For the reason that starting of this 12 months, we have now seen vital modifications within the distribution of Bitcoin provide. Bitcoin holdings are distributed often based on market cycles, however the launch of a spot Bitcoin ETF within the US seems to be on the forefront of this variation.

It is very important perceive the provision distribution throughout completely different Bitcoin holding cohorts. This supplies perception into market sentiment, potential liquidity modifications, and the stability between retail and institutional participation. Massive fluctuations in holdings could point out institutional investor exercise, strategic accumulation, or reallocation of property in response to market developments. Monitoring these modifications can present early indications of broader market developments, modifications in investor habits, and potential value actions.

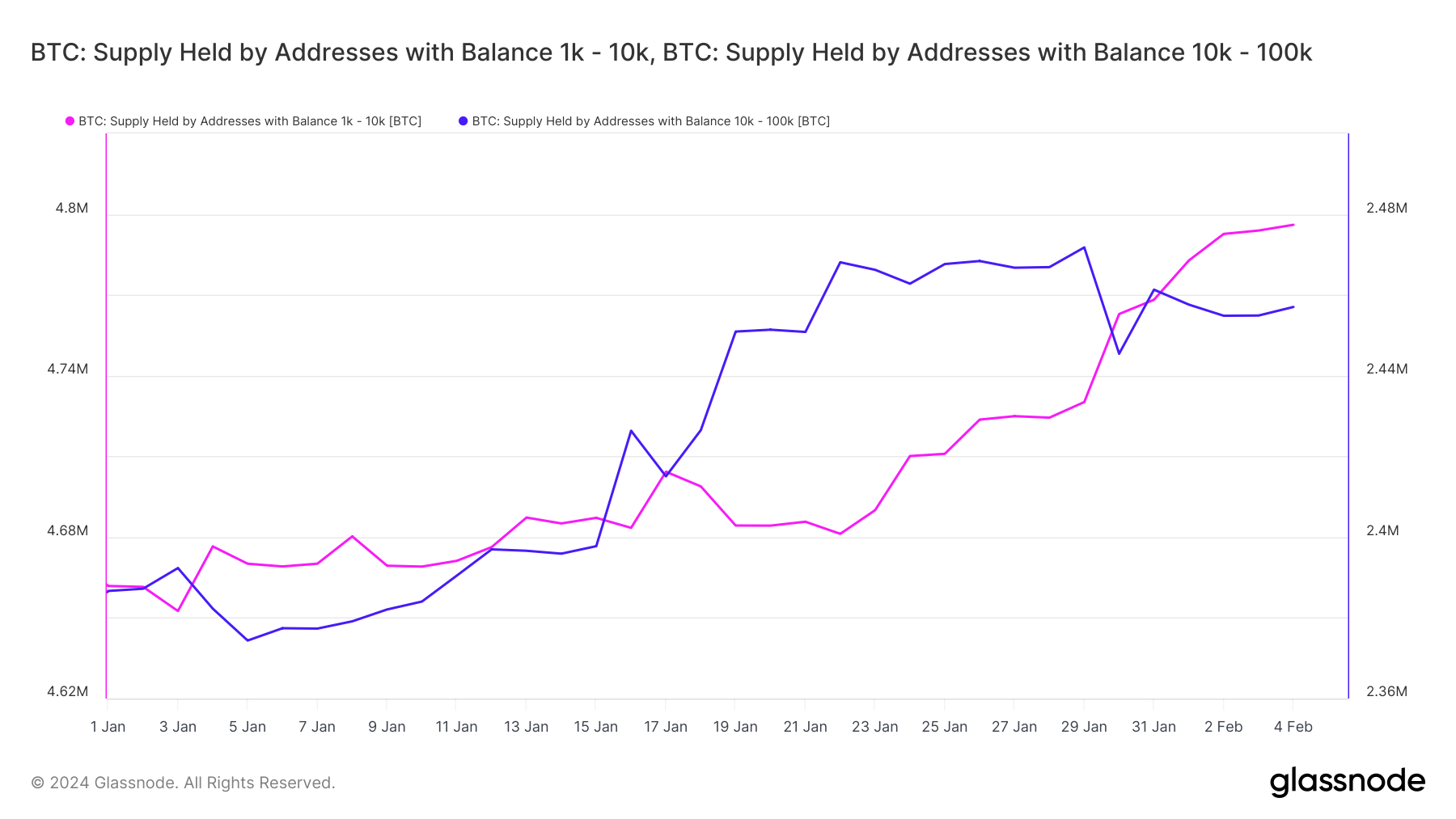

Addresses holding 10,000 to 100,000 BTC have seen their balances improve by 2.97% year-to-date (YTD), whereas addresses holding 1,000 to 10,000 BTC have seen their balances improve by 2.89% year-to-date.

