling costs. The convergence of those traces signifies rising promoting stress and will trigger BONKUSD to fall additional.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.