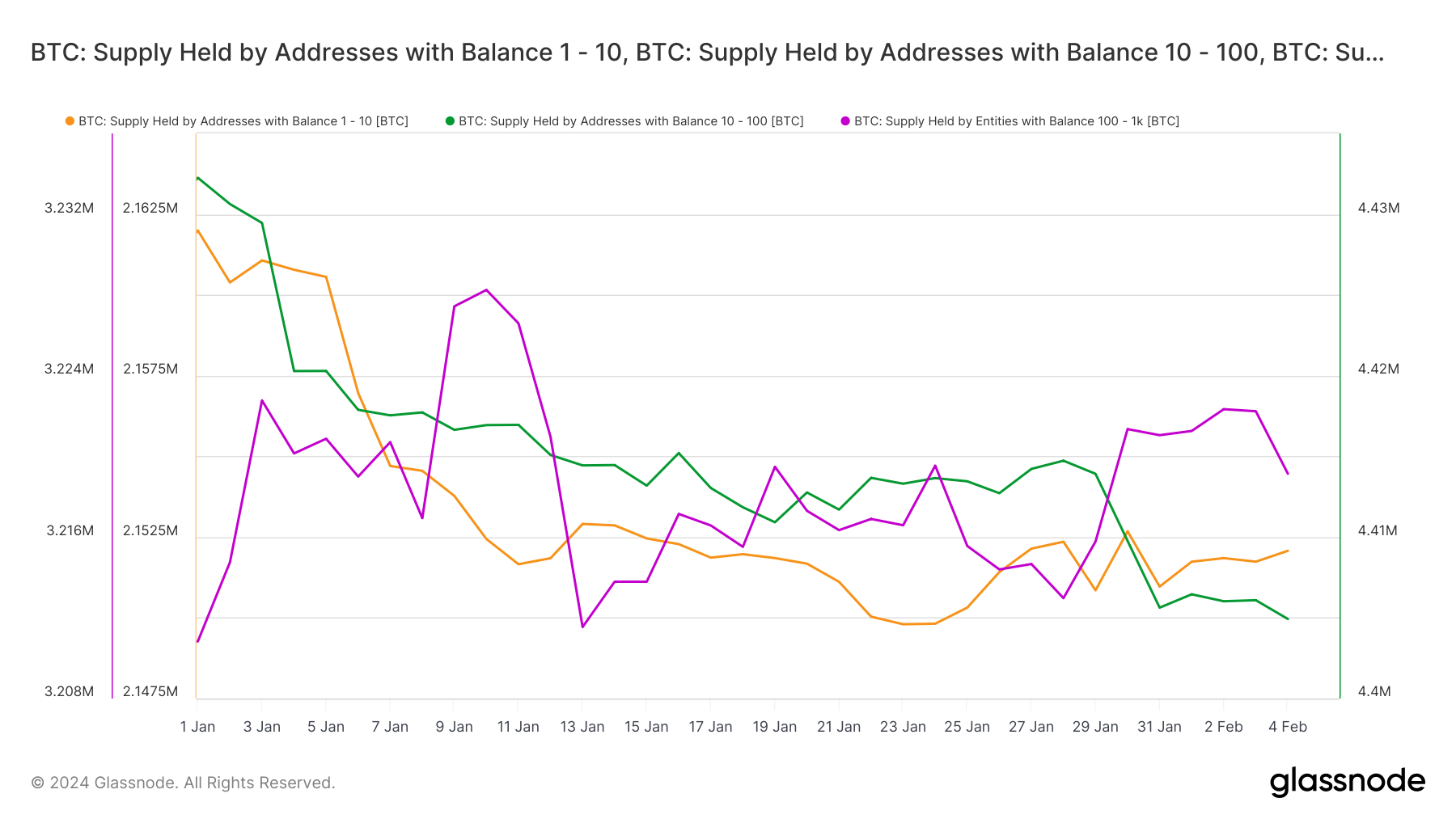

Quite the opposite, addresses holding between 100 and 1,000 BTC recorded the most important decline, lowering by -3.32%.

The rise in Bitcoin holdings noticed for addresses with massive balances (1,000-10,000 BTC and 10,000-100,000 BTC) contrasts with the lower for addresses with small balances (100-1,000 BTC). The massive improve in holdings within the largest cohorts signifies institutional accumulation and strategic actions by massive traders. This will likely be pushed by the legalization and elevated accessibility of Bitcoin by means of the launch of spot ETFs, regulated for giant capital inflows and probably offering a safer funding automobile. There’s a chance.

The rise in massive holding deal with balances may additionally replicate rising confidence in Bitcoin's long-term prospects, and could also be pushed by the introduction and recognition of spot Bitcoin ETFs. This will likely point out market maturity and acceptance inside the conventional monetary system.

The decline in holdings amongst addresses with balances between 100 and 1,000 BTC could point out a shift in the direction of diversification and danger administration methods, influenced by the provision of Bitcoin publicity by means of ETFs. Buyers on this cohort could also be reallocating property to stability their portfolios throughout completely different asset lessons inside the extra acquainted framework of ETFs.

One other doable cause why a small group skilled a decline of their Bitcoin holdings is revenue taking. The elevated liquidity out there following the launch of the ETF is definitely making it simpler for short-term and small-scale holders to take income. Buyers with smaller balances could also be extra inclined to reap the benefits of value actions, particularly after seeing how the introduction of ETFs has led to short-term value will increase.

The publish How ETFs Affected Bitcoin Provide Distribution Throughout Cohorts appeared first on currencyjournals.